Softer Canadian inflation won’t faze the central bank

Falling oil prices should see inflation slow temporarily in November’s data. That’s unlikely to worry policymakers, although the recent slowdown in wage growth might

The oil price plunge may only hit inflation temporarily

It is fair to say last month wasn’t great for any major oil-exporting economy. Both Brent and Western Texas Intermediate (WTI) fell by over 30% from their October highs. In the short-term, that should drag November’s headline inflation figure down from 2.4% to 2.1%.

However, following the recent OPEC+ decision to cut oil production, our commodities team expect prices to trend back above $70/bbl as we move into 2019. The recent Alberta curb on oil production has also seen Western Canada Select (WCS) surge, narrowing the discount it faced relative to benchmark prices. Taken together, these factors should limit some of the downward pressure on inflation in the months ahead.

Central bank may overlook core inflation if wage growth continues to weaken

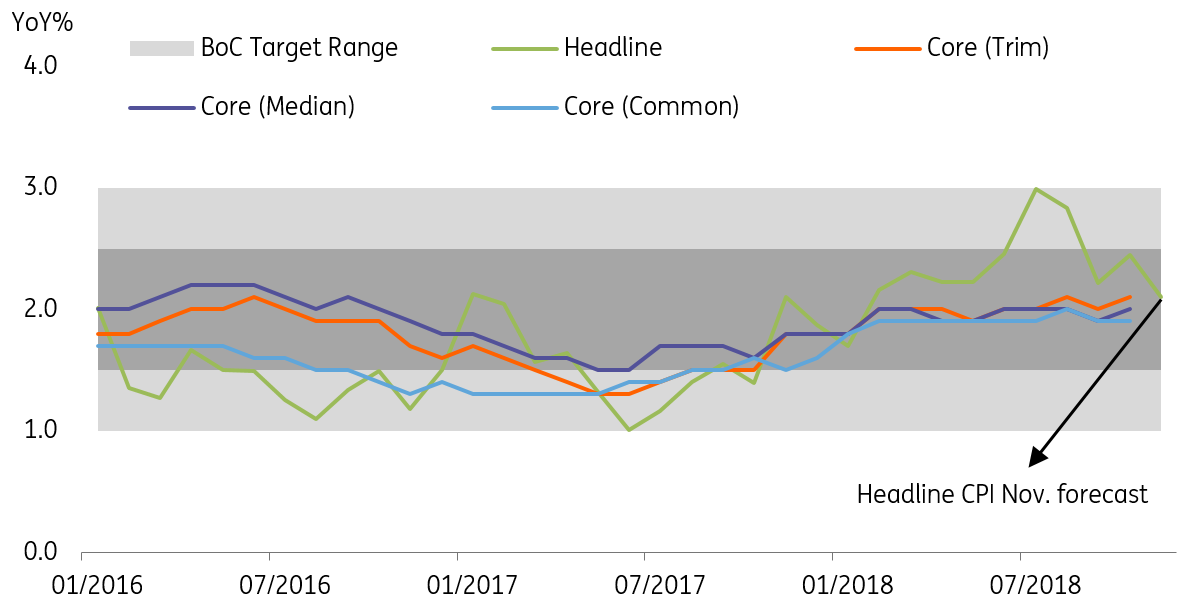

However, for the Bank of Canada (BoC) it is core inflation that counts, and the news here has been a bit mixed. Average hourly wage growth (for permanent workers) has been slowing for six months now, although so far this hasn’t had any adverse effects on core inflation. The Bank’s three main measures averaged a healthy 2% in October, and in the BoC’s October Business Outlook Survey, firms labour shortages were a considerable production constraint.

Our base case scenario is that weak wage growth shouldn’t be a theme throughout 2019

We expect this to gradually translate into some upward pressure on wages as firms seek to attract workers, and we’ll be keeping an eye out for further references of this in the next Outlook Survey due on Friday. For now, our base case scenario is that weak wage growth shouldn’t be a theme throughout 2019.

Headline inflation should fall towards core measures, but we see no reason for concern

Expect two more rate hikes in 2019

As higher borrowing costs feed into the economy, we expect growth to moderate a touch next year, which may take a little heat off core inflation in the medium-term. But assuming we do see some recovery in wage growth, we suspect policymakers will continue to hike rates in 2019.

The central bank's slightly less-hawkish tone at its December meeting, coupled with persistent trade tensions, remain key considerations for policymakers

We expect a rate rise in the first and third quarter of next year, and wouldn’t rule out a third. However, the central bank’s slightly less-hawkish tone at its December meeting, coupled with persistent trade tensions, remain key considerations for policymakers.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article