Spain: How will tourism support the recovery?

After another contraction in the first quarter, the economy is set to grow again. An important sector in the recovery will be tourism and travel. But how much will it contribute?

Winds of change

Things are starting to look better for Spain. The latest figures show that the seven-day moving average of new infections is at its lowest point since August 2020, while the vaccination campaign has gained speed. Consumers and businesses are now much more optimistic as restrictions are expected to be gradually removed. Consumer confidence rose in March and April and is now much closer to consumer confidence in the eurozone as a whole. The purchasing manager indexes show that both the manufacturing and service sector in Spain grew in April. Moreover, the improvement in the service sector was much stronger in Spain than in the eurozone.

Survey data much more optimistic

Tourism crucial for the recovery

So the economy is certain to grow again going forward. But we have to admit there is still a lot of uncertainty. A crucial unknown is the evolution of the pandemic and its impact on the tourism sector. According to the World Travel and Tourism Council, the travel and tourism sector was equal to 14% of GDP in 2019 or about €177bn.

The travel and tourism sector was equal to 14% of GDP in 2019 but was hit hard in 2020.

But the pandemic hit the sector hard. Indeed, activity in the sector shrank by 63% in 2020, while the economy as a whole contracted by 10.8%. If in 2020, the tourism sector had operated at the level of 2019, the contraction in GDP overall would have been ‘only’ 1.5% instead of the actual contraction of 10.8%. So there is no question that the tourism and travel sector will be critical for Spain’s economic recovery.

Keeping domestic infections at bay

While some regions still have a high incidence rate, such as the Basque country and Madrid, Spain, as a whole, has an infection rate that is lower than other large EU countries. However, the risks of another wave of new cases has not disappeared completely. The state of emergency was cancelled at the beginning of May, but this decision was made independently of the health situation at that time. As the state of emergency has now been cancelled, regions have relaxed (and were sometimes forced to relax) restrictions. As the percentage of vaccinated people, currently at 37%, is not high enough for herd immunity, the easing of restrictions comes with the risk of increasing new infections.

In 2020, spending by domestic tourists halved compared to 2019, from €60bn to €30bn.

A safe health situation is obviously important for domestic tourists. In 2020, spending by domestic tourists halved compared to 2019, from €60bn to €30bn. As the state of alert and restrictions to travelling between regions has now been annulled, domestic tourism will be able to recover. It will probably get an extra boost, as some Spaniards will opt to stay in Spain for the holidays. We expect total spending by domestic tourists will recover to €50bn in 2021.

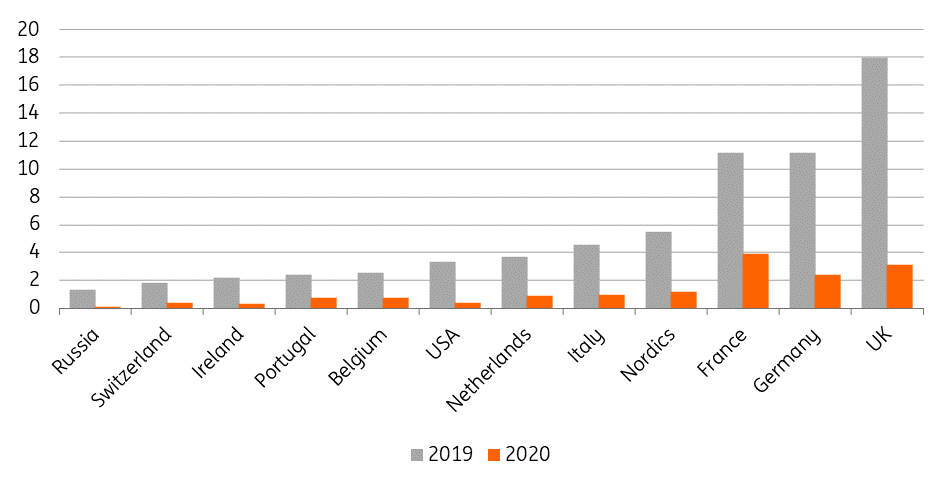

The health situation within Spain is also crucial for international tourists as other countries could determine that travelling to the country is too risky and make it illegal or more difficult to do so. The UK, for example, recently left Spain on the list of countries where travellers need a negative test on arrival, a 10-day quarantine period and two tests at home. There were about 18 million British tourists in 2019, which was about 26% of all international tourists. This dropped to about three million in 2020. If this UK decision continues during the summer months, it will have major repercussions for the Spanish economy. But this is not our base case. We expect Spain to be reclassified in the coming weeks, if the health situation remains benign.

Number of international tourists in Spain from various countries in 2019 and 2020

A travel passport will help

For travellers from the EU27, who make up the largest percentage of international tourists visiting Spain, a travel certificate will be crucial. Luckily, the EU recently agreed on a travel certificate for people who received a vaccine, have a negative test or are immune after recovering from Covid-19. Now the focus will move toward the technological hurdles. Indeed, it is not an easy task to have a system that is compatible at the pan-European level. Currently, there is a dry run to test the technology involving a number of EU countries, including Spain.

For now, we believe that the Covid-19 certificate will be ready by the summer. This implies that EU tourists will be able to travel more smoothly to Spain from the end of June onwards. This, however, will only be the case if the health situation has not deteriorated.

Interestingly, the EU system could be linked with non-EU countries. The European Commission has close contacts with, among others, the United States and the World Health Organization, to allow the certificate to be used more widely. This is also important for Spain as more than 20% of international tourists in 2019 were non-EU and non-UK.

For non-EU and non-UK tourists the situation is obviously more complicated. The health situation of the specific country will be crucial. But we think that most travellers will probably opt to stay relatively close to home and so the number of tourists from the US, for example, will recover more slowly. On top of that, the use of EU certificates will probably be used by non-EU tourists at a later date than Europeans themselves.

Our base case

In our baseline scenario, we assume that the health situation does not worsen, that British tourists will soon be able to travel to Spain with far fewer complications and that the EU certificate becomes operational at the end of June. Given the modest performance in the first half of the year in terms of international tourists and the expected recovery in the second half, we expect 40 million international tourists in 2021. This is more than double the number in 2020, but 50% less than in 2019.

According to our calculations, using the same methodology as the World Travel and Tourism sector, all this implies a total contribution of the sector to GDP of about €110bn in 2021. This is almost double the amount in 2020, but 38% lower compared to 2019. We can conclude that the tourism sector will recover in 2021, but that not all the economic damage from 2020 will be restored this year.

We believe that the tourism sector will recover in 2021, but that not all the economic damage from 2020 will be restored this year.

Our estimate of €110bn, however, could be an understatement. In this calculation we assumed that the average tourist spends as much as in 2019. If tourists spend more on average because they want to make up for lost time, then the contribution to GDP will be higher. Let’s hope for that!

Number of international tourists in 2019, 2020 and 2021

Conclusion

Accounting for 14% of GDP in 2019, the tourism and travel sector will be key for the Spanish recovery. As the health situation in Spain improves and gets better in the countries where international tourists come from, the sector will be able to recover in the next few months. But given the weak first half of the year and the incomplete recovery in the second half, we think that the level of international tourists in Spain in 2021 will be 50% lower compared to 2019. The contribution of the sector to GDP is also expected to almost double compared to 2020, but will still be about 38% lower compared to 2019.

We continue to forecast GDP growth to be at 5.0% in 2021 and 6.0% in 2022.

For the Spanish economy as a whole, we expect the economy to grow from the second quarter onwards. We continue to forecast GDP growth to be at 5.0% in 2021 and 6.0% in 2022. This implies that the economy will not have reached its pre-crisis level before 2023. Admittedly, risks to these forecasts are to the upside as the national Recovery and Resilience plan could boost growth a bit more than currently expected.

Assumptions in our base case

EU (Belgium, France, Germany, Ireland, Italy, Netherlands and Portugal)

In the first quarter, there were 88% fewer tourists from the EU compared to the first quarter of 2019. For the second quarter, we expect a slight improvement (we assume that the number of EU tourists in April, May and June is at 20%, 30% and 40%, respectively, of the level in 2019). In the third quarter, we expect a large increase due to the improved health situation and the EU certificate, with a further improvement in the fourth quarter (we assume that the number of EU tourists in the second and third quarters is at 75% and 90%, respectively, of the level in 2019).

UK

In the first quarter, there were 98% fewer tourists from the UK compared to the first quarter of 2019. For the second quarter, we expect a slight improvement in April and May, and a large improvement in June on the back of Spain being added to the UK’s ‘green’ list (we assume that the number of British tourists in April, May and June is at 5%, 15% and 75%, respectively, of the level in 2019). In the third quarter, we expect the situation as that seen in June will continue, while the fourth quarter is likely to see a further improvement (we assume that the number of British tourists in the second and third quarters is at 75% and 90%, respectively, of the level in 2019).

Rest of the world

In the first quarter, there were 92% fewer tourists from the rest of the world compared to the first quarter of 2019. For the second quarter, we expect a marginal improvement (we assume that the number of tourists from the rest of the world in April, May and June is at 10%, 15% and 20%, respectively, of the level in 2019). In the third quarter, we expect an increase and a further improvement in the fourth quarter (we assume that the number of tourists from the rest of the world in the second and third quarters is at 40% and 70%, respectively, of the level in 2019).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article