The unemployment puzzle

Growth in France has been revised upwards and we're not expecting any deceleration here in the coming months. But things have perhaps been tougher for Emmanuel Macron than expected. He saw a drop in his popularity in February and he does face 'reform fatigue'.

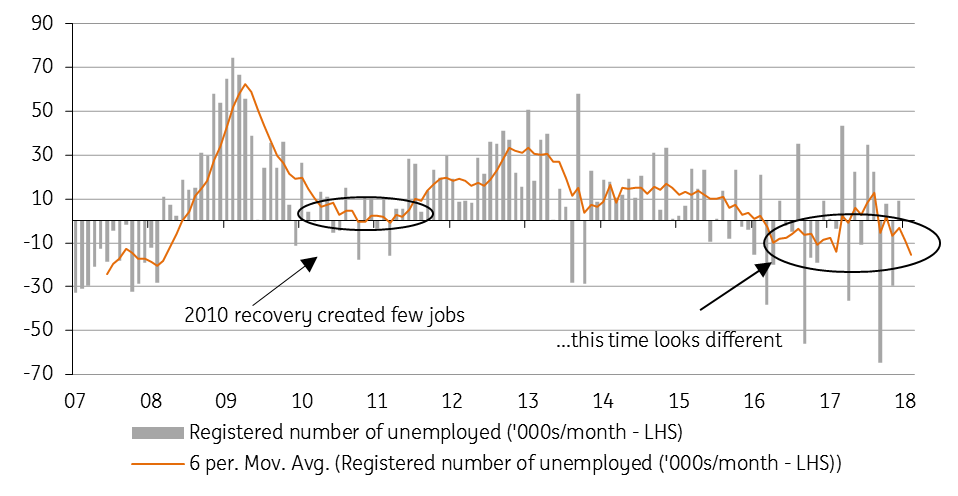

The number of people looking for work in France barely declined in January, according to the latest figures from INSEE. They also showed the 2017 decline was very limited: 3,700 people out of 3.4 million. This casts doubt on the sudden drop in the unemployment rate as measured by ILO in the fourth quarter, from 9.3% to 8.6% in mainland France, one of the largest declines. This was explained by a drop in those actively looking for work, by 205,000 people in 4Q17. That is more than has been registered by the employment agency in the last two years.

As the unemployment rate is obtained by survey, we expect an upward revision in the first quarter. Indeed, if the job-seeking population barely declined in 2017 after a 100k drop in 2016, it is mainly because of the end of Francois Hollande’s subsidised job schemes, which sees people being counted again in the unemployment figures if they've failed to find a job.

That said, employment growth is slowly gaining traction and unemployment should be declining, although probably not as fast as the ILO numbers seemed to suggest in February.

President Macron currently aims at reforming these unemployment reduction plans by focusing on apprenticeships. The reform, however, is not ready yet; social partners have failed so far to come up with a reform proposal bold enough to be accepted by the government. Muriel Penicaud, the Labour Minister, has not hidden her willingness to go faster.

Slow decline in the jobseeker population in the last 12 months

Consumer confidence recently declined

That need for speed is probably necessary to maintain consumer confidence, which is key to the current economic recovery. The main confidence index went below the 100 level for the first time in the twelve months to February. Consumer confidence in job market improvements seems intact. However, households seem to fear for their financial situation in the coming year despite growing wages in the private sector and a rather positive set of fiscal measures for 2018. This fear might be related to some financial turmoil in the first week of February, but it is hard not to see the downward trend of recent months, confirmed in the Q4 GDP revision: private consumption growth slowed down from 0.6% to 0.2% QoQ at the end of the year, one of its slowest quarter in two years. At 1.3% in 2017, private consumption growth is lagging the rest of the economy.

| 2.0% |

France revised GDP, 2017The highest since 2011 |

| Better than expected | |

Economic growth should remain supportive

Consumer confidence is not the only reason for the government’s willingness to go faster on reforms. We won't see elections this year, and both political opposition and trade unions are divided and economic growth is supportive: GDP growth has been confirmed at 0.6% QoQ in the last quarter of the year, bringing GDP growth at 2.0%, its fastest pace since 2011.

We do not expect a strong acceleration for 2018, but growth should reach 2.2% on the back of stronger investments, both from corporates and households (as the real estate market has been recovering since 2014) and a private consumption rebound. Reforms and confidence should go hand in hand. In 2017, it seems that his reforming stance helped President Macron spread optimism among households and businesses. For this virtuous cycle to continue, he absolutely must avoid reform fatigue settling in among the French which would depress confidence.

Indeed, the menu is quite full for 2018: apprenticeship and unemployment benefits first but education, pension and state organisation are next on the list, on top of the European agenda. This should certainly keep the government busy this year, but at the start, it has been a little harder than expected. PMI activity and confidence have scaled back, even though they remain at relatively high levels, and President Macron’s popularity went down to 43%. That could be a short-timed blip but certainly, something to keep an eye on.

Lower consumer confidence could hamper the recovery acceleration

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article