Social media companies face perfect storm

Social media companies have suffered heavily in the recent stock rout. Recent revenue trends contribute to this. Some companies will be impacted by declining advertising revenues more than others, caused by changing policies around the use of cookies

Equity returns of social media companies have been dreadful lately

The technology sector is not immune to the severe economic disruption caused by the war in Ukraine and rising energy prices. The Nasdaq index, which is dominated by technology companies, has lost about 27% of its value over a year. This loss is larger than the Dow Jones index which is traditionally more focused on industrial companies. The Dow Jones index has lost 15% of its value in a year. However, there are many underlying differences within the technology sectors, pointing to a divergent impact.

Social media companies rely on advertisers

The business model of many internet companies depends on advertising revenues. This holds especially true for some companies that are well-known online, such as Meta (Facebook, WhatsApp), Alphabet, Amazon, but also Snap, Pinterest and Twitter. For example, about 81% of revenues at Alphabet are from advertising, according to Moody’s. The revenues of these companies have exploded as many advertisers have moved their advertising budgets online. This move has been compounded by the relatively high effectiveness of online advertising.

Western Europe advertising expenditure (US$bn)

The outlook for advertising revenues has deteriorated

As shown by the figures above, advertising expenditures allocated to time-based, or linear, audio-visual media is expected to be moved towards digital media. From 2016 to 2025, advertising spending on linear media is expected to decline by 29% according to Magna Global, while advertising spending on digital media is expected to more than double in the same period. Revenue growth at the digital platforms is therefore not only driven by market growth but mostly by shifting advertising preferences.

The bigger advertising agencies have so far not announced any weakness in advertising revenues. According to Bloomberg, the consensus expectation for Omnicom’s organic 2022 revenue growth is still around 3%. Publicis raised its expectation for organic 2022 revenue growth on 21 July, to which the equity market reacted strongly positive. The fact that these companies did not report disappointing revenues can be explained by the fact that the budgets the agencies work with have been committed beforehand. By comparison, ads on technology platforms are often sold through an auction. This real-time process makes the pricing of ads much more susceptible to a drop in demand. Something we see happening now. In addition, agencies are making their way into this new domain of online advertising. Publicis made some acquisitions and is working with an ID-based solution to track online advertising performance.

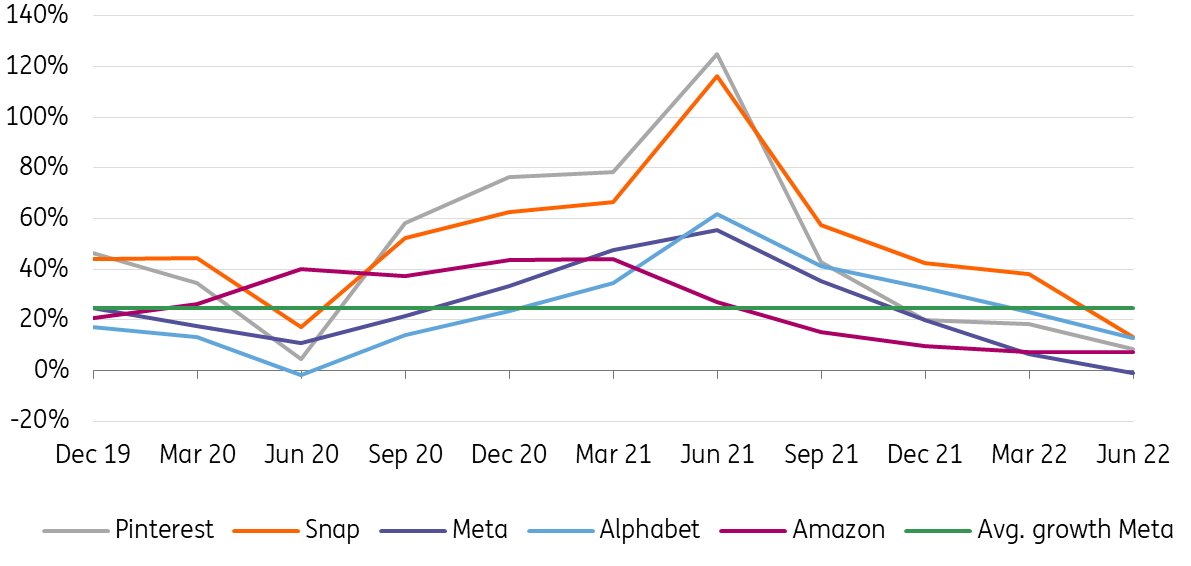

Quarterly revenue developments online advertising companies (YoY)

Recently, however, many social media companies have announced that they expect their advertising revenues to decline. Meta announced a small year-on-year decline in 2Q revenues by -0.9%, while its historical average quarterly growth rate has been 35.8% since 2015. This is the first time the company has reported negative quarterly revenue growth. Alphabet announced an overall revenue increase of 12.6% in 2Q22, but the company mentioned that its advertising segment is facing headwinds, while cloud is doing well. Snap announced a 2Q22 revenue increase of 13%. The company had indicated already in May that growth would be below the initial guidance of 20-25% growth for 2Q22.

