South Africa: Trump’s unwelcome attention

President Trump’s foreign policy tirade has turned in a surprising new direction: South Africa. His concerns over threatened land expropriations from farmers are raising fears of fresh US sanctions. This is more a risk for the rand than the sovereign since a large part of South Africa's external debt has been issued in local currency

Trump tweet hits the rand

The ZAR briefly sold off Thursday on news that Donald Trump had tasked Mike Pompeo, the US Secretary of State, to ‘closely study’ the issue of land expropriation from farmers in South Africa. With US foreign and economic policy merging into one this year, investors have naturally started to worry about whether Washington could look at the economic sanctions tool to effect change.

For reference, South Africa’s ruling ANC party is currently examining ways to amend the constitution to potentially expropriate farmland without compensation. A parliamentary review committee will come back with an opinion on this issue by the end of August.

Where could this lead and how could the rand react?

It seems unlikely that the Trump administration would attack this issue with as much gusto as it has done against China (unfair trade and superpower threat), Russia (election meddling) or Turkey (holding a US evangelical pastor). Yet the situation is certainly worth monitoring.

Were Washington to decide that action needed to be taken, the world would naturally look at South Africa’s trade exposure to the US. Here 7% of South Africa’s exports go to the US and South Africa runs about a $2 billion annual goods surplus – largely in precious metals, stone and vehicles. A particular focus may be South Africa’s eligibility for the African Growth and Opportunity Act, a Bill Clinton initiative providing duty-free status for US imports from eligible African countries.

In what would seem the unlikely event of Washington dialling up the sanctions threat on South Africa (actually South Africa was already caught by US steel and aluminium tariffs earlier this year), how would the rand respond?

The rand is typically a high beta currency to risk sentiment given its relatively liquid equity and debt market and prominent position in emerging market benchmark indices. It typically trades as a high volatility currency and currently shows, against the dollar, one-month realised volatility of 27%. This is high compared to the Russian rouble (15%), Polish zloty (11%) and Mexican peso (14%).

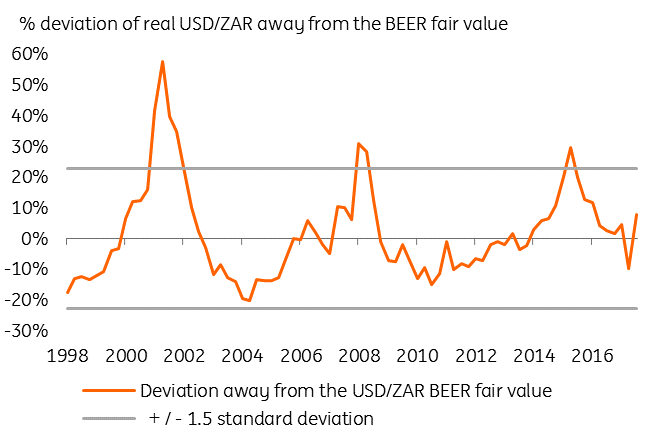

Our medium-term fair value model (the BEER) currently shows USD/ZAR some 8% above its fair value – but that can easily extend into the 20-25% overvaluation area, or 16-17 in USD/ZAR, during times of extreme concern.

