Shrinking oil inventories mean higher prices

ICE Brent broke back above US$70/bbl last week due to geopolitical risks along with some fundamentally bullish developments in the market. We are finding it increasingly difficult to justify our current price forecasts, and therefore have revised them higher

Geopolitical risk in the Middle East

“Russia vows to shoot down any and all missiles fired at Syria. Get ready Russia, because they will be coming, nice and new and “smart!” You shouldn’t be partners with a Gas Killing Animal who kills his people and enjoys it!”

Those were the words that Trump wrote on Twitter, following allegations that Syria used chemical weapons on its citizens. This was followed by US, UK and French airstrikes on suspected facilities in Syria over the weekend. However, the short duration of the campaign and little retaliation from Russia as of yet, have reduced concerns over the conflict potentially spilling over to the oil market.

US$80/bbl Saudi target and OPEC cuts

There have been media reports that Saudi Arabia is targeting an oil price of US$80/bbl ahead of the IPO of Saudi Aramco, which now looks more likely to be a 2019 event. The market, particularly the record spec long, has taken comfort in these reports, as it suggests that the Saudis along with other OPEC members should remain committed to the production cut deal.

If the Saudis are targeting a price of US$80/bbl, it will make one producer very happy- the US. If current prices are a no-brainer for the US industry to increase drilling activity, anything between US$70-80/bbl on WTI should see US producers throw everything they have into expanding production.

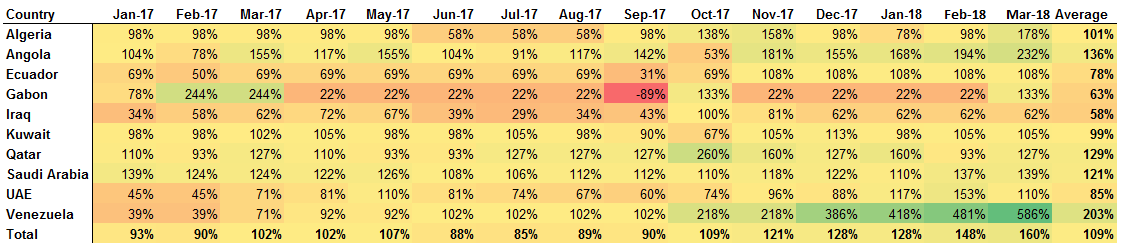

OPEC compliance to the production cut deal remains high. In March, compliance amongst OPEC was 160%, which has taken average compliance since the deal started to 109%. However let’s not forget OPEC has been given a helping hand by the continued slide in Venezuelan production, which has fallen by almost 500Mbbls/d over the last year, to a little over 1.5MMbbls/d. If declines continue at the same rate, we could see production slump to just 1.22MMbbls/d by the end of this year. This will clearly help OPEC in achieving its goal of bringing inventories back to “normal”.

The IEA’s latest oil market report suggests that OECD inventories could already be at the five-year average. By the end of February, the IEA estimates that stocks were 30MMbbls above the five-year average. A tightening in the global oil market is evident when looking at the deepening backwardation in the front month spread in ICE Brent, with it trading at over US$0.60/bbl currently, up from US$0.23/bbl in mid-March.

Given the fate of Venezuela, continued strong compliance from other OPEC members, and robust demand growth we now expect that the global oil market will be in deficit for the remainder of the year, which supports our relatively more constructive view.

OPEC compliance with production cuts- Venezuela leads the way

The US goes drilling

In a market that is looking more constructive, one of the downside risks remains the US. The number of active oil rigs in the US increased to 815 last week, which is the highest level seen since March 2015, and an increase of 68 since the start of the year. Given current prices, we would expect rig activity to pick up moving forward.

Looking at oil output, unsurprisingly it is a similar story. US production hit a high of 10.53MMbbls/d over the last week, increasing from 9.49MMbbls/d in the first week of 2018. The EIA in its Short Term Energy Outlook estimates that crude oil production will average 10.7MMbbls/d over 2018 and 11.4MMbbls/d in 2019. While the administration has left its 2018 forecast largely unchanged, it has increased its 2019 forecast by 100Mbbls/d from last month.

