Singapore: Manufacturing misses the mark

Based on December manufacturing data, we estimate a downward revision to 4Q18 GDP growth from 2.2% to 2.1%

| 2.7% |

December industrial production growthYear-on-year |

| Lower than expected | |

Electronics depresses manufacturing

Industrial production rose by 2.7% year-on-year in December, slower than the 4.0% consensus estimate and down from November’s 7.6% growth. The seasonally-adjusted 5.6% month-on-month fall was the steepest monthly fall in two years and this nearly wiped out monthly gains in the previous two months.

Electronics remained the weak spot; a 6.8% year-on-year and 10.9% month-on-month (unadjusted) fall wasn’t a surprise though given a crash in semiconductor exports in December. Chemicals was another one. Pharmaceuticals held up steady, while transport and marine and offshore engineering outperformed.

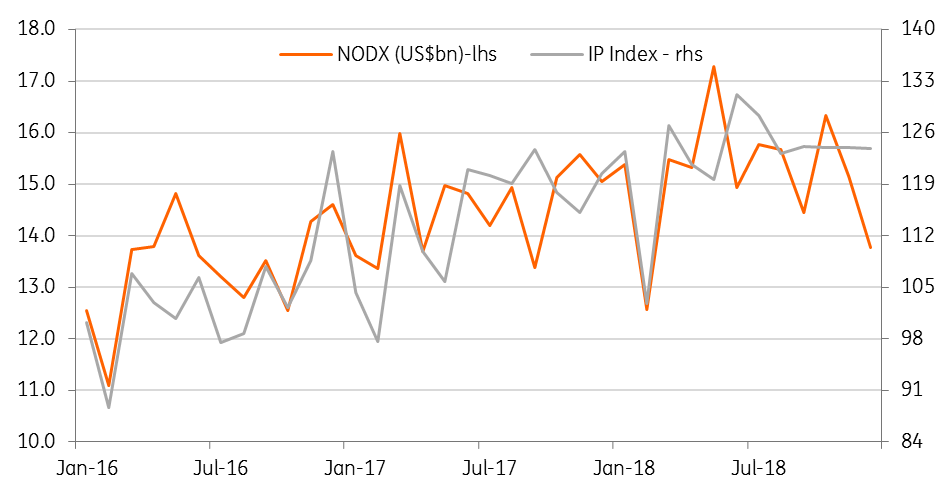

Non-oil domestic exports and manufacturing growth

Possible downgrade of 4Q18 GDP growth

IP growth is tightly correlated with manufacturing GDP growth. The consensus estimate of IP growth in the last month of the quarter is typically derived from the manufacturing growth in the advance GDP for the quarter. It wasn’t any different this time; the 5.5% YoY manufacturing GDP growth in 4Q18 implied a 3.8% December IP growth.

However, the below-consensus outcome for December suggests a downgrade to manufacturing GDP growth to 5.1%, which on its own should push the headline GDP growth for 4Q18 from 2.2% to 2.1% (revised data is due mid-February). This doesn’t affect the 3.3% estimate of the full-year 2018 growth though.

Policy implications

Singapore’s small open economy is exposed more than most other Asian economies to the widely anticipated global growth slowdown. Even as GDP growth should remain within the official 2.5-3.5%, more likely closer to the lower end of the range, the risk of it falling short cannot be ruled out.

Against such a backdrop and having tightened policy twice in 2018, we believe the central bank (MAS) will choose the course of stable policy, by which we mean no change to the prevailing pace of appreciation, or the width or the level of the S$-NEER policy band, at the next semi-annual meeting in April. Nor do we expect growth or inflation to deteriorate sufficiently to require a reversal of last year’s tightening this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 January 2019

Good MornING Asia - 28 January 2019 This bundle contains 3 Articles