GBP: Brexit and the bumpy ride to its eventual recovery

The undervalued pound still has a bumpy ride before its eventual recovery. We look at various Brexit scenarios and sterling's possible reaction. Reasons behind an Article 50 extension matter dearly for GBP

A bumpy week for sterling

We believe there's more than a 60% chance Article 50, the treaty which began the UK's withdrawal process from the European Union will be extended. But be careful... not every scenario there will be positive for the pound, for instance, it could fall if a general election is called.

The most positive outcome for GBP is a second referendum, likely bringing EUR/GBP to or below 0.85. We still expect a market-friendly resolution by the end of the year which could see sterling stronger (GBP/USD at 1.40). While GBP is ultra-cheap (the cheapest currency in the G10 FX space), the valuation gap is unlikely to close fully as the damage to the economy has already been done.

For now, the lack of short-term risk premium priced into GBP and the potential disappointment if Article 50 isn't extended immediately may translate into weaker GBP this week

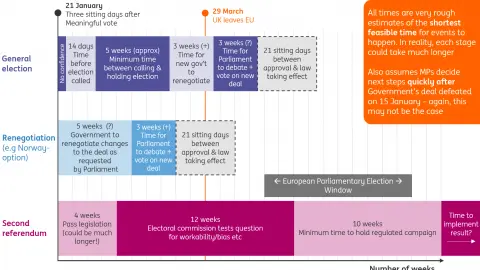

Figure 1: Six scenarios for the pound

Will the Prime Minister extend Article 50 immediately? Not necessarily

Press reports that the two-year negotiating period could be extended began circulating last Friday (coupled with market hopes that a second referendum could be in the pipeline), giving sterling a bit of a boost last Friday.

But while we think it’s now more likely than not that the government will be forced to push for an article 50 extension, it seems unlikely the Prime Minister will go down this route immediately. Instead, we think ‘Plan B’ is likely to involve seeking further legal concessions or reassurances on the Irish backstop, although it’s not clear that Brussels would be prepared to offer them.

The number of members of parliament who vote against the Brexit deal is likely to be seen as an acid test of how hard it will be for Theresa May to get a revised deal through parliament on a second attempt. A number above 100 MPs would set an extremely high bar to get a modified version of the deal approved in the next 2-3 weeks.

Market expectations are cooling, limiting further near-term GBP upside

Whatever the number, we may see market hopes for an immediate article 50 extension begin to cool, helping to push EUR/GBP towards the 0.90 level again. This is particularly likely given that our models suggest there is currently no short-term risk premium priced into GBP at this point compared to a 3-4% risk premium last autumn. Figure 2 below shows EUR/GBP trading largely in line with its short-term fair value, indicating some complacency ahead of this week’s events.

Figure 2: Virtually no short-term risk premium in the pound

A vote of no-confidence in the government?

There is a possibility that the opposition Labour Party puts forward a motion of no-confidence in the government in the aftermath of the defeat. This could potentially happen as soon as Wednesday if the government’s deal is defeated, although Labour leader Jeremy Corbyn has kept his cards close to his chest so far on the exact timing. If a no-confidence motion is put forward, then this is also unlikely to be positive for GBP.

Should a no-confidence vote lead to early elections (which is not guaranteed, given that some Conservative MPs would need to get behind it), this would inevitably require an extension to Article 50. In our view, a snap election would be a bad option for the pound, as it would bring further uncertainty about the Brexit path.

The market is unlikely to react well to the potential mix of a) ongoing Brexit uncertainty and b) the perceived risk of a Labour-led government. As a result, GBP would weaken with EUR/GBP likely moving towards the 0.95 level.

Will MPs finally have their say on which Brexit path to take?

If her deal is rejected, Theresa May will have three days to return to Parliament with a new plan.

