Spain: Decelerating after a great run

After three years of above 3% growth, we expect momentum to slow somewhat in 2018 and 2019. The situation in Catalonia will not be resolved anytime soon and could be a further drag on the economy

The growth momentum

In terms of activity in 2017, there is nothing to complain about. With an annual growth rate projected to be 3.1%, Spain remains one of the fastest growing economies in the Eurozone. Growth momentum remains healthy for now, as PMIs for both the services and manufacturing sectors ended the year on a high note.

Domestic demand, which has provided a positive annual contribution to growth since the first quarter of 2014, continues to be the main driver of growth. As in 2016, private consumption remained the largest contributor to growth in 2017, although its importance declined. In contrast, the contribution of investment rose. In the third quarter of 2017, the YoY growth contribution of investment of 1.2 percentage points equalled that of private consumption.

External demand was another growth engine

Despite the troubles in Catalonia, Spain saw a record number of visitors in 2017, with the number of tourists increasing by nearly 9% YoY. However, with imports now also accelerating on the back of stronger domestic demand, the positive growth contribution of net exports was somewhat smaller in 2017 than in the previous years.

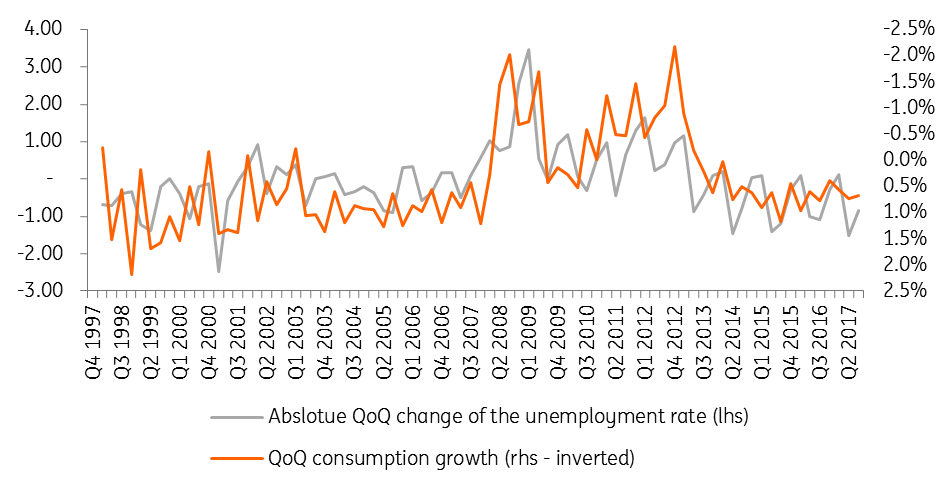

The labour market performed well last year. In the third quarter, employment grew at 2.8% YoY. Accordingly, the unemployment rate declined to 16.4% in the third quarter from 18.9% a year earlier. For 2018, we expect the unemployment rate to be 16% before dropping to 15% in 2019. This positive evolution, however, is still likely to result in a higher unemployment rate than before the financial crisis of 2009 and remains one of the highest in the Eurozone. The projected decline in unemployment will nevertheless continue to support private consumption in the coming quarters, although to a lesser extent.

Absolute changes of unemployment rate are highly correlated with consumption growth

Headline inflation to converge towards the core rate

Headline inflation moderated in the second half of 2017. In the fourth quarter, headline inflation had come down to 1.5% from 2.7% in the first quarter. Core inflation, however, has remained around 1% since mid-2015. As the base effect of oil prices fades away, we expect headline inflation to converge towards core inflation. We think, however, that core inflation will edge upwards, although at a slow pace, as the cyclical slack in the economy only gradually disappears. We expect a headline inflation rate of 1.5% in 2018 and 1.7% in 2019.

The government deficit is expected to have declined from 4.5% in 2016 to 3.1% in 2017. This is mainly due to a strong macroeconomic performance, which supports tax revenues and limits social security expenditures. We expect this trend to continue and forecast a deficit of 2.6% in 2018 and 2.4% in 2019. Government debt is also set to decline as nominal growth offsets the negative budget balances.

Headline inflation will converge towards core inflation

While core inflation is likely to slowly edge upwards

Politics muddle the picture

A big question mark is how the situation in Catalonia will unfold. The results of the Catalan snap elections last month show a divided region. The three pro-independence parties obtained a majority of seats in the Catalan parliament but did not receive more than 50% of the vote. The separatist parties agreed to re-elect Puigdemont as president of the region. However, it is not certain whether this will be possible from a constitutional point of view, as Puigdemont still resides in Brussels so a clear-cut solution doesn’t seem to be in the offing.

Political concerns haven't gone away

Unfortunately, the longer this process lasts, the more harmful it could be for the economy. According to Spain’s economy minister, the Catalan crisis already cost one billion euro in the fourth quarter, although this kind of calculation is notoriously difficult to make. On the other hand, the main Catalan pro-independence parties have somewhat softened their stance and for the time being have backed away from unilateral independence, which diminishes the risk of greater turmoil.

All in all, the macroeconomic situation remains rosy, although we expect the economy to slow a bit. The Spanish government is planning to increase its growth forecast for this year from 2.3% to at least 2.5%. This seems realistic in our view as we expect the Spanish economy to grow by 2.6% in 2018 and by 2.0% in 2019, compared to 3.1% in 2017.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SpainDownload

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles