South African elections to bring new challenges for ruling ANC

South Africa’s ruling ANC could lose its majority in the country’s national elections if polls are to be believed. Expectations have shifted towards policy continuity from a coalition with smaller opposition parties

Ruling ANC likely to lose majority, but markets expect a benign outcome

South Africa heads to the polls today, in what could be the most important elections for the country since the end of apartheid in 1994. The ruling African National Congress (ANC) has seen its support gradually dwindling since the early 2000s, with recent opinion polls pointing to the potential for the party to lose its majority and have to form a coalition to stay in power, albeit remaining the dominant political force. The entry of former president Zuma’s MK party onto the ballot sheet as a challenger to the ANC has added further uncertainty to the process, especially with a recent court ruling barring the former president from standing for parliament.

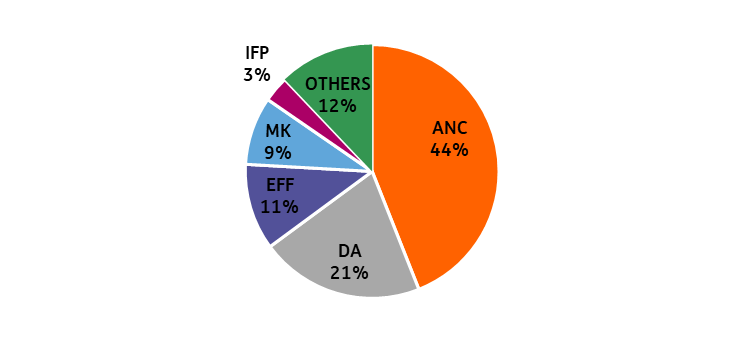

South Africa election polling – modelled support based on full turnout of all registered voters (Ipsos)

Investor nervousness rose in recent months on the back of polls showing ANC voting potentially dipping below 40%, while a more recent recovery in support and more clarity on the polling process has eased some of the concerns. Polls from Ipsos and the Social Research Foundation show ANC support in the range of 42-46% among various turnout scenarios, while market consensus seems even more optimistic, with most expecting the ANC to reach 45% or above.

South Africa election polling – possible party support in medium turnout scenario (Ipsos)

The market implications here are clear – such a scenario (ANC nearer 45% or higher support) would likely mean the ANC is able to build a coalition with one or a few smaller parties (the IFP seen as the most likely first choice of coalition partner), ensuring some level of policy continuity and more certainty on the outlook. In contrast, a coalition with the leftist EFF in particular has been seen as a clear negative tail risk scenario by investors, that could occur if ANC support falls to nearer 40%. A further alternative scenario would be an even sharper drop in support for the ANC to below 40%, that would likely require the main opposition DA, in order to form some sort of grand coalition. While this would see plenty of near-term uncertainty, there is an argument that this outcome may bring more medium-term optimism in driving more significant reforms after many years of stagnation and seemingly unfulfilled promises from the ANC’s political dominance.

Stagnant growth a key area of discontent amid chronic power crisis

Alongside voter concerns over crime and corruption, the economic aspect of falling ANC support should not be underestimated. The country has seen stagnant economic growth for much of the past decade, alongside soaring unemployment and inequality. The IMF calculates real GDP per capita (in $PPP terms) for South Africa has declined since 2013, and even fallen below the EM average amid local growth rates that have averaged less than one percent over the past decade.

Real GDP per capita ($PPP)

When breaking down the composition of growth, investment has been particularly weak, while household spending has also stagnated more recently, and government spending has offered little stimulus given ongoing attempts at fiscal consolidation. Business and consumer confidence surveys have broadly been trending downwards, despite a slight uptick in the past few months.

Contributions to real GDP growth (YoY%)

A key explainer for South Africa’s economic stagnation and lack of confidence, and an important election topic, is the electricity situation. The economy has suffered from persistent blackouts and lack of electricity generation capacity, amid poor performance from state-owned utility Eskom. The country’s electricity available for distribution declined gradually for much of the past decade, before a more notable drop-off from late 2021. While Eskom’s issues are clearly far from solved, there are a few reasons for optimism – firstly, electricity generation from other, private-sector power producers has been steadily increasing, amid a push from the ANC to reduce Eskom’s monopoly on the market. Additionally, since mid-2023 there has been a slight uptick in electricity generated, with signs of stabilisation in the situation and a solid streak of almost two months without load shedding.

Electricity available for distribution, seasonally adjusted (GWh)

Whatever the election outcome, this is likely to remain a hot topic, with accusations from the opposition that the government is leaning on Eskom to burn diesel in the short term, in order to stabilise the power situation in the runup to the election.

