Spain: Has growth peaked?

The Spanish economy has continued its strong growth in 2018 but a slowdown could well be on the horizon. Meanwhile, there are optimistic tunes around the budget but no symphony just yet

Current activity is strong

The Spanish economy continued its strong performance at the beginning of the year recording 0.7% quarter-on-quarter growth identical to third and fourth quarter growth in 2017. This figure was expected as the high-frequency data for the first quarter was overall optimistic. The average PMI for 1Q18 was higher than 4Q17's, the unemployment rate continued to decline and consumer confidence still remains at a considerably high level despite having dipped slightly.

Cool down ahead?

Looking ahead, the Spanish economy could cool down a little.

The European Sentiment Indicator (ESI) for Spain increased from 109.0 in March to 110.6 in April, which is close to the recent peak of 110.9 in January 2018. Forward-looking indicators in the survey, such as order books and hiring intentions in manufacturing and employment and demand expectations in the service sector, however, decreased in April. Furthermore, PMIs declined for a second consecutive month in April. All this points to the fact that Spain is currently still on a strong growth path, but this could ease over the course of the year.

PMIs drop for a second consecutive month in April

Exports driving recovery

A remarkable feature of the Spanish economy today is the importance of exports.

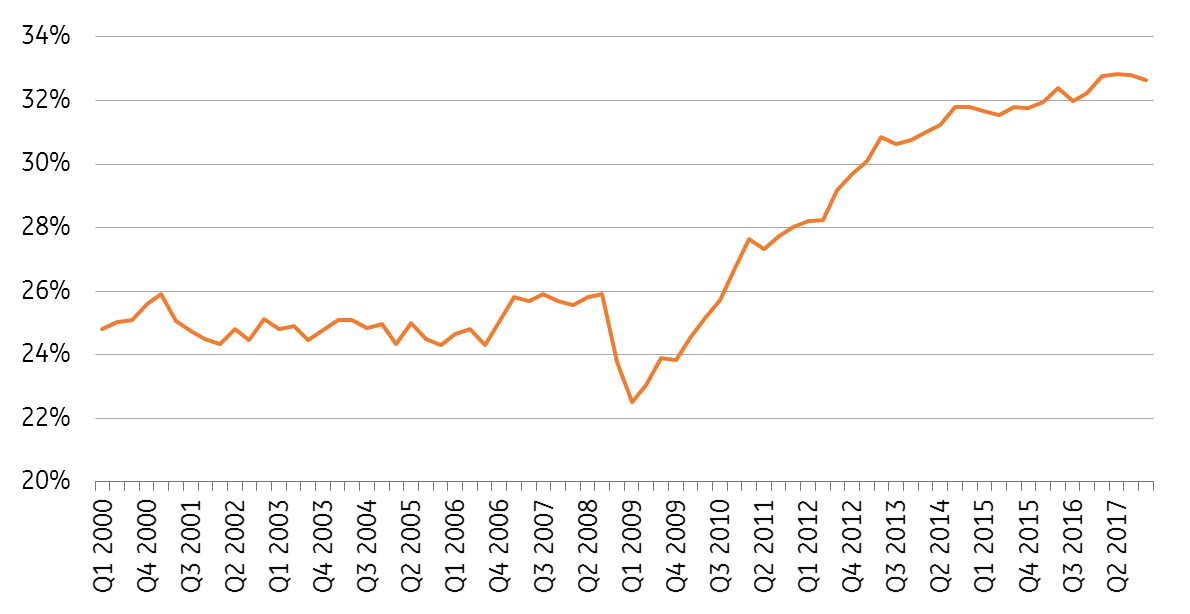

The share of exports increased to 33%, compared to 25% before 2008. A few reasons include the decline in wages after the crisis followed by the labour market reforms which made it more business-friendly. Secondly, the crisis forced companies to broaden horizons and look towards foreign markets as the domestic market collapsed and finally the rise in productivity. Given that these changes were not temporary and the fact that Spanish exports are now more geographically diversified, it is likely that exports will continue to support the economy.

Exports on the rise (as a percentage of GDP)

Structural weaknesses in the labour market remain

The labour market continues its recovery as the unemployment rate continues to decline and employment growth remains firm.

This, of course, supports private consumption, but structural problems remain. The proportion of employees on temporary contracts relative to total employment equalled 26.8% in 4Q17. Young and low-skilled workers often fail to secure permanent jobs, and this reduces the incentive to invest in training and lifelong learning, limiting potential human capital formation.

Broader measures of the labour supply also show some weakness. For example, underemployed part-time workers still account for 6.0% of the active population in 2017 while this is only 4.1% in the Eurozone.

Optimistic tunes on the budget, but no symphony yet

On the political front, there seems to be a breakthrough concerning the 2018 budget. Last year, the approval of the budget had to be postponed as the Basque Nationalist Party (PNV) withdrew its support to protest against the government’s management of the Catalan crisis. But now, there is initial parliamentary support for the budget from several political parties. The PNV agreed too after a deal with the government to boost public pension in 2018 and 2019.

However, the PNV continues to say it will not back the budget until the government removes its direct control over Catalonia. But there are also positive sounds on that front. Now that a new Catalan premier is elected, a new Catalan government is imminent. And once the new government is installed, the central government could lift Article 155.

Even though political uncertainty hasn't disappeared, it has eased compared to a few months ago, and the negative impact on the economy was also limited. The rating agency, Moody’s recently upgraded Spain’s long-term credit rating citing the low impact of the Catalan crisis but good economic performance and structural improvements in the banking sector also helped.

The three main rating agencies, Fitch, Standard and Poors and Moody’s, have all upgraded Spain’s long-term credit rating in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles