Singapore Green Plan 2030 – Important steps towards a sustainable future

With the “Green Plan 2030”, Singapore has joined the ranks of countries making solid pledges in the direction of sustainable development. The Green Plan 2030 is clearly not the ultimate destination for sustainability in Singapore but with a little imagination, and more plans like this one in subsequent budgets, Singapore can move towards a net-zero carbon future, if not as early as 2050, then soon after

Introduction

In its fiscal response to the Covid-19 crisis in 2020, we noted that the Singapore government’s support measures were light on stimulus that could be described as environmentally oriented, or put it another way, “Green”. Back then, the over-riding priority was job and income protection so income handouts and corporate cash flow support were appropriate and delivered in a timely and substantial fashion.

Since then, several economies in Asia have put forward new green pledges, following the direction set by the EU with their heavily environment-focused “Rescue and Recovery” plan. For example, Korea’s “Green New Deal”.

Along with other economies, including most notably China, Korea has now set target dates for net zero carbon emissions ahead of this year’s COP26 climate change conference in Glasgow.

The Covid-19 crisis has caused governments to wake up to the existential climate emergency that is unfolding.

It is very clear that around the world, the Covid-19 crisis has caused governments to wake up to the existential climate emergency that is unfolding. And in increasing numbers, they are choosing to press the “re-set button” on their economies and start taking the difficult, but necessary steps towards net zero carbon. It is also apparent that there is an overlap between the job creation needed to undo the damage caused by the Covid-19 pandemic, and plans to decarbonise the economy.

In its latest budget, “Emerging Stronger Together” the Singapore government unveils its “Singapore Green Plan 2030”. In this note, we outline the main features of this plan and consider the measures being adopted in a global context, highlighting where additional measures might have been adopted or considered for future budgets.

Any move in the direction of more sustainable development is welcome, and this plan takes some important steps. There is, however, clearly a long way to go. And with COP26 later this year, international pressure to deliver concrete progress at a faster pace is mounting.

Singapore Green Plan 2030

Transport

The first concrete pledge of this Green plan is to expand Singapore’s Electric-Vehicle (EV) charging infrastructure, deploying 60,000 charging points at public carparks, airports etc by 2030. This is a substantial increase from the prior 28,000 target. The EV charging goal is boosted by S$30m of earmarked funds aimed at catalysing the initiative.

60,000 is a very competitive figure by current international standards. For example, the Netherlands is one of the EU’s best-equipped countries currently for electric charging points, with a 2020 figure of more than 52,000 charging points for a country with more than 500 private cars per thousand adult population (about 7.6m total car fleet). Singapore has far fewer vehicles per adult (about 110 per thousand) so a 60,000 charging unit total looks very good, approximately one for every 8.6 cars.

Singapore’s new EV charging target by 2030 is good, but it might not be able to take “global best in class”, though maybe it can in Asia.

However, this compares to a current figure (that of the Netherlands) with a future target (Singapore). Singapore currently has only around two thousand charging points for electric vehicles, one for approximately every 250 cars. The current ratio in the Netherlands is about one for every 150 cars. But the Dutch have announced plans for more than 200,000 units by 2025, and 1.8 million charging points by 2030, which would reduce the figure still further to one for about every four cars. So Singapore’s new EV charging target by 2030 is good, but it might not be able to take “global best in class”, though maybe it can in Asia.

Equally helpful we believe is the reduction of the “Additional Registration Fee” for new EVs to zero, though this appears to be only temporary at this stage between January 2022 and December 2023.

Road tax treatments are also being revised to bring EVs into line with their ICE equivalents. It looks as if petrol and petrol-hybrid vehicles are also eligible for a 1-year road tax rebate from 1 August 2021 to 31 July 2022, so it may take a bit longer in practice for net road taxes for EVs to fall into line with other vehicles than suggested unless this is taken into account in the pricing scheme. We would hope it would be.

Petrol duties were also raised, though this could be argued as more of a longer-term fiscal adjustment (estimated revenues of $113m) than an environment-aimed policy, especially as it is offset for business users with a road tax rebate worth a similar amount.

The last item under the transport heading was for a S$60bn expansion and renewal of the rail network. The Ministry of Transport has for some time noted its goal to expand the rail network from 230km today to about 360km in 2030. This is a very positive aspiration, which will help keep Singapore a car-lite nation, but as a pre-existing plan, it may be generous to include it as a new item in this budget.

Green Financing

The announcement of $19bn of public sector green bonds will be an important demonstration for the green bond market for Singapore, helping to create references for a rapidly growing market and paving the way for the private sector to embrace green financing more readily.

In a later section, we suggest measures that could make this public financing effort more effective in catalysing the private sector to follow suit. But demonstration by the public sector is a tried and trusted method for promoting green finance.

Actions of our people

This section lays out some public sector initiatives that it is hoped, will spur similar actions elsewhere. Like green finance, these appear to be demonstration efforts by the public sector with the aim of promoting a broader uptake. They include:

- Reduction plans of electricity and water usage by ministries and achieving the “Green Mark” for buildings.

- Adoption of low-global-warming refrigerant chillers (presumably for air-conditioning units) by some agencies.

- More ambitious goals under the Singapore “GreenGov.SG” initiative for the public sector. We have no details on this yet.

This section also noted the S$5 per tonne carbon tax introduced in the 2018 budget for the years from 2019 to 2023 and introduced a review of its trajectory (due to be increased to between S$10 and S$15 by 2030). The review will be announced with the Budget 2022 and may or may not increases the tax trajectory from 2023.

The 2021 budget also announced the Enterprise Sustainability Programme – more details to be released by the Ministry of Trade and Industry.

That essentially wraps up the content of the “Green Plan 2030”.

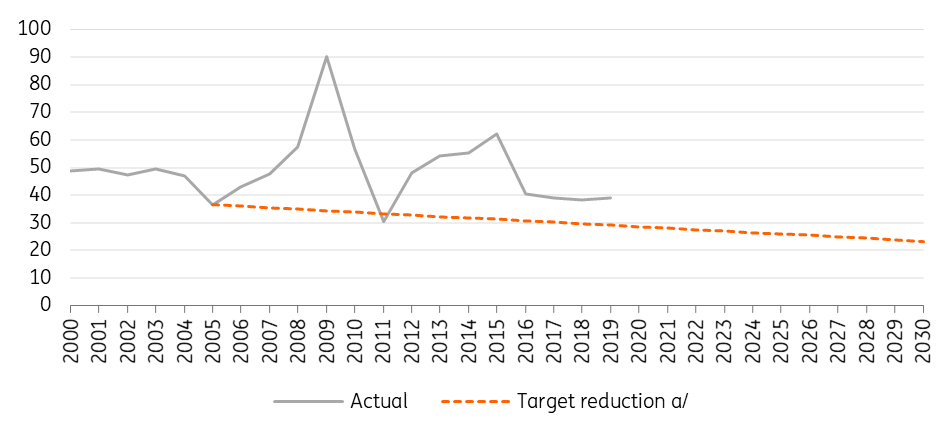

Singapore Annual CO2 Emission (million tonnes)

What more could have been done? Net zero?

The overwhelming consensus of opinion of scientists currently, as expressed by the intergovernmental panel on climate change (IPCC), is that net-zero carbon is the goal. This provides countries with a very clear destination. Where previously there was ambiguity about living with a low-carbon world, we now know that the target is a no-carbon world. And how long it takes to get to net zero, and how much CO2 we will pump into the atmosphere in the meantime will determine how much hotter the planet becomes.

Not only is the destination clear, but the clock is also ticking.

Consequently, the single biggest addition to this Green plan would have been a commitment to net carbon zero. And if not by 2050, as most other countries that have adopted such a policy have done (110 of them as of counting), then by 2060 in line with China. Singapore may be a small greenhouse gas emitter in absolute terms, but it is high when considered per capita. A bold target to net-zero by Singapore might also encourage neighbouring countries to follow suit – we consider the role of ASEAN later when discussing carbon taxes.