USD/ZAR: A little overvalued but could rally further

South Africa's external debt burden is manageable

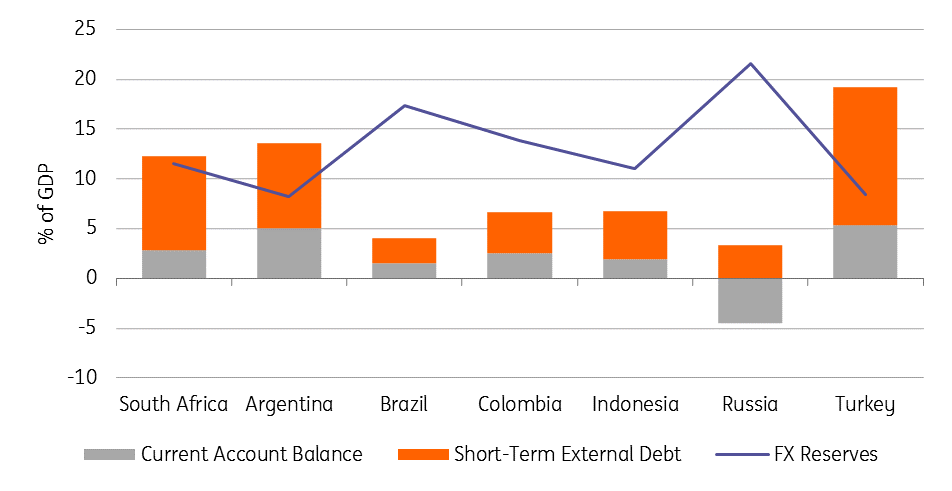

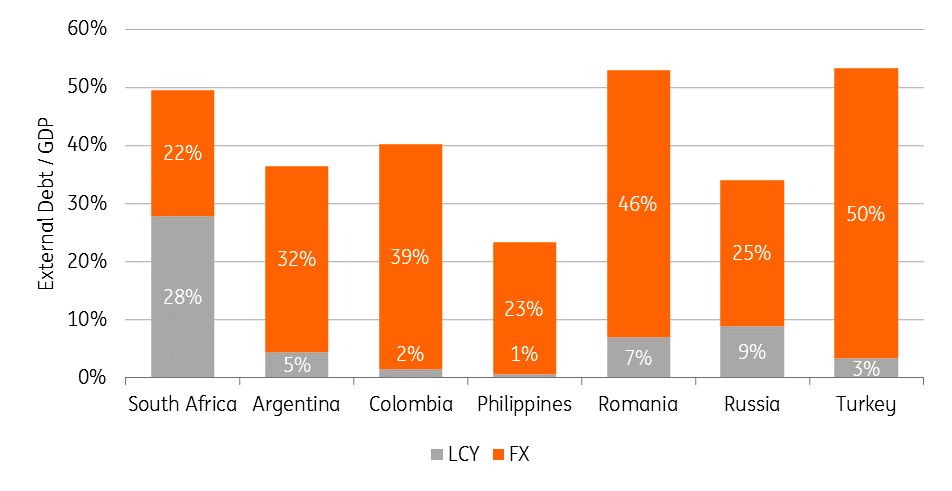

At first glance then, South Africa appears to be vulnerable given its high external debt (50% of GDP) and short-term refinancing needs (3% current account deficit and 9% short-term external debt as a percentage of GDP), with FX reserves just sufficient to cover the latter.

Yet, South Africa stands out for its high share of local currency debt (53% of total external debt) which substantially eases the pressure from a depreciation of the rand on fiscal and corporate balance sheets.

In comparison to idiosyncratic stories such as Argentina or Turkey, we also believe that South Africa will be able to prevent substantial outflows: Institutional independence and credibility of the National Treasury and the Reserve Bank (SARB) are key strengths. Reassuringly, inflation stood at 5.1% year-on-year in July, which is still within the South African Reserve Bank's target band of 3-6%.

EM Refinancing needs and FX Reserves (% of GDP)

Tough times for the rand

Trump's tweet merely adds to the headwinds facing the rand. These headwinds are blowing out of Washington, where: i) a Fed shifting monetary policy to neutral if not tight and ii) US economic sanctions are starting to weigh on South Africa's biggest trade partner, China.

Were the US in late September to go ahead with 25% sanctions on the next $200 billion of Chinese imports, we could see the emerging market FX complex, especially the commodity exporters like South Africa, taking another leg lower. So even though the rand looks to be cheap and has an implied yield of 7% per annum through the three month forwards, we're more worried that USD/ZAR has to trade to the 15.50 area first.

Currency depreciation would also raise questions for the South Africa Reserve Bank (SARB). The market is toying with the idea of a 25 basis point rate hike from South Africa over the next six months, but more aggressive tightening could easily be priced in were the rand to come under heavy pressure over coming months.

EM Local Currency and FX External Debt (% of GDP)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 August 2018

In case you missed it: De-throning the king This bundle contains 8 Articles