Spanish house prices move against the eurozone trend

Spanish house prices continue to rise, unlike in many other eurozone countries. Despite the negative impact of rising interest rates, property demand remains resilient. Combined with inadequate supply, this is what's driving prices higher

Despite rising interest rates, Spanish house prices continue to rise

Spanish house prices rose 2.1% quarter-on-quarter in September, according to figures released by Eurostat, well above a quarter-of-quarter growth rate of 0.1% in the eurozone. In several eurozone countries, including Germany, France and the Netherlands, house prices fell again on a quarterly basis in the second quarter. As the chart below shows, Spanish property prices rose 3.7% year-on-year, while in the eurozone, they fell by an average of 1.7%. So, despite the sharp rise in mortgage rates, Spanish house prices continue to grow and are holding up much better than in the rest of the eurozone.

Fig. Year-on-year evolution of house prices in the largest eurozone economies in the second quarter

A resilient property demand

In Spain, soaring interest rates on mortgage loans are a headwind for the property market. According to data from the Spanish statistical service INE, the number of mortgage loans granted in July 2023 was 18.6% lower than in the same month last year. The number of transactions also cooled significantly and was 10.1% lower in July than a year ago. Still, the downturn is not as strong as in other countries. There are several elements that differentiate the Spanish property market from other eurozone property markets, the first distinguishing factor being resilient demand.

There are several factors supporting housing demand. The number of Spanish households is growing strongly, partly due to immigration. In addition, the property market is also supported by stronger economic growth than the eurozone average. According to our forecasts, the Spanish economy will grow by 2.5% in 2023, compared to only 0.5% average growth in the eurozone. The more resilient economy has also reduced the unemployment rate more than in the rest of the eurozone, although it is still above the region's average. A combination of higher nominal wage growth and lower inflation has also caused real wage growth to return to positive territory, with Spanish households currently gaining purchasing power. This tight labour market and pick up in wage growth improve gross disposable income. Many families were able to accumulate considerable savings during the pandemic, which they are now using to buy a house.

Finally, strong foreign demand for Spanish property is putting additional upward pressure on house prices. During the pandemic, this foreign demand had completely disappeared due to travel restrictions but is now fully back. It explains why house price growth in tourist regions such as the Balearic and Canary Islands and the Mediterranean region is above the national average. With the strong recovery of tourism after the pandemic, more owners are also keeping their properties free to rent out to tourists, creating additional tightness in the property market.

Supply has been growing too slowly for several years

When growing demand is offset by growing supply, this tempers price increases – but in Spain, supply growth is insufficient to meet growing demand. Net household growth is much higher than net supply growth, creating scarcity and exerting upward pressure on house prices. This is not a recent phenomenon; the growth of Spanish supply has been growing too slowly for several years to keep up with demand. The drop in foreign demand during the pandemic and more inheritances due to the high number of Covid-19 fatalities took some of the pressure off during the pandemic.

The number of projects started to fall during the pandemic due to restrictions, and the number of developments was later further slowed down by sharply increased interest rates and higher prices of building materials. We should not expect a push from lower interest rates or lower prices of construction materials in the short term. European Central Bank (ECB) communication clearly hints that it wants to keep interest rates at these high levels for a long time. We expect it to cut interest rates again only after the summer of 2024. Building will also remain expensive. While the price trend of most building materials has cooled somewhat over the past year, construction costs will remain higher than before the pandemic.

Spanish property market also less overheated during pandemic

This combination of resilient demand with supply growing too slowly exerts upward pressure on house prices. Another distinguishing factor is that Spanish house prices rose less during the pandemic than in other eurozone countries, which is now likely to lead to a more modest downturn compared to countries where the property market was more overheated.

Despite further price increases, the ECB still estimates the overvaluation in the Spanish housing market to be lower than in most other major eurozone economies. The ECB makes quarterly estimates of the overvaluation of the various property markets in the eurozone based on different methodologies and underlying parameters, such as income growth and interest rate developments. In the first quarter, the ECB estimated overvaluation in the Spanish property market at 10.3%, lower than the eurozone average of 12.8%. The overvaluation estimate is also significantly lower than the 19.8% in the Netherlands and 14.8% in Germany, where house prices have already corrected significantly from their peak levels. Spanish overvaluation is therefore still relatively low compared to other countries.

Fig. ECB overvaluation estimate, Q1 2023

We expect house prices to continue to rise, albeit at a slower pace

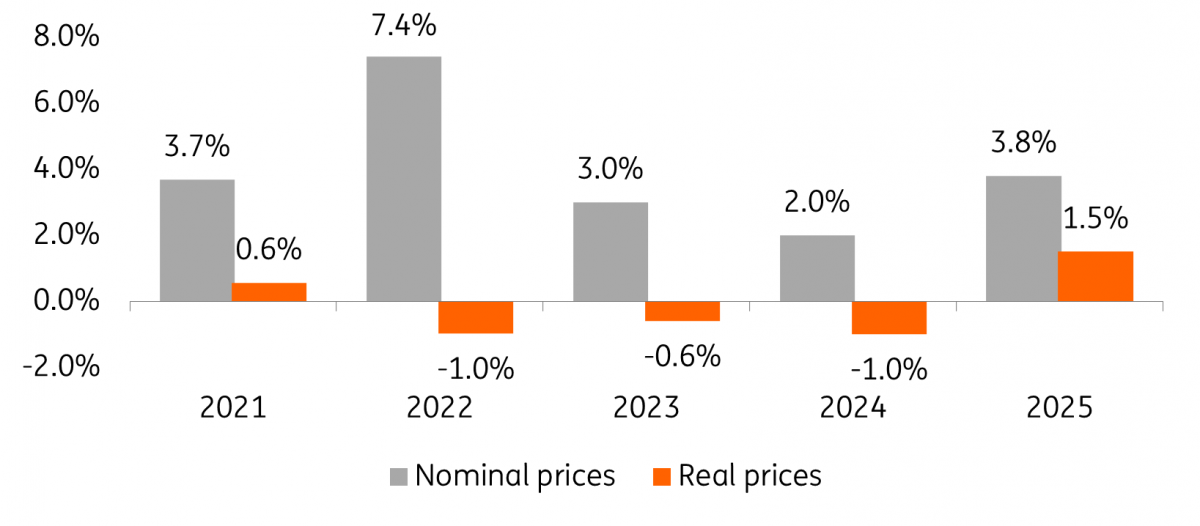

Despite the resilience of the Spanish property market, there are several factors that are likely to further temper the dynamics on the property market. It seems likely that mortgage lending rates will rise further until the end of this year and stay at that level for a while, putting further pressure on real estate purchasing power. Finally, we expect economic growth to slow down during the winter months, which will also weigh negatively on the property market. For 2023, we assume an average GDP growth of 2.5%, which is expected to slow to 1.4% in 2024. For this year, we expect Spanish house prices to grow 3% on average and 2% in 2024. Adjusted for inflation, this does still amount to a slight real price correction.

Fig. Spanish house price growth, including forecasts ING

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article