Spain: Shifting into a lower gear

The economy slowed in 2018 and we think that it is bound to slow further. In part, this is a normal process of the business cycle, but it also has to do with a weaker external environment and political uncertainty

A slowing economy

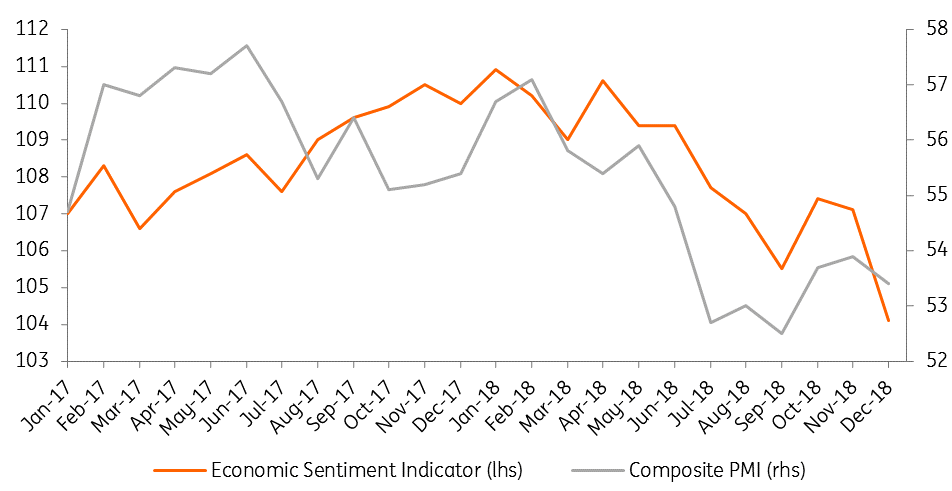

Survey data started to show a downward trend in early 2018, but stabilised in the third quarter and even recovered a bit after that. Following a few stable months, survey data reverted to a downward trend in December. The Economic Sentiment Indicator even dropped by three points, the sharpest decline in the Eurozone.

Hard data also disappointed, as industrial production contracted by 2% year on year - the worst growth figure since August 2013.

Sentiment indicator heading south

This offers evidence that the economy is slowing further. On an annual basis, GDP growth slowed from 3.1% in the final quarter of 2017 to 2.4 % in the third quarter of 2018. There are several reasons for this.

First, as the economy had been growing at more than 3% on an annual basis since 2015, strongly above the potential growth rate estimated by the European Commission, the economy was bound to slow at some point. According to the EC, the output gap even turned positive in 2018.

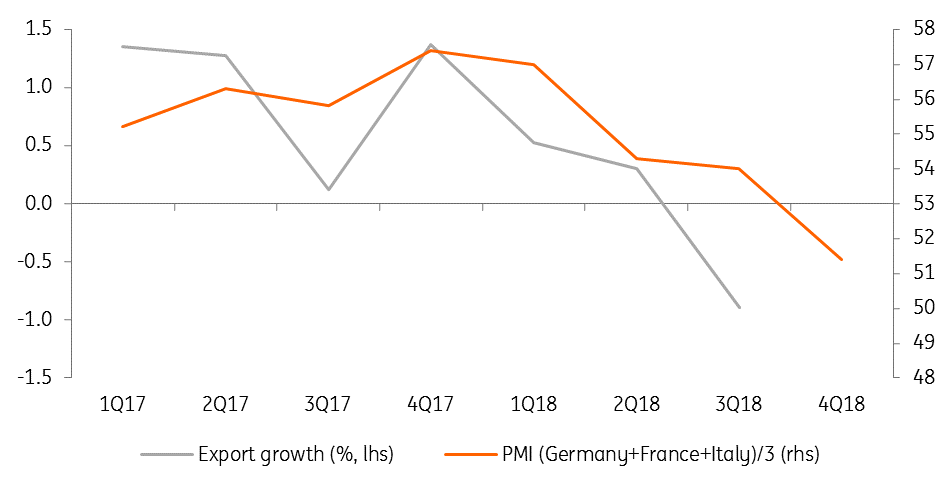

Second, export growth slowed, and turned negative in the third quarter of 2018, due to the weaker external environment. Indeed, the economic situation in the three most important export countries for Spain (Germany, France and Italy) clearly deteriorated.

Furthermore, the number of tourists in 2018 was similar to 2017, a record year. While 82 million tourists for two years in succession is a noteworthy performance, it also means tourism wasn't a source of growth in 2018.

Export growth down

Political uncertainty abounds

Political uncertainty can impact growth performance, with companies delaying investment and hiring and consumers waiting before buying that new car - and Spain has had a great deal of political uncertainty recently.

In June 2018, the centre-right People's Party government was replaced by another minority government led by the socialist party with even fewer seats in parliament, the Catalan situation continues to cause tensions, the 2019 budget is still not approved by parliament, and another non-traditional party, Vox, has entered the political equation following the regional elections in Andalucía.

However, the impact of the political uncertainty on the economy is difficult to judge; investment growth and hiring intentions are currently still strong, but may well have been stronger without the uncertainty.

The 2019 budget

The key influence of politics on the economy is, of course, via fiscal policy.

Spanish prime minister Pedro Sanchez recently increased the minimum wage by 22%, from €813 to €900 a month by decree, but to continue with his plans to increase social spending, he needs more room to manoeuvre, for which 2019 budget approval is necessary. Sanchez hasn't succeeded as the budget didn't receive the needed 19 Catalan votes. Recently, the government announced a new draft budget, again supported by Podemos. It would reduce the budget deficit from 2.7% of GDP in 2018 to 1.3% in 2019. The plan increases social spending and increases taxes for the rich. The plan also increases transfers for Catalonia.

The key question is whether this plan will receive the Catalan support. This is difficult to judge given continued tensions, but the increased transfer should make it more attractive to the Catalans.

If this draft does not get approved then the government will keep the 2018 budget, but it has not ruled out snap elections. Snap elections, however, would be a risk for Sanchez due to the recent developments in Andalucía. Following the Andalusian regional elections a right-wing coalition (the People’s Party (PP) and Citizens, supported by Vox) came into force, after 36 years of socialist party rule in Andalucía. And the risk for Sanchez is that this coalition could do well at the national level as well. Furthermore, according to the official poll by the Centre of Sociological Studies, the support for PSOE dropped to its lowest level since Sanchez became prime minister in June 2018, even though it remains the largest party.

The year ahead

We see the economy slowing further in 2019 as the elements that caused the slowdown in 2018 are here to stay. The external environment will continue to be a drag, with the Eurozone economy slowing from 1.9% in 2018 to 1.4% in 2019. Political uncertainty is bound to remain high in Spain. In addition, there are local, regional and European elections planned in May. But it is not all bad news. The labour market continues to support consumption. The unemployment rate continues to fall and hiring intentions in both the industry and services remain solid.

All in all, we forecast a 2.0% growth rate for 2019 and 1.6% for 2020.

The Spanish economy in a nutshell (% YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains 13 Articles