Singapore: Recession looms

A recession in Singapore seems inevitable. That's why we've cut our forecast for annual growth to 0.3% from 1.0%. Hopes are pinned on stimulatory policies, including central bank easing in April to hopefully revive some demand in the second half of the year

| 0.3% |

2020 GDP growthRevised down from 1% |

Weakening demand

Singapore’s recent activity indicators continue to reinforce a weak backdrop for the economy that’s bracing for a beating as Covid-19 goes global. Trade and tourism are the sectors most affected, as they are largely dependent on strong demand from China.

Retail sales for January contracted by 5.3% year-on-year - the steepest fall in almost a year following December’s 3.4% fall. As expected, weak automobile sales were the main drag, posting a 34% YoY plunge on top of the 24% fall in December. Sales ex-autos just about scraped 0.6% growth.

The yearly fall may have been inflated by the Lunar New Year holiday, which last year was in February. As a result, we anticipate a much bigger plunge in sales as the epidemic spreads, which will not only dent tourist spending but also weigh down domestic consumer shopping.

Among other things, rising unemployment is also depressing consumption.

PMI points to negative GDP growth

January non-oil domestic exports and industrial production were a mixed bag as the former continued to fall and yet the latter rose. But, like retail sales, these were distorted by the new year holiday and are likely to dip further in February and the months ahead.

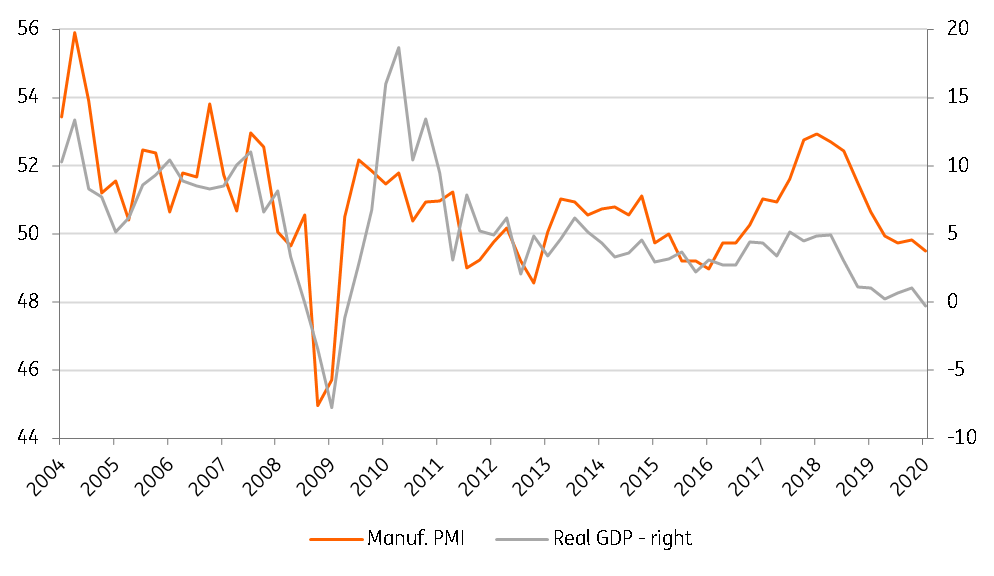

Manufacturing purchasing managers index is foreshadowing a clear oncoming trend, as it dipped to 48.7 in February from 50.3 in the previous month - a big single-month fall in over five years while the electronics sector PMI fell to 47.6 from 50.1.

The headline index is correlated with year-on-year GDP growth, not a perfect fit though fairly close as the chart below shows. And, it’s pointing to steady downward grind in GDP growth, more likely into the negative territory.

GDP growth headed into negative territory

Recession seems inevitable

In light of the evolving Covid-19 situation, especially the rapid spread of the epidemic beyond Asia, Singapore’s small open economy is among the most vulnerable. Having grown by only 0.7% in 2019, negative GDP growth doesn't look too far-fetched.

Consistent with initial indications from the PMI data, we think a couple of quarters of GDP contraction, both on a yearly and quarterly basis, now look inevitable. Accordingly, we see -0.3% YoY and -0.5% GDP fall in the first and second quarters respectively, both also implying a quarterly contraction tantamount to a technical recession.

2020 growth forecast downgrade

Hopes remain pinned on the record fiscal stimulus and possible policy easing by the central bank to help revive demand, though that’s probably something for the second half of the year. We do anticipate a return to positive GDP growth in the third and fourth quarters at 0.8% and 1.2% respectively.

Our full-year growth forecast for 2020 now stands at 0.3%, a sharp downgrade from 1.0% earlier

Our full-year growth forecast for 2020 now stands at 0.3%, a sharp downgrade from 1.0% earlier. This is even lower than the official baseline of 0.5% growth this year, or the mid-point of -0.5% to 1.5% forecast range announced by the trade and industry ministry last month. We also revise our inflation view for this year to 0.2% from 0.8% as weak demand will continue to dampen price pressures.

With the risk of a recession looming large, we believe the central bank is on course to join the global easing bandwagon at the next meeting in April.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SingaporeDownload

Download article

5 March 2020

In case you missed it: Global flight to safety This bundle contains 9 Articles