Singapore central bank leaves policy on hold as GDP rises 0.2% YoY in 1Q21

As sustained Covid-19 spread globally continues to threaten Singapore’s export-led recovery ahead, a stable MAS policy remains our baseline for the rest of this year

Stable MAS policy

The Monetary Authority of Singapore released its semi-annual Monetary Policy Statement this morning. The central bank decided to maintain its neutral policy stance implied by the prevailing zero appreciation path for the S$-NEER within an unspecified policy band. There was also no change either to the width or the mid-point of the policy band.

This policy outcome was widely expected by the market. The statement struck a fairly positive chord, noting that “The upturn in external demand will sustain an above-trend pace of growth in the Singapore economy for the rest of 2021. Activity in the trade-related and modern services sectors should expand at a firm pace”. However, it also cited persistent risk from the “unabated” Covid-19 spread globally.

| 0.2% |

1Q21 GDP growthYear-on-year |

| Better than expected | |

GDP growth turns positive

Also released alongside the MAS policy decision, the advance GDP estimate for 1Q21 showed the economy growing by 0.2% YoY and 2.0% QoQ rates, bang on our forecast and better than the consensus (-0.5% YoY and 1.7% QoQ). This puts Singapore among the first few Asian economies to turn the corner to positive year-on-year GDP growth (China and India are the other two).

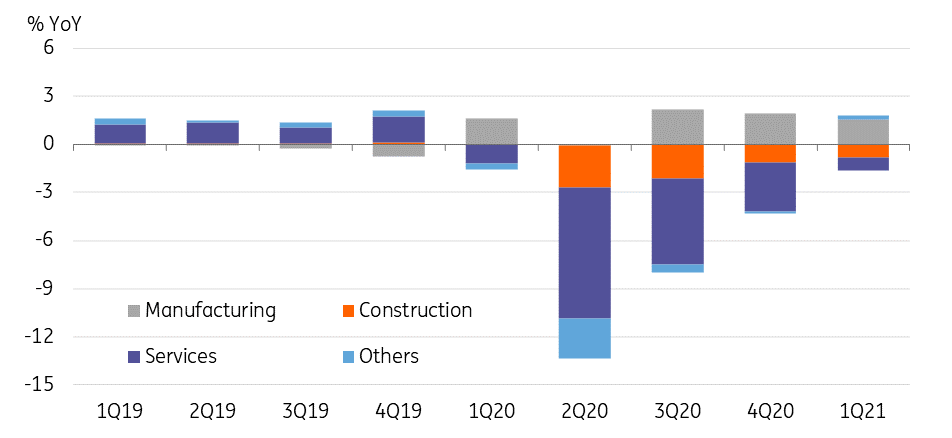

The electronics-driven export surge kept manufacturing in the driving seat for headline GDP growth. Manufacturing output expanded by 7.5% YoY in the last quarter. The modest slowdown from 10.3% YoY growth in 4Q20 resulted from high base effects, not an underlying weakness.

Construction and services remained as drags on the GDP growth although to a lesser extent than previously. The fall in construction output moderated to -20.2% YoY from -27.4%, and that in services to -1.2% YoY from -4.7%.

Contribution to year-on-year GDP growth (percentage point)

Outlook for the rest of 2021

The sustained Covid-19 spread globally continues to threaten the export-led recovery over the rest of the year. Even so, year-on-year GDP growth is poised for a significant jump in 2Q21 (ING forecast 14.2% YoY) as the sharp plunge of activity during the Covid-19 Circuit Breaker a year ago flatters the 2Q21 comparison. As the base effects work through the year, we expect the yearly GDP growth rate to taper to low single digits over the second half of the year. On the inflation front, the lingering impact of the 21% petrol price hike in the FY2021 Budget and as well as low base effects should push CPI inflation upward in coming months (0.7% YoY in February), though demand-side pulls on prices should continue to be muted.

Our full-year 2021 forecast for GDP growth is 4.9% and that for inflation is 1.1%. There is no change to the official view of 4% to 6% GDP growth this year, but the MAS did revise their inflation forecast upward. The MAS now sees headline inflation between 0.5% to 1.5% as against the previous range of -0.5% to +0.5%. It left the core inflation view for this year unchanged at 0% to 1%.

We don’t think these trends will warrant any tightening in the October 2021 MAS policy statements either.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 April 2021

Good MornING Asia - 14 April 2021 This bundle contains 2 Articles