Soybeans: Chinese tariff fully priced in

As the clock hit 12.01am on Friday, US tariffs on $34 billion worth of imports from China came into effect, and it did not take long for China to retaliate by imposing tariffs on a number of US goods, including a 25% import tariff on US soybeans. We believe the tariff impact is fully priced in already, and therefore do not expect further pressure on CBOT soybeans

What has happened to soybean prices since the initial announcement?

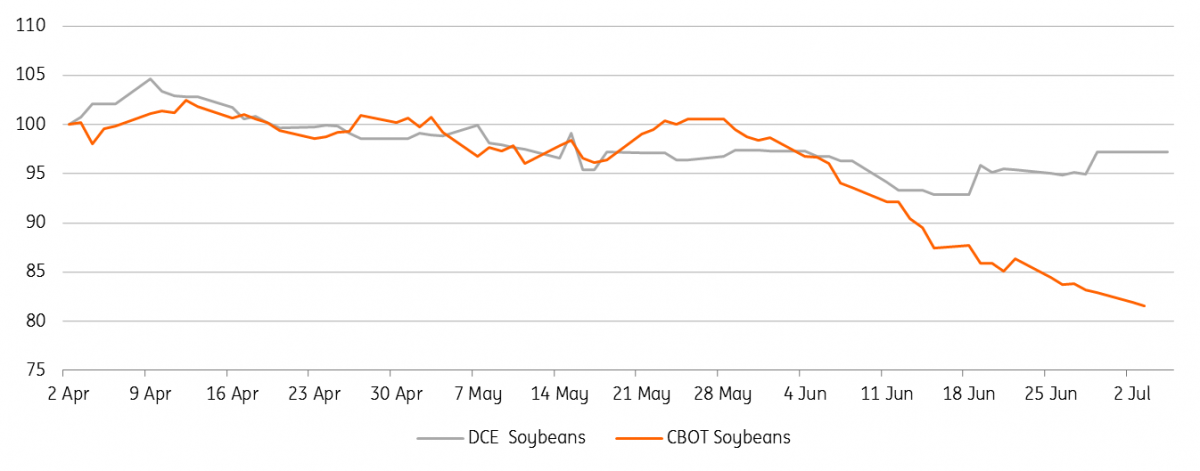

Unsurprisingly, CBOT soybeans came under significant pressure following the initial announcement from China back in April that it would retaliate to any US tariffs. CBOT soybean prices have fallen by a little over 21% since mid-April, trading below $8.50/bu, levels last seen back in 2008. In fact, CBOT has traded down to levels where, even if we take into consideration the 25% import tariff, US soybeans are still workable into the Chinese market. At the moment, we estimate that import parity is around $8.70/bu, compared to the CBOT November 2018 contract trading at around $8.56/bu.

Meanwhile, the Chinese domestic soybean futures market has strangely also traded lower, falling by around 7% since mid-April. If we look at the move in the domestic market in USD terms, prices have fallen by almost 12%, reflecting the depreciation that we have seen in the CNY recently. It appears that the domestic market started pricing in these tariffs earlier in the year, with domestic futures rallying strongly over 1Q18.

CBOT and Dalian normalised soybean price

Has there been an impact on US soybean flows yet?

