Singapore: Manufacturing misses the mark

Based on December manufacturing data, we estimate a downward revision to 4Q18 GDP growth from 2.2% to 2.1%

| 2.7% |

December industrial production growthYear-on-year |

| Lower than expected | |

Electronics depresses manufacturing

Industrial production rose by 2.7% year-on-year in December, slower than the 4.0% consensus estimate and down from November’s 7.6% growth. The seasonally-adjusted 5.6% month-on-month fall was the steepest monthly fall in two years and this nearly wiped out monthly gains in the previous two months.

Electronics remained the weak spot; a 6.8% year-on-year and 10.9% month-on-month (unadjusted) fall wasn’t a surprise though given a crash in semiconductor exports in December. Chemicals was another one. Pharmaceuticals held up steady, while transport and marine and offshore engineering outperformed.

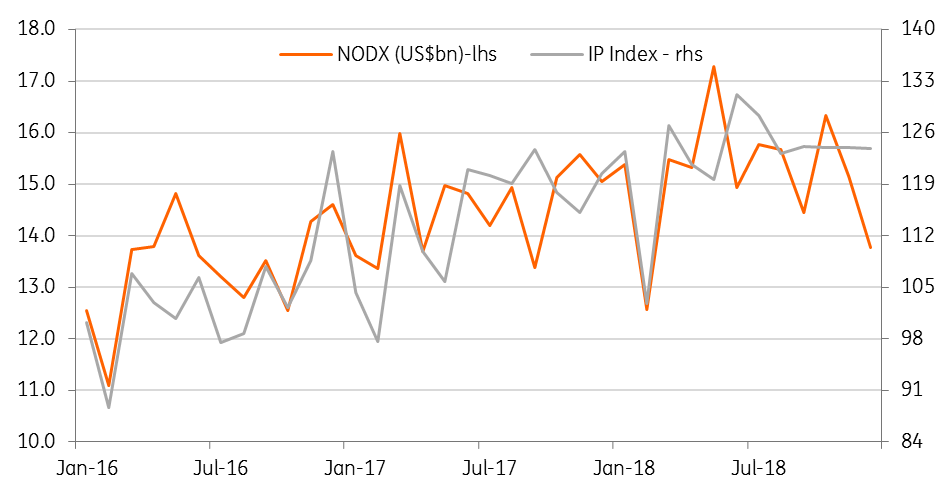

Non-oil domestic exports and manufacturing growth

Possible downgrade of 4Q18 GDP growth

IP growth is tightly correlated with manufacturing GDP growth. The consensus estimate of IP growth in the last month of the quarter is typically derived from the manufacturing growth in the advance GDP for the quarter. It wasn’t any different this time; the 5.5% YoY manufacturing GDP growth in 4Q18 implied a 3.8% December IP growth.

However, the below-consensus outcome for December suggests a downgrade to manufacturing GDP growth to 5.1%, which on its own should push the headline GDP growth for 4Q18 from 2.2% to 2.1% (revised data is due mid-February). This doesn’t affect the 3.3% estimate of the full-year 2018 growth though.

Policy implications

Singapore’s small open economy is exposed more than most other Asian economies to the widely anticipated global growth slowdown. Even as GDP growth should remain within the official 2.5-3.5%, more likely closer to the lower end of the range, the risk of it falling short cannot be ruled out.

Against such a backdrop and having tightened policy twice in 2018, we believe the central bank (MAS) will choose the course of stable policy, by which we mean no change to the prevailing pace of appreciation, or the width or the level of the S$-NEER policy band, at the next semi-annual meeting in April. Nor do we expect growth or inflation to deteriorate sufficiently to require a reversal of last year’s tightening this year.

Download

Download article

28 January 2019

Good MornING Asia - 28 January 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).