South Africa budget: A Herculean task awaits

In its supplementary budget, the South African National Treasury undertook sharp revisions in the macro and fiscal framework amid the ongoing pandemic. By March 2021, government gross debt is expected to rise to 82% of GDP from 63.5% a year earlier, driven by a contraction of 7.2% in growth and a GDP fiscal deficit of 15.7%

| 81.8% |

Gross government debt to GDP projection in FY20/21an increase by 18.3ppt vs a year earlier |

The big conundrum

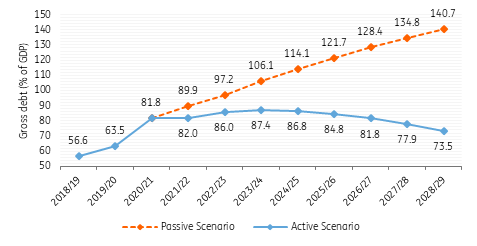

The revisions for FY20/21 are mostly in line with market expectations but the big conundrum on how South Africa can stabilise its public debt trajectory remains, with the National Treasury presenting two scenarios:

The passive scenario is much in line with market fears of an uncontrolled debt spiral. The active scenario which the cabinet has endorsed would see a primary surplus and debt peaking at 87% by FY23/24. This would be achieved through tax increases, further spending adjustments and economic reforms, in addition to plans from February to tackle the public wage bill. Lastly, future fiscal frameworks would be “guided by the principles of zero-based budgeting” (where spending allocations are matched with revenues, rather than previous year’s spending).

Gross debt outlook under the NT’s active vs passive scenario (% of GDP)

This amounts to a Herculean task by the time when Finance Minister Mboweni presents the October Medium Term Budget Policy Statement.

Some hopes rest on the government’s ability to push for unpopular but much-needed reforms in unprecedented times. Ultimately, these policy choices will, however, take time and face many hurdles in a confrontational environment (namely ANC factions and unions). Meanwhile, the economic and fiscal reality paints a different and a much more dire picture. Over the next few years, debt sustainability will remain a serious concern.

Catching up with reality as debt/GDP surges above 80% in FY20/21

As expected, the supplementary budget marks a drastic deterioration in the fiscal outlook for FY20/21 and beyond. In comparison to the projections in the February budget, the Treasury expects the consolidated fiscal deficit to more than double from 6.8% to 15.7% of GDP for the current fiscal year.

On the one hand, revenues are affected by lower growth (seen contracting by 7.2% in 2020 before recovering by 2.6% next year) and tax revenue shortfalls, resulting in revenue as % of GDP falling to 22.6% (vs 25.8% in the February budget). On the other hand, expenditures are on the rise driven by the government’s stimulus package and rising debt-service costs. For the Covid-19 relief package, ZAR145bn have been allocated in the supplementary budget which is offset by ZAR109bn from in-year spending adjustments, implying a ZAR36bn increase in expenditure.

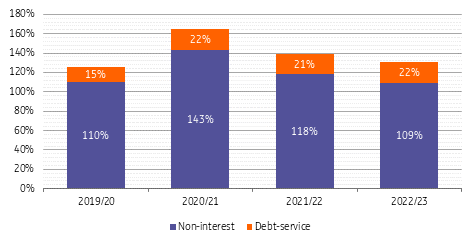

Meanwhile, the higher debt burden and lower revenues result in a jump of debt service costs to 22% of revenues in 2020/21 (up from 15% in FY2019/20).

Non-interest vs interest spending (% of revenues)

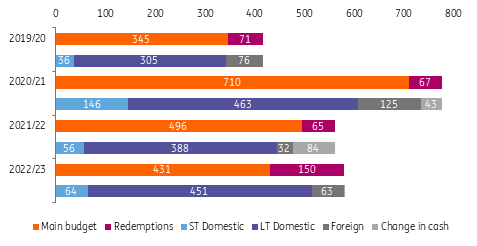

The substantial funding needs for the current tax year (ZAR777bn, thereof ZAR710bp for the budget deficit and ZAR67bn in redemptions) have resulted in larger domestic borrowing needs. The government focusses on short-term borrowing in the near-term (ZAR146bn for FY2020/21 vs ZAR48bn in February budget) which eases the pressure on long-term borrowing (ZAR463bn vs ZAR338bn).

Foreign funding of ZAR125bn (c.US$7bn), we believe, represents the funding sought from IFIs, including the already secured US$1bn from the New Development Bank and US$4.2bn under the IMF Rapid Financing Instrument (talks ongoing). This would mean no or only opportunistic Eurobond issuance for FY2020/21.

Gross borrowing requirement and financing (ZARbn)

Bold and unpopular reforms needed to stabilise government debt

The 15.7% of GDP deficit will see government gross debt/GDP rising from 63.5% in March 2020 to 81.8% by March 2021. The Treasury has developed two scenarios for the future debt trajectory, with the passive scenario (low growth, higher debt service and public expenditure) seeing debt/GDP steadily rising to 141% of GDP by end of the decade (see chart on front page).

The active scenario sees debt/GDP peaking at 87.4% in FY2023/24 but would require bold steps by the government, notably ZAR250bn in spending reduction over the next two years to achieve a primary surplus (vs -9.7% of GDP in FY2020/21). More details will be revealed by October, but the NT already indicated that tax increases are inevitable from next year onward (ZAR4bn in 2021/22, ZAR20bn in 2022/23, ZAR10bn in 2023/24 and ZAR15bn in 2024/25). Moreover, additional spending adjustments will be taken. In terms of economic reforms, we would be looking for plans in the MTBPS to reduce the cost of doing business and improve competitiveness. All this comes on top of the NT’s ambitious target to tackle the bloated public wage bill (the February budget indicated ZAR160bn of spending reduction here) although the timeline for negotiations remains unclear while unions remain strongly opposed.

Lastly, key risks come from weak state-owned enterprises: The supplementary budget allocated ZAR3bn for the Land Bank recapitalisation but larger risks come from loss-making South African Airways and notably Eskom. The Treasury sees “the urgent need for broad-based reforms at SOEs but this has faced some roadblocks, notably with Eskom delaying its divisional split to March 2022.

Rating pressure increases for future budget statements to deliver

Among rating agencies, Moody's said that the debt increase for FY20/21 is the highest in South Africa's rating category (Ba1 with a negative outlook) but in line with the rating agency's forecasts. However, stabilising debt by 2023 will be very difficult to achieve given the weak fiscal consolidation track record and weak medium-term economic outlook. The rating agency downgraded the sovereign rating in end-March, resulting in the loss of South Africa's last investment-grade rating and the exit from the FTSE World Government bond Index for local currency government bonds. S&P and Fitch also cut the sovereign rating by one notch each in April, to BB- and BB, respectively.

The rating remains on negative outlook at Moody’s and Fitch. We believe that the National Treasury’s budget has maintained a commitment to fiscal discipline by projecting a possible scenario towards debt stabilisation. Notwithstanding, increasing rating pressure will be on the October MTBPS and the February 2021 budget statement to deliver on reforms.

Rating drivers/Factors that could lead to an upgrade or downgrade

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article