Soybeans: How much is “substantial”?

The soybean market was eagerly awaiting the outcome of trade talks between China and the US at the G20 summit, and discussions were constructive with the two nations suspending any new trade tariffs. However, until China lifts tariffs on US soybeans, upside to CBOT prices should be limited

What was agreed?

Trade talks between China and the US appeared to go better than many in the market were expecting, evident in the strength that we have seen across the commodities complex today. According to a White House statement, both nations will refrain from implementing any additional tariffs for a 90-day period, while they try to come to a deal. Failing to do so would mean that US tariffs on Chinese goods would increase from 10% to 25%, an increase that was planned to come into force on 1 January 2019.

Specifically for the soybeans market, the White House statement does say that China agreed to buy a “substantial” amount of US agricultural products from US farmers immediately. However there was no mention of what “substantial” means, whilst the Chinese statement does not specify what specific goods they agreed to purchase, and under what timeframe.

Chinese tariffs remain on US soybeans

While trade talks were constructive, it is important to remember that Chinese tariffs on US soybeans still remain in place. The tariff remains at 25%, which means at the moment, particularly after the rally in CBOT soybeans, that Brazil still remains a more cost-effective origin for buyers. The import arbitrage for Brazilian soybeans is still open, whilst for US soybeans it remains shut.

Furthermore, sentiment following developments over the weekend may weigh on Brazilian cash values, whilst propping up US cash values, and if this is the case it should further support the view that Chinese buyers will continue to favour Brazilian soybeans from a landed cost point of view.

We believe that China will only return as a “substantial” buyer of US soybeans if and when the 25% import tariff is removed, up until then we would expect the US to be a marginal supplier of beans to China.

The other alternative is that the government puts pressure on state enterprises to start increasing purchases of US soybeans.

Brazilian cash values could come under further pressure with a US/China deal (USc/bu)

Don't forget about seasonality

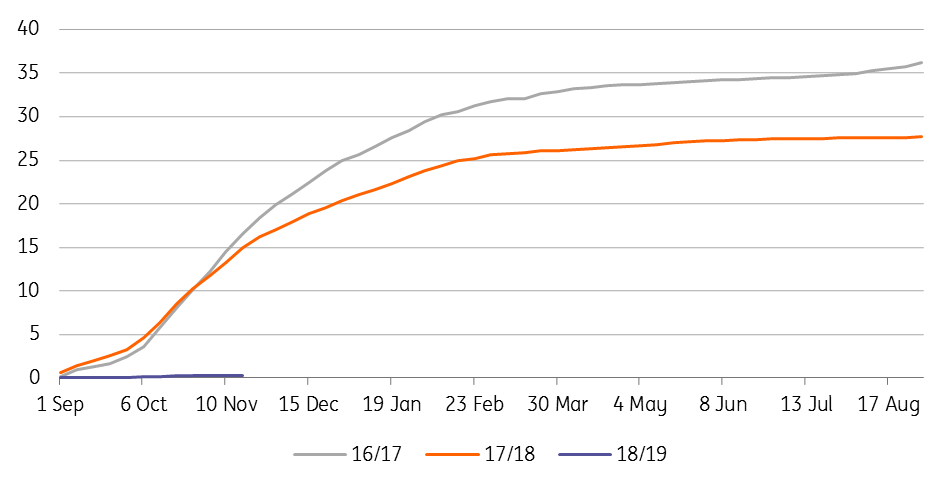

In the coming weeks and months the market will be watching closely US export volumes to China, to see what exactly “substantial” means. We would suggest to largely ignore any WoW or MoM comparisons, given that we are in the peak of US supply, and the low point of Brazilian supply, and so naturally US export volumes should pick up. The key is to focus on the YoY changes, and in our view given the closed import arb for US soybeans, Chinese buyers will continue to minimise US purchases as much as possible. In the 2017/18 marketing year, at this stage, China had imported 14.98mt of US soybeans, which was down from 16.61mt in the 2016/17 marketing year. However so far in the 2018/19 marketing year (starting 1 September), cumulative exports over the same time period total just 339kt.

