Stable Yuan Memorandum: More about shutting the door on depreciation

Reports are emerging that the US and China will agree on the need for a stable yuan as part of its trade deal. For China, this looks to be consistent with current FX policy. For the US, the aim of this memorandum is probably an attempt to limit Beijing’s room to depreciate its way out of a slowdown. This reduces the risk of a CNY devaluation and should help Asia FX

Defining a stable yuan

Reports emerging over recent days suggest that the US and China will somehow try to incorporate a soft commitment to stability in the renminbi into a Memorandum of Understanding (MoU) on trade relations. This MoU looks to be part of the preparatory work before a meeting between Presidents Trump and Xi in March in an attempt to diffuse the trade war.

We imagine any US-China currency pact would be short on detail and would loosely refer to the need to keep the renminbi stable, and that both sides would avoid competitive devaluations (the latter already a part of existing G20 policy).

We doubt there would be any detail on what constitutes a stable yuan, however. For example, we doubt the People's Bank of China would be backed into a corner by committing to keep the trade-weighted CFETS Renminbi index stable. And the IMF’s annual work on renminbi fair value, using its External Balance Assessment model, looks too opaque to be highlighted. Actually that model, last produced in summer 2018, suggested the renminbi in real terms was anywhere between 13% undervalued and 7% overvalued.

Washington wants to fix the goods deficit with China

What do Beijing and Washington really want?

For the PBOC, it would like to have a currency policy that looks like a floating exchange rate. The central bank is trying to fulfil this ambition by allowing the USD/CNY to follow the dollar index in general.

For the US Treasury, we suspect a stable yuan means a stable USD/CNY – or at least a USD/CNY bilateral rate that doesn’t trade substantially higher. Certainly, the core objective of Washington is to shrink the US$400bn+ bilateral goods deficit with China, suggesting the US Treasury will have more interest in the bilateral rate than any CNY trade-weighted index.

While acknowledging the appreciation of the real trade-weighted renminbi over the last decade, the latest US Treasury semi-annual FX report highlighted that on a bilateral basis the renminbi had fallen back to a level last seen over a decade ago. Here, the US Treasury probably suspects that the 8% rally in USD/CNY last summer was not an entirely market-led move. In fact the CFETS Index (the renminbi versus a basket of 24 currencies) fell nearly 6% during this period, confirming independent CNY weakness here.

Washington doesn't want a repeat of last summer's CNY sell-off

The unwritten understanding

We can’t know for sure, but one could argue that the unwritten understanding of any agreement in the MoU could be for the PBOC to keep USD/CNY south of 7.00, such that China would be prevented from devaluing its way out of a sharp narrowing in its trade balance. It is also not in China’s interest to sharply devalue the yuan, which could trigger a new round of capital outflows. Certainly we saw China's resistance to a weaker yuan last year, where authorities re-introduced both the counter-cyclical factor (greater PBOC control in the daily fixings) and measures to make it more expensive to sell the CNY forward.

On the other hand, one could argue that yuan stability means just that - yuan stability. That could be interpreted as the USD/CNY just being left to track the DXY, which it seems is what the PBoC is trying to do currently. Fortunately, our views on DXY (topping later this year) would be supportive of such a strategy, such that USD/CNY should turn gently lower. However, we very much doubt – should the DXY surge for whatever reason - that Washington would be happy to see USD/CNY trading substantially above 7.00, even though the CNY basket was stable. It’s just too difficult a message to get across to US voters – that it’s a dollar move not a CNY move.

Market implications

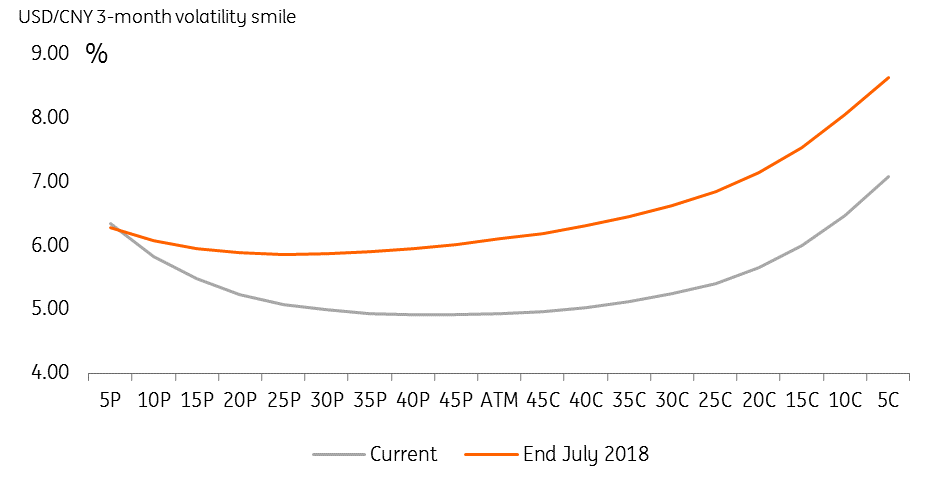

Any agreement on the need to keep the renminbi stable could reduce the tail risk of a competitive devaluation in the renminbi. Again, Washington is more interested in its trade deficit with China (and the USD/CNY bilateral rate), than it is about an IMF-style need for a clean float in the renminbi. The FX options market is well on the way to pricing lower tail risk of a CNY devaluation, where the CNY smile curve now shows much lower implied volatility levels for low delta USD calls/CNY puts (see chart below).

Stability in USD/CNY and lower levels of volatility should be positive for Asian FX. Were the USD/CNY stability story to develop, CNY realised volatility could actually drop back (e.g. 3m USD/CNY realised volatility to 3% from 4% currently) helping Asian FX volatility lower across the board. Such a trend could be beneficial for risk-adjusted carry trades in Asia. This environment could see the Indonesian rupiah outperform its steep forward curve (where implied 3m yields through the Non Deliverable Forward are still a high 7.3%).

CNY tail risk is being downgraded in the FX options market

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 February 2019

In case you missed it: Hoping for stability This bundle contains 8 Articles