The increase in output has been driven by the Permian region, where the EIA expects output to hit 3.18MMbbls/d in May, up from 2.38MMbbls/d in May last year. The growth in output is weighing on certain spreads, with the WTI Midland/Cushing spread having traded to a US$6/bbl discount, with takeaway capacity unable to keep up with production growth in the region. Although more recently the spread has traded back towards a US$3.50/bbl discount, with news that Enterprise will add 35Mbbls/d to its Midland to Sealy crude oil pipeline over May, which would take total capacity of the pipeline to 575Mbbls/d.

Meanwhile in the longer term, there are some projects which are set to increase takeaway capacity from the Permian region over 2019. Magellan is looking to add 40Mbbls/d of capacity, whilst the EPIC pipeline, which is set to start up by mid-2019, will have a capacity of 440Mbbls/d.

Looming Iranian sanctions

The 18th May is expected to be the day when Trump will decide whether he will certify the Iranian nuclear deal. All signs suggest that he won’t, and instead will reinstate sanctions on the country. This does mean the potential for a loss in Iranian oil supply. A large part of the recent move higher we believe is the market pricing in the risk of sanctions.

If Trump follows the Obama administration, the reduction in supply should only be seen in November onwards, with the market given 180 days to settle outstanding contracts. The next question will then be who will actually reduce their Iranian oil purchases.

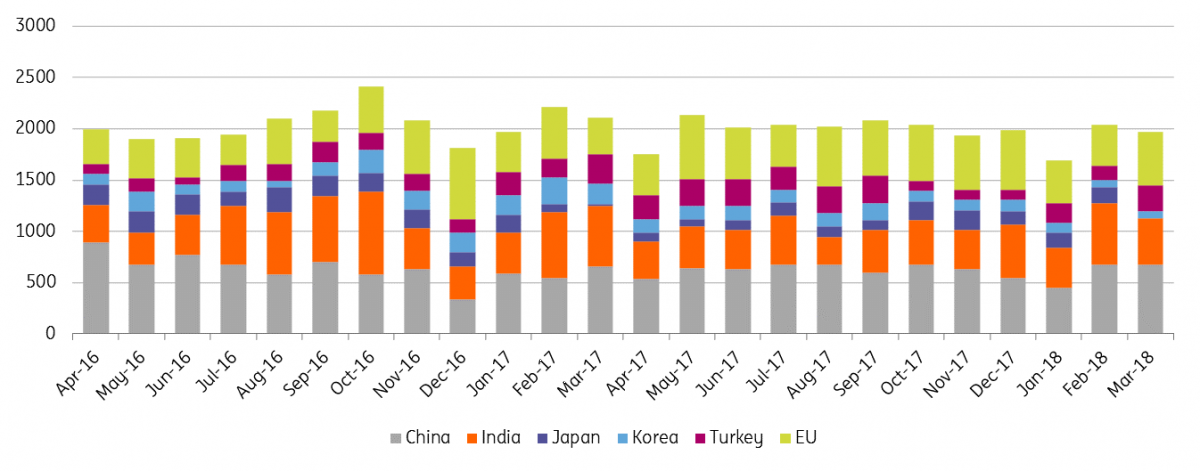

Currently, China and India are the largest buyers of Iranian crude, making up around 60% of demand, we believe that these two nations will continue to purchase Iranian oil. Other significant markets are Turkey, Japan, South Korea, and the EU. We believe that the supply which is most at risk is that going to the EU. If this is the case we could see up to around 500Mbbls/d of supply lost to the world market. But as mentioned this could start to be felt only from November onwards. However, there is no certainty that Trump would follow what was done in the past when it comes to implementing these sanctions.

Iranian crude oil export destinations (Mbbls/d)