Net-zero is still Singapore’s aspiration according to the latest budget. But without committing to a date, one could argue that some businesses will continue to drag their feet in moving to a more sustainable position.

External bodies such as Climate Action Tracker already indicate that if all government’s Nationally Determined Contributions (NDCs) were in line with Singapore’s, it would be insufficient to keep climate change under 2%, and certainly not consistent with the Paris Club’s more ambitious 1.5% maximum goals. Accelerating policy action was undertaken at the last COP meeting, but more is certainly still possible. The arguments for doing more sooner remain strong from a climate, as well as from an economic standpoint. There does not have to be a trade-off between economic growth and sustainability.

Per Capita Electricity Consumption and CO2 Emission

Electric Vehicles (EVs)

The EV push in Singapore is welcome, though it is starting a little later than in some economies, and one could argue that it consequently needs a slightly stronger push than has been given here. Though it is always easy to argue that more should be done, and we concede that this could be argued by environmentalists whatever had been done.

That said, the actions to bring road tax for EVs into line with ICE vehicles does look as if it could have gone further, and perhaps been met with an increase in road tax for internal combustion engines, making it revenue neutral. There is, it seems to us, an argument not to level the playing field with respect to ICE vehicles, but to skew it in favour of EVs. That said, these moves could be viewed as a first step in that direction.

There could also be preferential treatment for EVs.

Countries like Norway show how successful tax incentive schemes can be to help speed the adoption of EV uptake. There could also be preferential treatment for EVs with respect to the Electronic Road Pricing traffic system during the transition too, and dedicated lanes to ease congestion for EVs. In short, this is a great initiative, and it would be a shame if it did not progress rapidly simply for lack of a big enough initial nudge.

Complete phasing out of ICE vehicles

Solar missing

In a video on the Green Plan from the Ministry of Sustainability and the Environment, there was talk of fitting public housing, managed by the Housing & Development Board, with solar panels. This is an idea that is particularly compelling, as not only does it begin to address Singapore’s relatively low solar photovoltaic (PV) electricity generation, such retro-fitting for environmental projects are highlighted as some of the most positive public policy actions that can be taken in terms of job creation and GDP multipliers, according to many academic studies. There is no reference to this in the budget speech, so we are not yet clear if this is part of the Green Plan or not. If not, that would be a pity. And if it is, we would suggest not limiting this to HDBs.

Singapore is indeed hindered from greater take up of some renewable energy sources.

Singapore is indeed hindered from the greater take-up of some renewable energy sources. Sitting just above the equator, there isn’t much wind, and there isn’t much tidal action to harness either. Biomass is also not something that will ever be readily available to Singapore. For solar, the argument is generally made that there is insufficient landmass to make this work. However, the HDB suggestion shows that this is possible, and with a little imagination, it is not too big a stretch to see how this could be rolled out to other types of construction.

There are, for example, more than 200km of covered walkways in Singapore, protecting residents from the extremes of sun and rain. These are at least 1.5M wide and sometimes wider, so represent an area of no less than 300,000m2. That is the equivalent of 42 soccer pitches and provides enough unused space for about 300MW of solar PV power generation. And it all sits neatly by the roadside with good access to the grid. Throw in all the MRT stations and encourage private housing to do likewise with subsidies, and you could multiply this many times.

This still won’t solve all of Singapore’s renewable or even solar energy needs. The plan to import up to 10GW of (solar) energy from Australia’s Northern Territory will undoubtedly also be required. But until that gets off the ground, this would help raise Singapore off the floor with respect to solar power. For comparison, cloud-covered nations like the UK generate proportionately (relative to total generation) eight times more electricity from solar energy than (usually) sunny Singapore, even though they also have other more readily available alternative sources of renewable energy, such as wind, wave, hydro and biomass as well.

Singapore's relatively low renewable share in total electricity generation

Green finance

We are very encouraged by the government’s goals on green bonds, though there are also other forms of green finance that it could also usefully promote and we would not limit this to the green bond market.

