Spain goes to the polls - once again

Spaniards go to the polls for the third time in four years this Sunday. While economic activity is still decent, political uncertainty could cast a shadow over the outlook

What do opinion polls suggest?

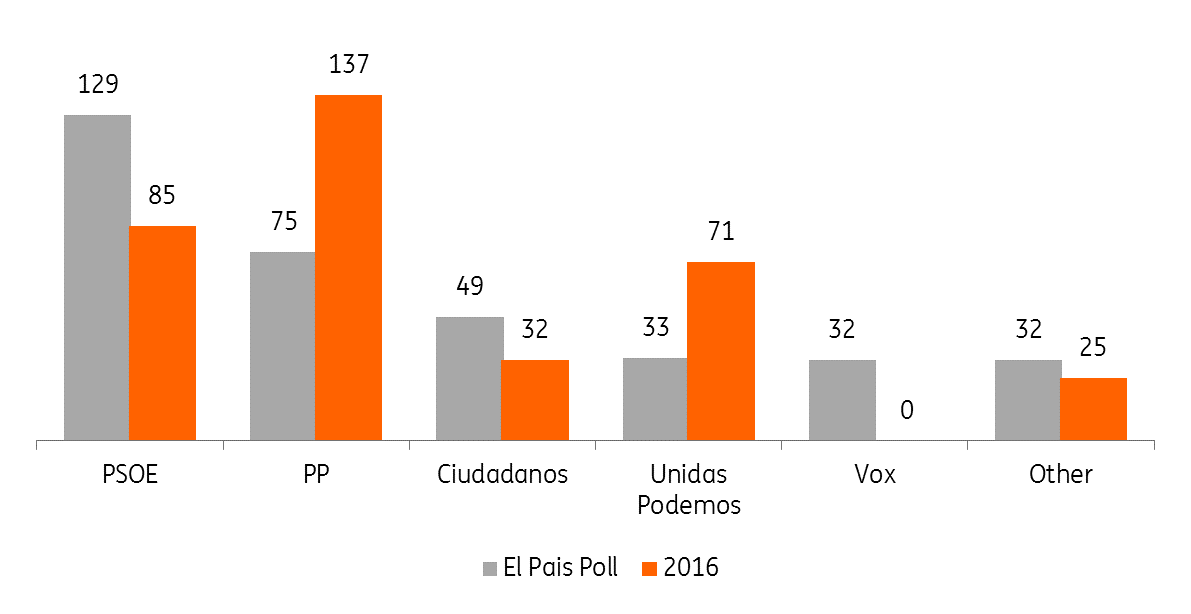

The latest opinion polls confirm big shifts in Spanish politics. Focussing on the recent Spanish newspaper El País opinion poll we conclude that:

- Pedro Sanchez's socialist party would become the largest party with 129 of the 350 seats - a sharp increase compared to 2016, where the party gained only 85 seats. Despite, being the largest party, the PSOE is likely to fall short of an absolute majority, and so a coalition would be required.

- The other large left-wing party, Unidas Podemos, would lose 28 seats and became the fourth largest party. It seems likely that the gains for the PSOE will come at the expense of Unidas Podemos. These results imply that a coalition between the PSOE and Unidas Podemos, with 162 seats, would not have a majority. Even adding the left wing Valencian party Compromis, which is likely to gain three seats might not be enough.

A majority, however, could be formed by adding nationalistic parties, but this seems unlikely. The Catalan pro-independence parties continue to ask for an independence referendum, but prime minister Sanchez has said this is unconstitutional and he wouldn't accept it. - On the right, the PP could lose about 60 seats and would become the second largest party with 75 seats. The liberal Ciudadanos (Citizens) could gain about 20 seats and would become the third largest party with 49 seats. But the big winner on the right is clearly Vox who could jump from zero to 32 seats. The party wants to abolish the autonomous regions and bring more power to Madrid and also want to combat illegal immigration and prohibit abortion.

A coalition of the three biggest right-wing parties would have 156 seats and so also fall short of a majority. Adding nationalistic parties to this mix is highly unlikely, given the harsher stance against an independent Catallan by all three right-wing parties. - A coalition between the PSOE and Ciudadanos would have a majority (178 seats). However, Albert Riviera, the leader of Ciudadanos has already ruled this out as he believes prime minister Pedro Sanchez was too lenient on the Catalan issue. If the first round of coalition talks fail, then this coalition could become more likely.

However, we won't exclude the possibility that the inability to form a coalition leads to new elections as we have seen previously in 2016.