Gradual fiscal consolidation facing pressure from interest costs

Another key election topic for investors will be the outlook for fiscal policy. The past decade has seen a significant increase in government debt, from just over 20% of GDP in 2009, to over 70% as of the latest data. The need for support for struggling state-owned companies such as Eskom, along with elevated social spending has kept expenditure high, while the stagnant growth environment has also contributed to something of a debt spiral. 2023 saw the budget deficit widen to 6% of GDP amid a rising interest bill, compared to around 4% in general pre-Covid. Monthly central government fiscal data through to March has offered some reasons for optimism, with the country reaching a primary surplus for fiscal year 2023/24 (FY runs April-March), especially impressive given the pre-election context. However, the process of further fiscal consolidation is likely to remain a painful one absent more significant growth momentum.

General government budget balance (% of GDP, rolling 12-month)

As a structural positive for South Africa, despite the rising debt levels, the majority of government debt remains denominated in local currency and is also locally held. The share of foreign investors in the domestic market has fallen from almost 43% in 2018, to less than 25%, meaning lower risk of a further rapid surge in outflows from the local bond market from hot money. Overall, this leaves South Africa’s problems more akin to many developed markets, in terms of a gradual deterioration in fundamentals and rising government debt ratios, rather than at near-term risk of a more classic EM crisis.

Government debt (% of GDP)

External metrics normalise to a comfortable position

The Covid shock in 2020 saw a rapid adjustment in South Africa’s current account, amid improving terms of trade and depressed imports. This drove a rare current account surplus, reaching as high as 5% of GDP, before normalising more recently to a deficit of nearer 2% of GDP. Despite the recent normalisation, this current account deficit leaves South Africa in a far less vulnerable position than the 5% of GDP deficits seen prior to the taper tantrum in 2013, with goods trade remaining in a modest surplus, and terms of trade still elevated compared to pre-Covid levels.

Current account balance (% of GDP, rolling 12-month)

At the same time, the overall negative sentiment towards South African assets in recent years has also reduced external vulnerabilities. We have seen persistent selling of South African domestic assets by foreign investors, in particular equities, amid the negative economic backdrop. When combined with the nation’s credible central bank and freely floating exchange rate, along with a positive net international investment position, the risk of any form of external/BOP crisis appears low, even in a scenario of an election result that is perceived as less market friendly than initially expected.

South Africa – Non-resident flows to local assets (Rolling 3-month)

FX: A lot of good news already in the rand

The rand has been one of the top emerging market currency performers over the last six weeks. That may partially be due to the tick-up in ANC popularity in the polls – reducing the risk of a market-unfriendly coalition. A large part of that rand out-performance, however, will be down to the external environment. Here low FX volatility has favoured the relative high-yielders, like the rand, which offers a 3% real interest rate. Additionally, the rand has been enjoying some strong terms of trade support given the surge in the prices of South Africa's top exports such as gold and platinum.

The question is whether the rand has to rally much further? We suspect a further decline in USD/ZAR will require some more good news from the external environment such as some softer US inflation data. It is not clear to us that USD/ZAR needs to trade substantially below 18.00 should the ANC do well enough in the election to minimise the risk of uncertain coaltiions. At the same time, the rand is one of the currencies most highly correlated to the China growth story and to the renminbi. USD/CNY trading above 7.25 over the next week or so could well undermine any further gains in the rand.

In short, we doubt the local story will justify USD/ZAR sustaining a move under 18.00 – unless that is softer US data provides a lift to the whole emerging currency complex.

USD/ZAR spot rate

Inflation and interest rates

Sovereign credit spreads still offer a decent pickup over rating peers

Multiple years of fundamental deterioration and credit rating downgrades have seen South African sovereign credit spreads widen relative to IG and BB-rated peers. After a tough start to the year, the more recent shift in expectations towards a likely benign election outcome has seen a recovery in SOAF bonds, although they still offer a 50bp pickup on average to BB-sovereigns (versus 90bp in early April), and now trade only 100bp tight to the single-B sovereign average.

South Africa USD bond spreads vs EM average (bp)

On the positive front, geopolitical headline noise has died down about South Africa’s foreign policy stance, with clear attempts to balance relations with the West and BRICS peers. At the same time, limited issuance in the Eurobond space should be a positive technical driver. While signs of a potential ANC-EFF coalition would clearly see a negative market reaction, most other election scenarios should offer scope for a further medium-term compression in spreads back towards the BB-sovereign average, although investors will want to see more concrete evidence that recent reform momentum can be maintained.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article