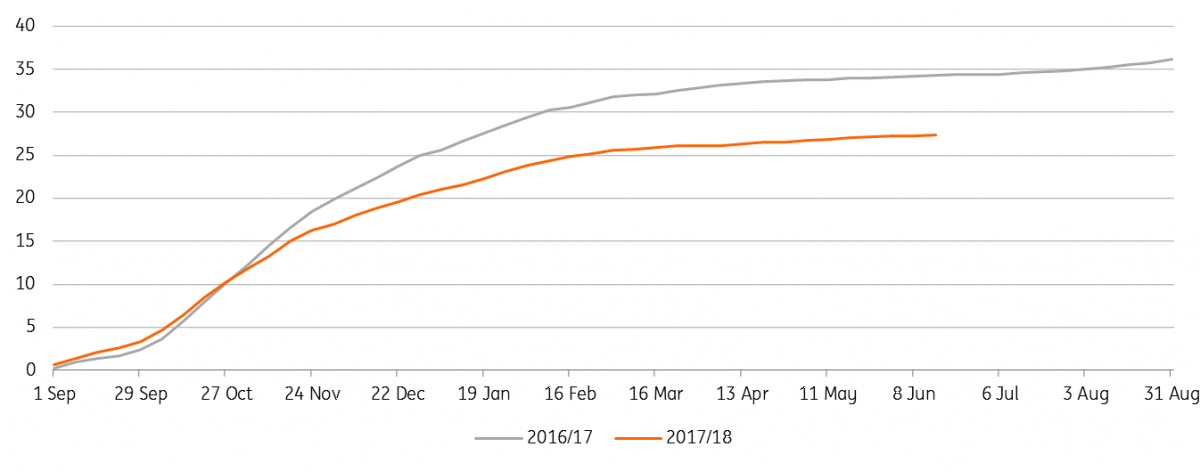

The US exported 36.16mt of soybeans to China last season, making up 39% of total Chinese soybean imports. Meanwhile, China made up 62% of total US export demand. Looking at US export sales over the current marketing year does show that exports to China have fallen well behind last season. The latest data shows that cumulative sales to China are down 20% YoY. However, it's important to point out that exports started falling behind last season prior to the escalation in the trade spat. There are about 1.14mt of outstanding sales in the current marketing year, which shows China as the destination. Given the introduction of the tariff, we are likely to see these sales cancelled, or at least the destination changed, with an incentive for Chinese buyers to source Brazilian soybeans, a situation which will keep Brazilian farmers happy.

US soybean export sales to China (m tonnes)

US loss is Brazil's gain

Brazil is on course to harvest a record soybean crop this season, with it estimated to total 118mt, up 3.5% YoY, putting the country on par with the US when it comes to soybean production. So Chinese tariffs on US soybeans have come at a great time for Brazilian farmers. Cash values for Brazilian soybeans have rallied over CBOT, a sign of growing demand for Brazilian product. However, we are in a period where Chinese buyers seasonally rely on Brazilian supply. It will be interesting to see how the purchase of US soybeans evolves as new crop supply hits the market later in the year.

Brazil soybean cash value over CBOT soybeans (Usc/bu)

What does this mean for prices?

While Chinese buyers will be keen to buy soybeans from origins that do not attract a 25% import tariff, we believe that China will still need to rely on the US to help meet domestic demand. In order for flows from the US to China to make sense, we either need to see domestic prices rally, a weakening in CBOT soybeans, or a combination of the two. Clearly what the market has seen so far is weakness in CBOT prices.

As mentioned previously, CBOT has traded down to levels where imports of US soybeans into China are workable with the 25% import tariff. Therefore we don't believe that there should be much further weakness in CBOT, with prices likely trading largely between $8.00-8.70/bu over the next 12 months.

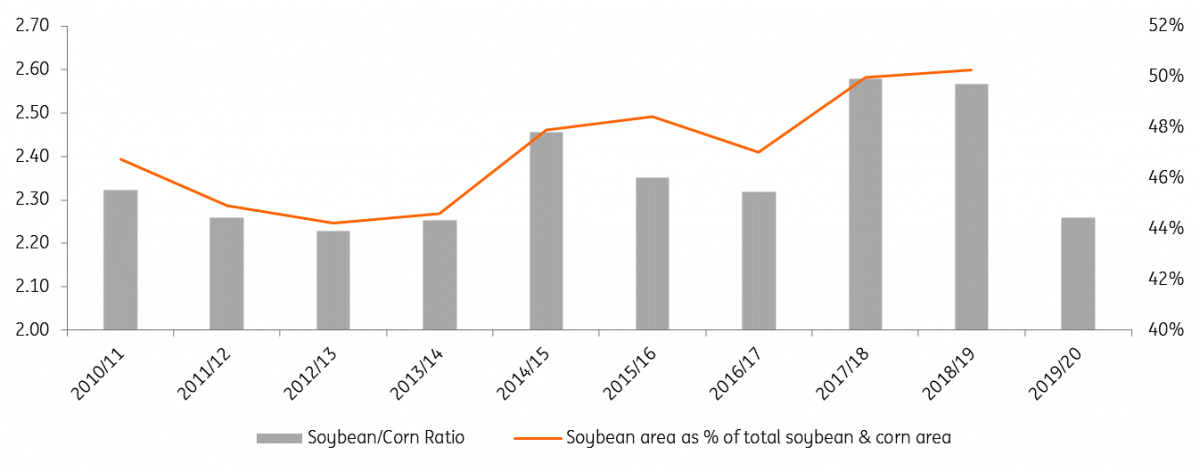

The knock-on effect from weaker soybean prices

The weakness that we have seen in the soybeans market has also had an impact on other agri commodities, with CBOT corn prices falling by more than 12% since mid-April. While it is too late for US farmers to adjust their 2018 plantings, it is likely that for 2019 farmers will make a significant adjustment, with them looking to plant more corn at the expense of soybeans. The soybean/corn ratio is already sending this signal to farmers, with it currently standing at 2.26. Therefore assuming normal weather conditions and yields over 2019, the market could expect to see significantly more US corn supply than it was initially anticipating.

However, the underlying fundamentals for the corn market remain constructive, and we believe the market needs this additional supply in order to meet demand moving forward.

US soybean/corn ratio weakens

Download

Download article

6 July 2018

In case you missed it: Trading blows This bundle contains 5 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more