What would surely catalyse the uptake of green finance in Singapore, would be greater clarity on the timeline of decarbonisation. Access to a deep and liquid green finance market is, without doubt, a helpful addition to the overall decarbonisation objective. But legislation including the tax structure will also arguably be a necessary condition. This takes us neatly to the next potential addition to the Green Plan – carbon taxes...

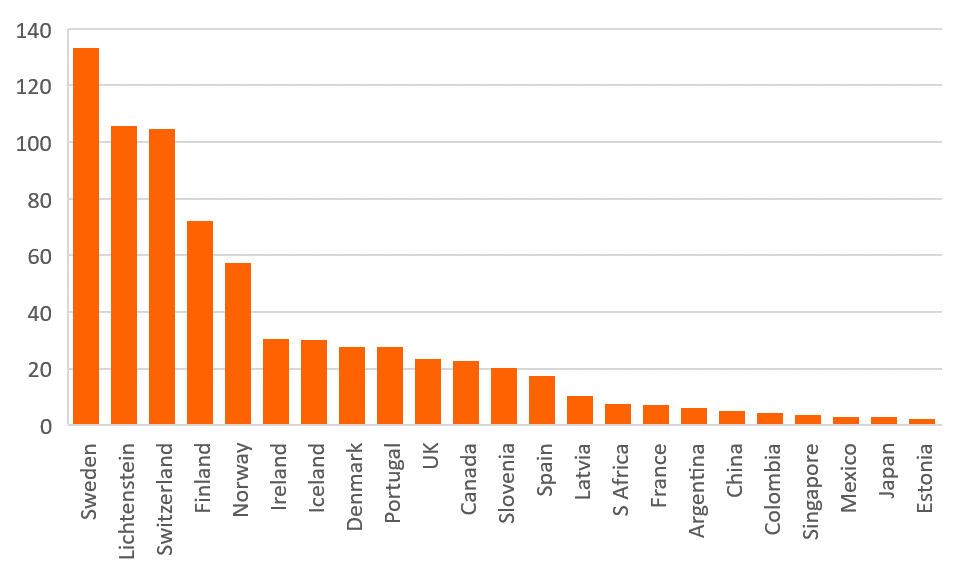

Carbon tax

Singapore is one of only a few countries in Asia with a carbon tax, which is to be applauded. But at only S$5 per tonne of CO2 Singapore’s carbon tax, this is at the low end of the scale globally. Japan also has a carbon tax, but it is probably too low to make a difference to their own sustainability goals.

Singapore’s carbon tax is at the low end of the scale globally.

The review of the carbon tax rate is a positive development but potentially, could have been fast-tracked further to provide a greater push to some of the other complementary policy initiatives such as Green finance.

Given that such taxes could potentially encourage neighbouring economies to free-ride and poach market share, this would seem like a perfect policy to promote at a regional level. For example, through the ASEAN.

ASEAN’s climate change credentials are not currently particularly impressive. Most other ASEAN members score no better than Singapore according to the Climate Action Tracker (with the exception of the Philippines), and many of them (like Vietnam) considerably worse. The ASEAN statement at the COP25 meeting was very light on commitment, and fairly heavy on requests for money from developed nations.

Invigorating an ASEAN rethink on sustainability through a regional carbon tax seems to us to be a very good way to both promote sustainability locally, as well as regionally, without losing competitiveness to neighbouring economies.

Carbon tax rate USD / tonne

Conclusion

With the “Singapore Green Plan 2030”, Singapore has joined the ranks of countries making solid pledges in the direction of sustainable development. It is early days, and there is without a doubt, a very long way to go with a number of other countries globally, as well as in Asia, further advanced in pursuit of this goal.

However, we believe that with a little imagination, and more plans like this one in subsequent budgets, Singapore can also move towards a net-zero carbon future, if not as early as 2050, then soon after. The Green plan 2030 is clearly not the ultimate destination for sustainability in Singapore, but it is an important first step on that journey (see "Building A Sustainable Home For All").

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 February 2021

What a wonderful world This bundle contains 6 Articles