Cumulative US soybean export sales to China (m tonnes)

Chinese imports of soybeans from Brazil and the US (m tonnes)

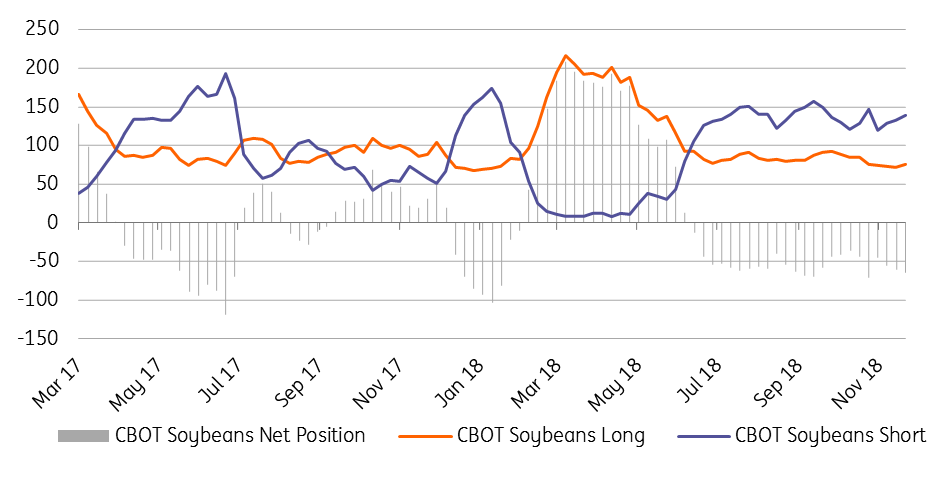

Will spec longs return?

We are likely to see some short covering from the headlines over the weekend, while the fact that China and the US have agreed to suspend further action is positive for sentiment. However, fundamentally for the soybean market, as things stand, nothing has changed. Therefore, any significant speculative buying will likely be short-lived.

As of 27 November, speculators hold a net short of 63,862 lots in CBOT soybeans, and have in fact held a net short of around this level since early July. There is a significant gross short in the market, with shorts totalling 139,235 lots, and therefore this does leave the market vulnerable to an aggressive short covering rally. This is obviously dependent on an appropriate catalyst, such as the removal of tariffs on US soybeans.

Speculators still hold a sizeable gross short in CBOT soybeans (000 lots)

African swine fever outbreak in China

The other issue for the market is whether there will be strong consumer demand for soybean products moving forward. China is currently going through an outbreak of African Swine Fever, which has seen around 600k hogs culled according to government data. However these numbers are several weeks old, and so the actual number is likely to be quite a bit higher. While this seems like a significant amount, it represents only 0.2% of the total Chinese hog count. Therefore as things stand, it is unlikely that the outbreak will have a significant impact on soybean demand.

The bigger downside risk, is if we do start to see protein content falling in animal feed. The government lower required content levels previously as a result of trade tensions between the US and China.

What does this all mean for US plantings in 2019?

US farmers still lack the clarity to make proper planting decisions for 2019. Given the loss of China as a key buyer, inventories have been building up in the US this season. Farmers are set to harvest a record 125mt crop, yet cumulative export sales come in at 11.92mt, down 44% YoY. This clearly sent the signal that farmers should reduce soybean area when it comes to 2019 plantings, and this is what the market is largely expecting. However if trade talks between China and the US are progressing in the right direction could this change?

We don’t believe farmers will risk it, they will already be in the early stages of making planting decisions, and would not want to see a repeat of this season- where there is a significant crop, yet China is not there to purchase the beans. Therefore we would still expect to see farmers increasing corn acreage at the expense of soybeans. A quick resolution though may mean the switch is not as aggressive as initially anticipated.

Download

Download article7 December 2018

In case you missed it: Rocky road ahead This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more