Latest El País poll

Increasing political uncertainty likely

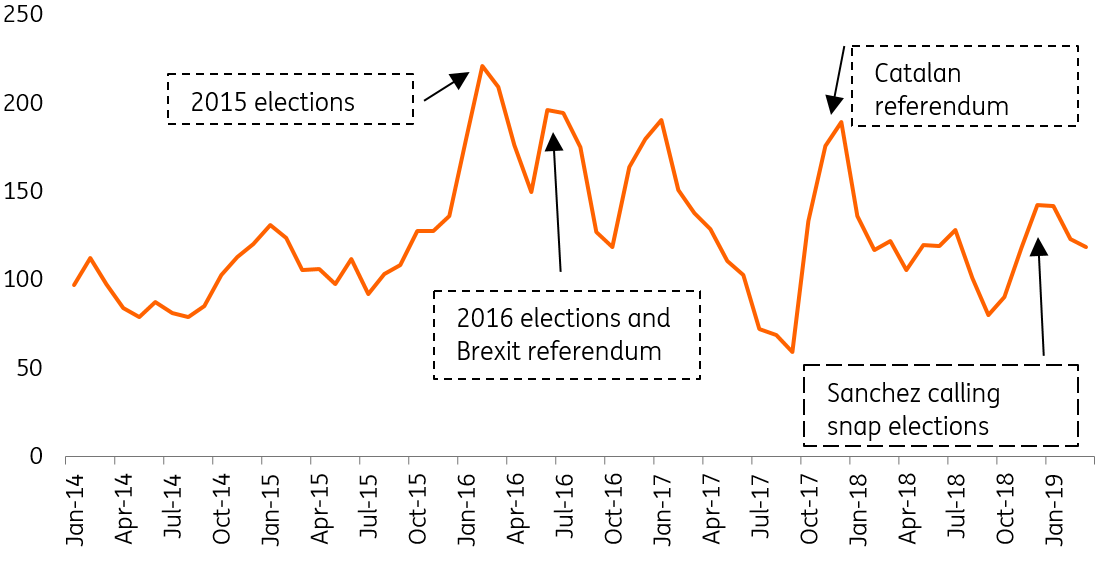

If the polls are right, then it looks like forming a government will be quite a hard task and would imply an extended period of political uncertainty, which could harm investment and hiring decisions. Admittedly, uncertainty has already been quite high in recent years, but Spanish growth has still been impressive. Indeed, political uncertainty shot up at the end of 2015 due to the elections and in October 2017 as a result of the Catalan referendum, but annual growth still managed to stay above 3% in 2015, 2016 and 2017.

We shouldn’t exclude the possibility that the inability to form a coalition could lead to new elections, as we have seen previously in 2016

During that time, the economy benefited from earlier structural reform, notably in the labour market, and from the strong external environment, but these factors are much less likely to help Spanish growth now.

Political uncertainty in Spain

Even though the economy is slowing, it's still in a decent shape

Although the economy is slowing, the current outlook is still positive. In part, a slower economy was inevitable given the fast growth in recent years and the low potential growth rate -1.4% in 2019 according to the European Commission. The weaker external environment also affects Spanish growth negatively.

Currently, we forecast 2.0% growth in 2019, compared to 2.5% in 2018. All in all, this is still a good performance and above our eurozone forecast of 1.2%.

But it's taken a backseat during the campaign

The election campaign concentrated on constitutional issues like Catalonia and social issues, such as woman’s rights, Franciso Franco’s legacy and the population decline in small villages. Given the strong growth performance of the recent past, it might seem that Spaniards aren't really all that interested in economic issues, as all seems well.

However, the latest survey from Eurobarometer carried out for the European Commission, found that's not really the case. According to the latest poll, Spaniards are most concerned about unemployment, the economic situation and pensions.

It is true that Spain's economic improvement was accompanied by lower unemployment rates as the unemployment rate reached a peak of 26.3% in 2013, but since then has continuously dropped and is now at about 14%. This is quite a substantial improvement, but unfortunately, it is still higher than the pre-crisis level of about 8.5%. Youth unemployment also remains sky-high at 32% in 2018, which helps to explain the concern around it all.

The latest Eurobarometer shows that Spaniards are most concerned about unemployment, the economic situation and pensions

Even though economic issues took a backseat during the campaign, various political parties understand that some reforms are needed. But the views on the direction are fundamentally different. The political right wants to reduce workers’ rights and make redundancies easier, whereas the left wants to repeal parts of the past labour reforms to reinforce workers’ rights.

The typical left/right divide also applies to tax policy. The left wants to concentrate on taxing the rich more, whereas the right wants to lower taxes, but what impact this would have on the deficit isn't really clear yet. And given the fact that we don't know who will be in government, it's difficult to judge what the deficit will be in 2019.

Based on the draft budget, that was not approved by parliament, the European Commission forecasted a deficit of 2.1%. We think it will be slightly higher than that, but lower than 2.7% in 2018. Overall we can say that Spain’s fiscal situation improved in recent years, due to reform and a strong economy. The debt, however, remains high - 97.1% of GDP in 2018 - and so there isn't much more room for a much larger deficit.

Opinion polls suggest forming a government will be difficult. Political uncertainty could impact economic activity negatively and as a result, bond spreads could also rise, but by much less than during the eurozone crisis. But even though there are challenges ahead, the economy is now much stronger.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 April 2019

In case you missed it: Secular stagnation? This bundle contains 8 Articles