Singapore: Manufacturing slows in August, again

As manufacturing slows down (again), we are reviewing our 3.3% forecast for third-quarter GDP growth for a downgrade. Couple this with steady core inflation under 2%, this should put to rest expectations of central bank tightening in October

The third consecutive month of a slowdown in manufacturing output in August suggests Singapore’s GDP growth is poised for another quarterly slowdown in 3Q18. We think it 'll drag growth under 3% in 3Q18 from 3.9% in 2Q18.

This underpins our view for the central bank carrying forward with the tweaking it made to the S$-NEER policy band in the April meeting – a move to ‘modest and gradual' appreciation of the trade-weighted exchange rate index – in October, without changing the slope, the width, or the mid-point of the band. We expect spot USD/SGD rate to trade around its current level, 1.37, through the end of the year.

| 3.3% |

August manufacturing growth |

| Lower than expected | |

Main drags were electronics and pharma

August manufacturing surprised on the downside with 3.3% year on year growth, undershooting the consensus estimate of 4.7%.

The slowdown from a 6.7% YoY growth in July, which was revised up from 6.0% initial estimate, was pretty much consistent across most sectors. In a continued clawback of an outsized 4.5% month-on-month (seasonally adjusted) bounce in June, August's 2% MoM decline followed the 1.2% decline in July. With over 40% combined weight in the total, electronics and pharma were the main drags on the headline growth in August.

Slower manufacturing points to slower GDP growth

On a monthly basis, September is a weak growth month. Assuming a monthly manufacturing change, in September, the average rate over the last three years, quarterly growth will have more than halved to 4.7% YoY in 3Q18 from 10.6% in 2Q. This will certainly be associated with a slowdown in GDP growth.

As for other GDP components, construction output has contracted by around 5% YoY in the last three quarters and services growth has started to taper off in 2Q after peaking at 4% in 1Q and both trends have prevailed in the current quarter. We see this nudging GDP growth below 3% in 3Q from 3.9% in 2Q, which is why we are looking to downgrade our current forecast of 3.3% GDP growth in 3Q. The latest Bloomberg consensus estimate is 2.2%.

Manufacturing drives GDP growth

No more policy tightening in October

The central bank will release an advance estimate of 3Q GDP sometime during 8-12 October, and the central bank’s policy statement is due around the same time. Slower GDP growth together, with steady core inflation under 2%, should put to rest expectations of a further policy tightening at the upcoming meeting.

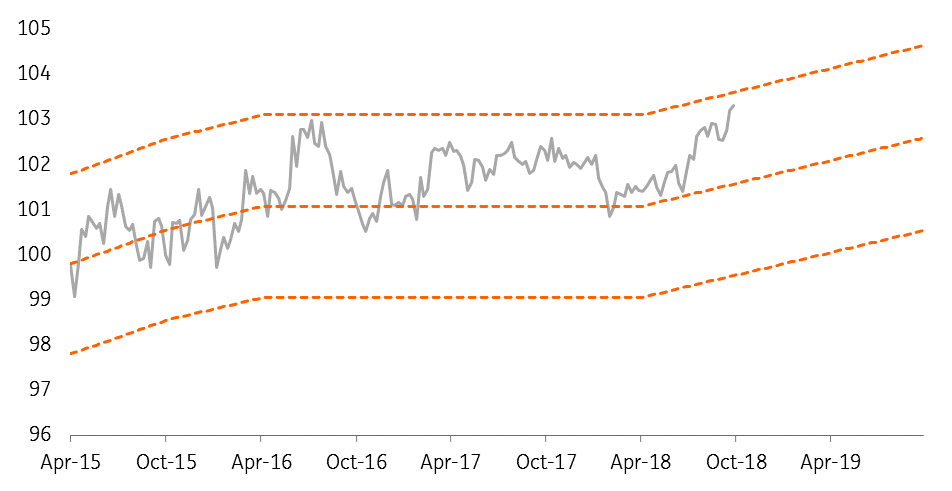

The central bank shifted the policy from neutral to tightening at the last meeting in April – a move from zero percent Singapore dollar trade-weighted exchange rate (S$-NEER) policy band appreciation to a 'modest and gradual' appreciation path (see figure).

We expect no change to the slope, the width, or the level of the S$-NEER band from the prevailing level. As one of the better performing currencies since April, USD/SGD peaked at 1.38 in August and has since retraced to 1.37 currently.

We expect the pair to trade roughly close to current level through the end of the year.

ING's estimate of the MAS S$-NEER policy band (weekly data)

Download

Download article

27 September 2018

Good MornING Asia - 27 September 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).