As we said above, this is likely to involve some form of renegotiation attempt on the Irish backstop. However, at this point, it is expected that MPs will also be able to table their own suggestions on the next steps (in the form of amendments). These won’t be legally binding on the government, but it could mean we finally discover whether there is a majority for any alternative Brexit strategy, meaning it would be a politically significant moment.

Out of all the possible options, two stand out: a second referendum, or a request to negotiate a softer Brexit stance (e.g. ‘Norway Plus’ or a permanent customs union). Nobody really knows if enough MPs would be prepared to get behind either of these strategies. But if they did, both options would almost certainly require an Article 50 extension.

It’s important to remember that EU member states must unanimously approve an extension, and they have been clear this would require a legitimate reason to do. “We simply cannot agree” probably won’t cut it.

But assuming the EU would be open to an article 50 extension for either a second referendum or a meaningful renegotiation, then we think both of these scenarios could be sterling positive:

- Second referendum. In our view, this would be the most positive GBP outcome, with EUR/GBP likely to move below 0.85 as the perceived probability of remaining in the EU would rise. That said, given that a ‘no deal’ Brexit may end up as one of the referendum options, the initial GBP strength would be bounded. With that in mind, once a decision is taken to initiate a referendum, sterling would react to both the polls, as well as the eventual decision on the question being put on the ballot paper. The GBP upside would clearly be higher where it is a straight choice between May’s deal and Remain.

- A different deal (e.g. ‘Norway Plus’ or permanent customs union). There are two reasons why this may not be a positive for GBP as a second referendum. Firstly, even if the Prime Minister succeeded in negotiating a new deal (not a given), there is no guarantee it would be approved by Parliament as the controversial Irish backstop is unlikely to disappear. Secondly, the most positive GBP outcome – the UK staying in the EU – would not be on the cards.

Figure 3: Pound the most undervlaued G10 currency

Probability-weighted outcome for GBP not far away from the current levels

In Figure 1 above, we also show the probability-weighted outcome of the various possible GBP scenarios. Interestingly, GBP is not trading materially off its probability-weighted level, largely because of the non-negligible risk of hard Brexit (around 20% in our view) which would see a large fall in the pound.

We also note that the likely Article 50 extension and the associated uncertainty would also mean a further delay to the next Bank of England rate hike, meaning that GBP would lack support from the BoE re-pricing channel for even longer

Figure 4: The pound is still considerably undervalued according to our model

We retain a constructive medium-term view on sterling

Our base case that 'no deal' will be avoided and that there will be some form of resolution by year-end (either a renegotiated deal or a second referendum – both preceded by an Article 50 extension) makes us constructive on GBP in the medium-term. This should lead to a higher GBP by end-2019, with the scale of the GBP upside depending on the form of the resolution (ie, a large GBP rally if the UK stays in the EU vs more modest strength if some-form of softer Brexit deal is achieved – as per above and Figure 1). Coupled with our constructive EUR/USD view for 2H19, we look for GBP/USD at 1.40.

In terms of medium-term valuation, and after suffering heavily since early 2016 (the point when the market started pricing in the associated risks stemming from the Brexit referendum), sterling is currently the cheapest G10 currency by a considerable margin (as evident in Figure 3) and is undervalued by staggering 20% against EUR (Figure 4). The scenario of no Brexit (if voted through in the second referendum) would in our view lead to a compression of around half of the current mis-valuation. This would bring EUR/GBP towards the 0.80 level, particularly in light of the still very short GBP speculative positioning (Figure 5).

Still, we don’t think it is likely that even in the best case scenario of the UK ultimately staying in the EU sterling would fully close the current valuation gap. This is because the damage to the economy and fundamentals has been already done over the past three years (as evidenced by the fact that the UK economy has been growing at half the speed of the US economy last year) and that all suggests less upside potential for sterling compared to what the fair value suggests.

Figure 5: Speculative shorts in GBP/USD significant

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

UKDownload

Download article

14 January 2019

Our guide to today’s crunch Brexit vote This bundle contains 3 Articles