Singapore’s core inflation dips to three-year low

Widening of the negative output gap suggests inflation is likely to remain subdued for a prolonged period

| 0.7% |

September core inflation |

| Lower than expected | |

Steady headline, lower core inflation

Consistent with the consensus view, Singapore's inflation rose by 0.5% year-on-year in September - unchanged from August. However, core inflation surprised on the downside with a dip to 0.7% from 0.8% - the lowest rate in more than three years since April 2016 (consensus 0.8%).

While the headline inflation has been in line with the central bank's forecast of 0.5% this year, core inflation has drifted below the 1-2% forecast range.

What dented core inflation?

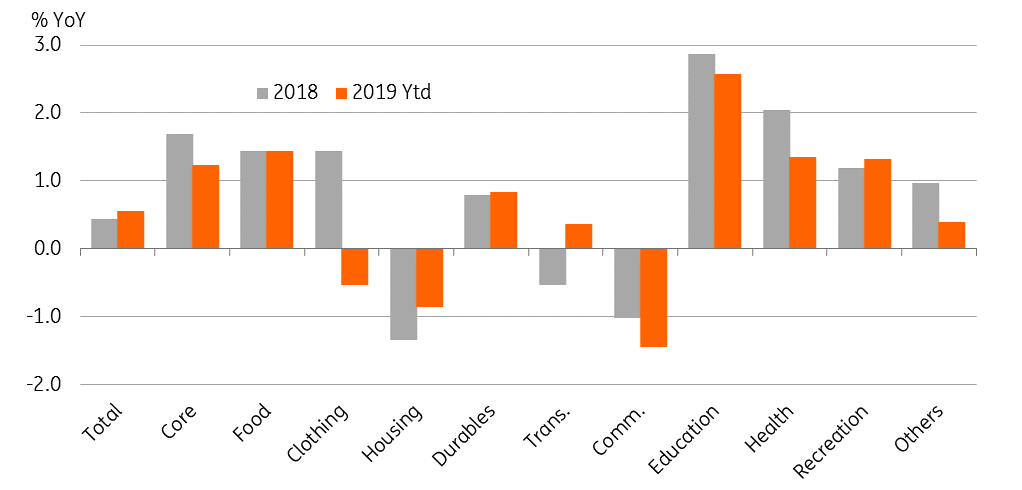

Slower increases in food, fuel and utilities, communication, and education components were responsible for lower core inflation.

Unlike the convention of excluding food and fuel prices, core measure in Singapore take out the accommodation subcomponent of the housing component and the private road transport subcomponent of the transport component from total CPI. While there was a slight improvement in the accommodation part, it was offset by weakness in the private road transport prices.

Clothing, healthcare and recreation components bucked the trend in September – all posting faster increases (slower fall in case of the clothing component).

Consumer price inflation by components

Conflicting policy

Singapore’s economy is already flirting with a recession. A widening of the negative output gap suggests inflation is likely to remain subdued for a prolonged period. These trends are in contrast with Singapore's macroeconomic policy that's bucking the global trend of easing. Last week, the central bank kept its tightening policy bias albeit with a slight reduction in the pace of SGD NEER appreciation.

Unfortunately, monetary policy is now fixed for the next six months so this shifts the onus on fiscal policy, which also looks unlikely to deliver a meaningful boost. Barring any improvement in the external trade environment, the economy is in for continued slow growth and low inflation in the near term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SingaporeDownload

Download article

23 October 2019

Good MornING Asia - 24 October 2019 This bundle contains 4 Articles