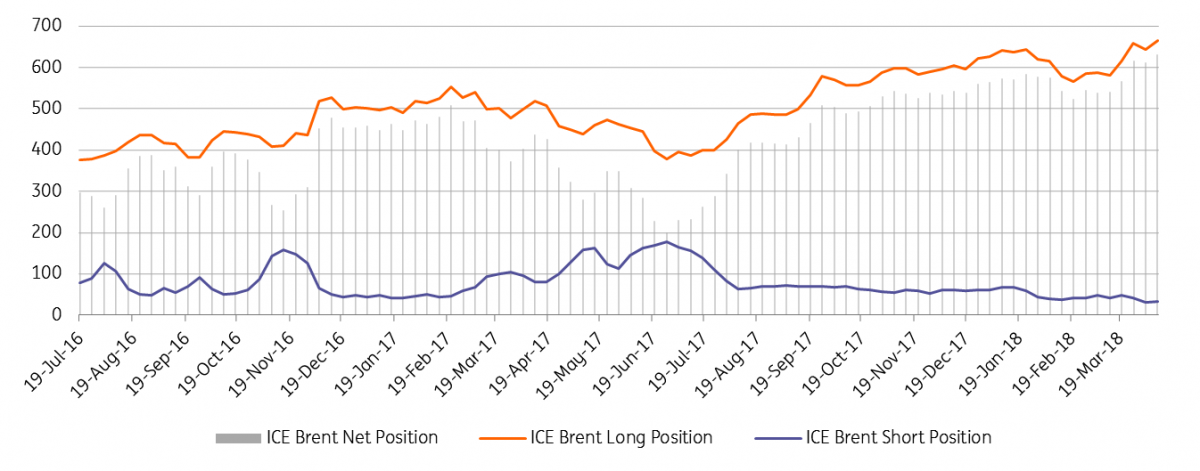

Speculators at the limit?

Speculators continue to appear comfortable buying the market, with the managed money net long position standing at a record 632,454 lots, up from 523,295 lots in February. The net position makes up 20% of total market open interest, whilst for every spec short there are a little over 20 spec longs. This also suggests that speculators are overextended, and consensus risk is significant. Speculators are pricing in plenty of supply risk around Iran and sanctions, so if Trump does surprise the market and certify the nuclear deal, expect a sizeable amount of spec liquidation.

Speculators hold a record long in ICE Brent (000 lots)

The trade war risk

There does appear to be somewhat of a softening in stance in the trade war between the US and China, this does help alleviate concerns over global economic growth, and the potential this can have on oil demand growth moving forward. However, we would point out that negotiations between China and the US are ongoing, and with plenty of uncertainty around planned tariffs, expect to see increased volatility not just in oil, but markets in general.

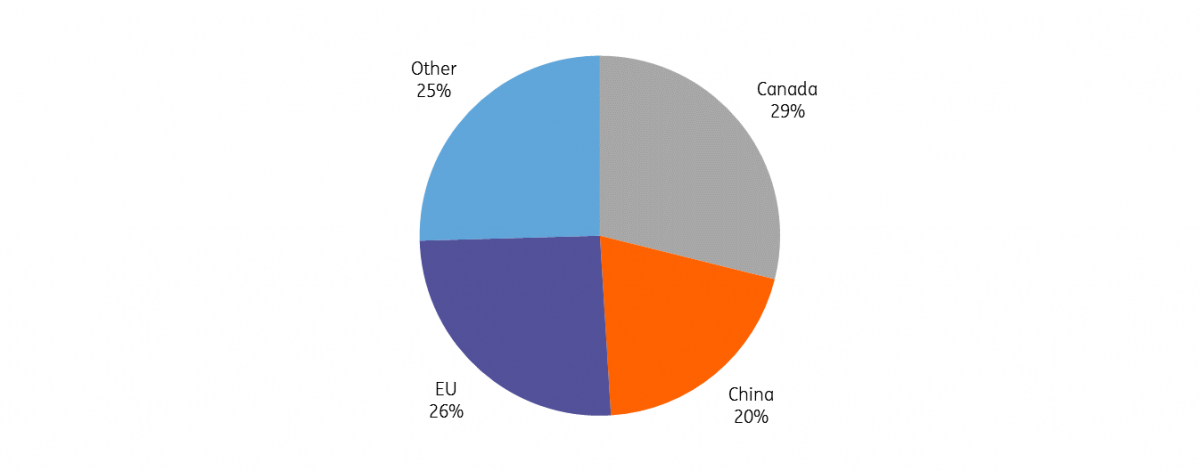

If we do see tensions escalate between the two countries once again, there is the risk that China takes action against flows of US crude oil into the country. This would be a blow for the US, given that over 2017, China took 20% of US crude oil exports. Any action like this would most likely mean further widening in the Brent-WTI spread, which is already trading at close to US$5.25/bbl.

Still, China appears to be keen to resolve trade issues and we do not see tariffs on US crude oil as a significant risk for the market, at least for now.

2017 US crude oil export destinations

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 April 2018

In Case You Missed It: The unreliable boyfriend returns This bundle contains 6 Articles