Nevertheless, the strong secular growth in online advertisement demand could mask the effects of an economic slowdown. Most companies are still reporting revenue growth, despite headwinds. However, when online advertising becomes more mature, it can no longer take market share from linear advertising budgets while it relies more on growing advertising budgets. Therefore, at some point in the future, growth rates of digital advertising revenues should come down while the industry becomes more prone to economic cycles. For now, online advertisers are still grappling with the effects of policies that intend to increase the privacy of citizens.

Apple has restricted the online tracking of users

In the summer of 2021, Apple started to significantly restrict the ability of advertisers to track the behaviour of users. Apple introduced a new privacy feature for iOS devices that limits app developers to target users as well as to measure ad performance. Companies that relied on such tools, such as Meta and Snap, have been impacted to a larger extent than advertisement companies relying on other means, such as advertisement income from search ads. In its 4Q21 earnings call, Meta announced that it expects the changes in iOS to have an impact on 2022 revenues of about $10bn.

We could see more barriers raised to target specific users

Apart from changes made at Apple, Google is also planning to phase out mechanisms that track user behaviour through cookies. There is an industry-wide awareness that users are increasingly concerned with the information collected by technology platforms. The introduction of cookie legislation as well as the European Union’s General Data Protection Regulation (GDPR) have also contributed to this. Google, for example, plans to introduce a new tool which should replace cookie tracking. It has been delayed now to next year. Nevertheless, there are many ways to segment users to be able to target ads. However, this is costly and easier for some than others. Some advertising agencies are also uncertain about the potential impact of restricting cookies. S4 mentions in its 2021 annual report that: “Google’s announcement that it will be blocking third-party cookies by 2023 (delayed from 2022) presents both a significant opportunity and challenge to the group, given that several of our programmatic activities are built on top of the third-party cookie”.

In any case, new technology has to match the appropriate regulations such as GDPR. There are also other issues. People use multiple devices interchangeable, which makes it hard for third-party cookies to track consumer behaviour as well as the effectiveness of advertisements. Users may open an email or website on one device and buy the goods or services that are advertised from another device. This reduces the effectiveness of the current systems.

Bigger platforms have more opportunities to invest in new technology

Other means to place targeted advertisements are possible. Some companies already own specific user data, which makes it easier to sell advertisements targeted at specific user groups. Companies that sell ads based on user search requests still have a straightforward model. It will also be possible to sell ads based on the context it will be shown in. Furthermore, systems could be created around target groups using data in an anonymised way. Nevertheless, it remains a challenge for companies to target specific user groups while also acknowledging privacy regulations that are likely to become stricter over time, because societies seem more willing to implement tougher regulations. And citizens are becoming increasingly aware of the value of their online profiles and are more able to avoid being tracked. So, companies need the financial muscle to keep investing in regulation-proof alternatives. Scale and a large user base make it easier to do so. Alphabet’s division Google announced that it is going to replace cookie tracking. However, the company has postponed the implementation date and has changed the characteristics of the solution that initially was intended to replace cookie tracking.

Financial conditions are tightening causing cost reduction efforts

Technology platforms are not only faced with revenue headwinds but also their cost of funding increasing. In August 2020, Alphabet issued 2027 notes in dollars at a yield of 0.8%. Today, these bonds have a yield of 4.2%. At the end of August 2021, Netflix's 4.875% 2030 USD notes traded at a yield of 2.37%, while today it yields slightly over 6%. This is happening at a time when interest rates in the broader market are increasing and it implies higher interest costs in the future for companies. The weakening outlook for advertising revenues also reflects a broader weak economic outlook, the catalyst for the equity sell-off, as reflected by equity indices turning lower. According to the Financial Times, investors have been selling private equity and venture capital funds at the fastest pace on record. Because of these tightening financial conditions, technology firms are turning their focus on cash flow generation, as opposed to investing in new ventures with an uncertain and remote pay-off. Snap has announced a reduction of its workforce by 20% and is reprioritising investments. Meta announced a headcount reduction for the first time as well as a sweeping reorganisation. Google chief executive Sundar Pichai hopes to make the company 20% more productive while slowing hiring and investments. Clearly, companies are working hard to make the best out of this situation.

Summary

Advertising platforms expect a slowdown in advertising revenue growth because of the expected economic slowdown. This comes at a time when companies are already having to overcome challenges from stricter privacy settings. Over time, the allocation of advertising budgets from linear media to digital media is expected to continue, providing a tailwind to revenues. Nevertheless, digital advertising companies are expected to only grow their revenues in line with market growth and will be more exposed to economic cycles over time. Investments in solutions that can track user behaviour in a privacy regulation-proof way need to continue. But the targeting of narrow audience segments will likely be challenging with regulations becoming stricter. These headwinds are compounded momentarily by tighter financial conditions.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article