SNB : Caution remains the codeword

As expected, the Swiss National Bank left its interest rate unchanged. But the economy is expected to rebound in 2018, which could lead to somewhat higher inflation and allow for some very gradual monetary tightening in late 2019. In this context, we expect the CHF to stay on a depreciation track

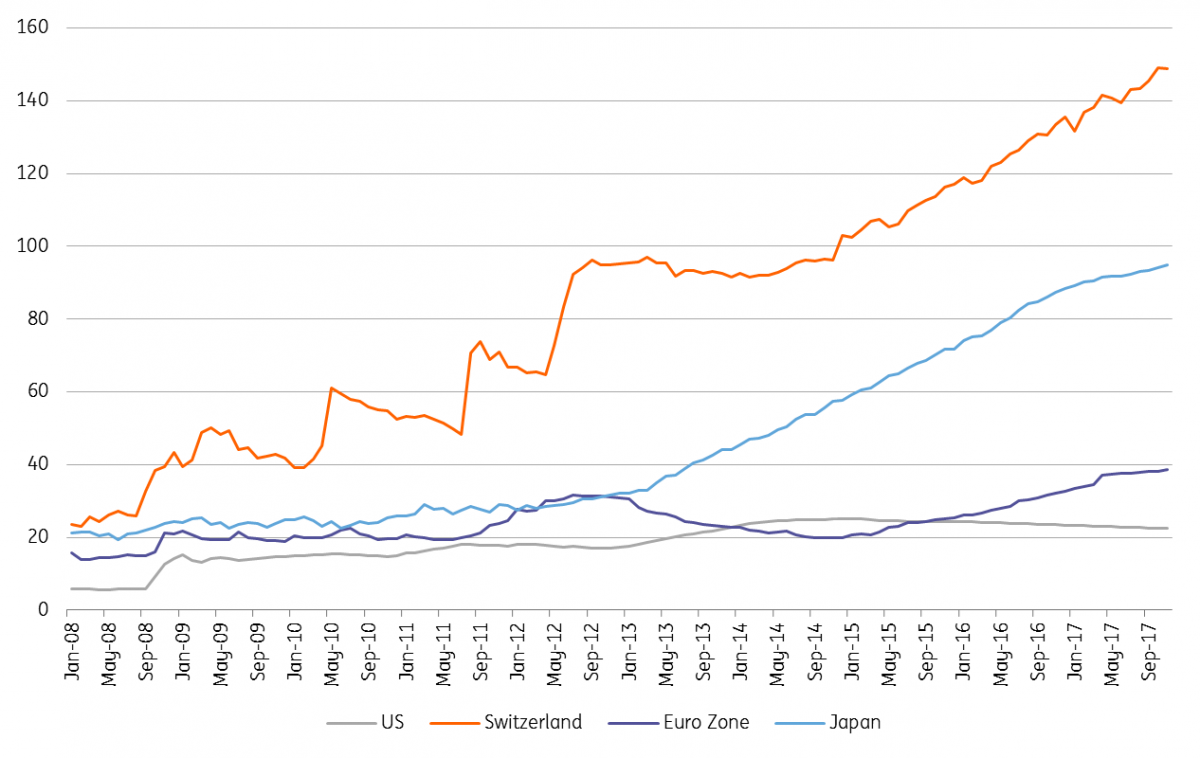

CHF overvaluation remains a reason to intervene

As expected, the Swiss National Bank (SNB) kept its interest rate unchanged on sight deposit at -0.75% and the target range for the three-month Libor at between -1.25% to -0.25% in March.

Moreover, the SNB President Thomas Jordan reiterated during the press conference that the SNB “will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration”.

The SNB still thinks that “the franc remains highly valued” and it acknowledges that since December “the Swiss franc has appreciated slightly overall on the back of the weaker US dollar”. The SNB also believes that “the situation in the foreign exchange market is still fragile and monetary conditions may change rapidly”, justifying the status quo in its interventionist stance.

| 2.0% |

Inflation forecast for 3Q 2020 |

The SNB was a bit less upbeat on inflation

After a strong end to 2017 with Q4 GDP growth increasing at 0.6% QoQ (and 1.9% YoY), the SNB’s growth forecast for 2018 is constant at 2%, which would be the highest rate since 2014, and President Jordan is quite upbeat on the world economic recovery.

Concerning inflation, after five years of negative or zero inflation, it reached 0.5% in 2017 and increased to 0.6% YoY in February. Given the “somewhat stronger franc”, the SNB revises downward its inflation forecast for 2018 (0.6% from 0.7% in December) and 2019 (0.9% vs 1.1% before), while it expects inflation to reach 2% by the third quarter in 2020.

This shows that the SNB remains very cautious about declaring victory on deflation, but it is still eager to show that getting back to the 2% target in the medium-term is still possible. We see a possibility that a weaker exchange rate next month will lead to better growth and higher inflation, above 1% in 2019.

Size of the SNB balance sheet in 4Q17 as a share of GDP, above Japan’s 99%

Expect more of the same in 2018

On the one hand, the current SNB inflation forecast is unlikely to allow for any monetary tightening before late 2019. Moreover, to avoid further appreciation of the CHF against the EUR that could decrease inflation, we think the SNB won’t start to tighten before the ECB starts increasing the interest rate, which is not expected before June 2019.

On the other hand, a stronger economic outlook and some inflationary pressures should eliminate any risk of further accommodating measures. A sharp rise in real estate prices will probably be counteracted with macro-prudential measures.

Therefore, we think that the SNB will keep its negative interest rates unchanged until late 2019 and will refrain from any further FX interventions while staying open to the possibility to intervene in case of a sudden risk aversion come-back.

All in all, the current policy mix equilibrium still looks very stable for the SNB. This should allow the CHF to depreciate a bit in 2018.

Download

Download article

16 March 2018

Week In Review: Calm before the storm? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more