SEK: Why we think the recent strength is not to be trusted

While we estimate the impact of rising energy prices to be broadly neutral for the SEK, we think Sweden's Riksbank will push back against the market’s hawkish pricing and refrain from pencilling in any hike in November’s rate projections. EUR/SEK may edge below 10.00 in the very short term but we see a high risk for upside correction in the pair later this year

Sweden is stuck in the middle of the energy story

Rising energy prices are arguably the most central story in markets at the moment. In FX, some currencies like RUB, NOK and CAD have been benefitting from the energy story as their respective economies are major energy exporters. The currencies of big energy importers, like JPY, TRY or HUF, are instead badly positioned against higher prices.

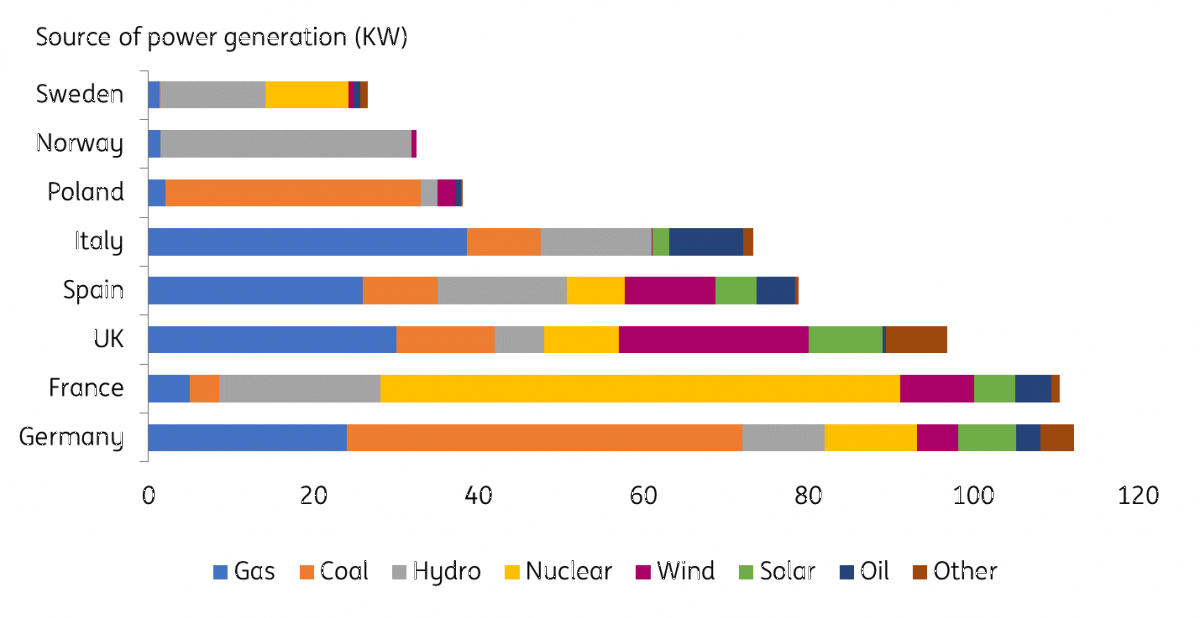

Sweden generally has a balance between energy exports and imports and in recent years, the country had a small surplus of energy that it would normally sell to other European countries. A major difference with other European countries is that Sweden is not heavily reliant on those commodities – like gas, oil and coal – that have seen a massive increase in price recently, as we show in the chart below.

Sweden mostly relies on hydro and nuclear power

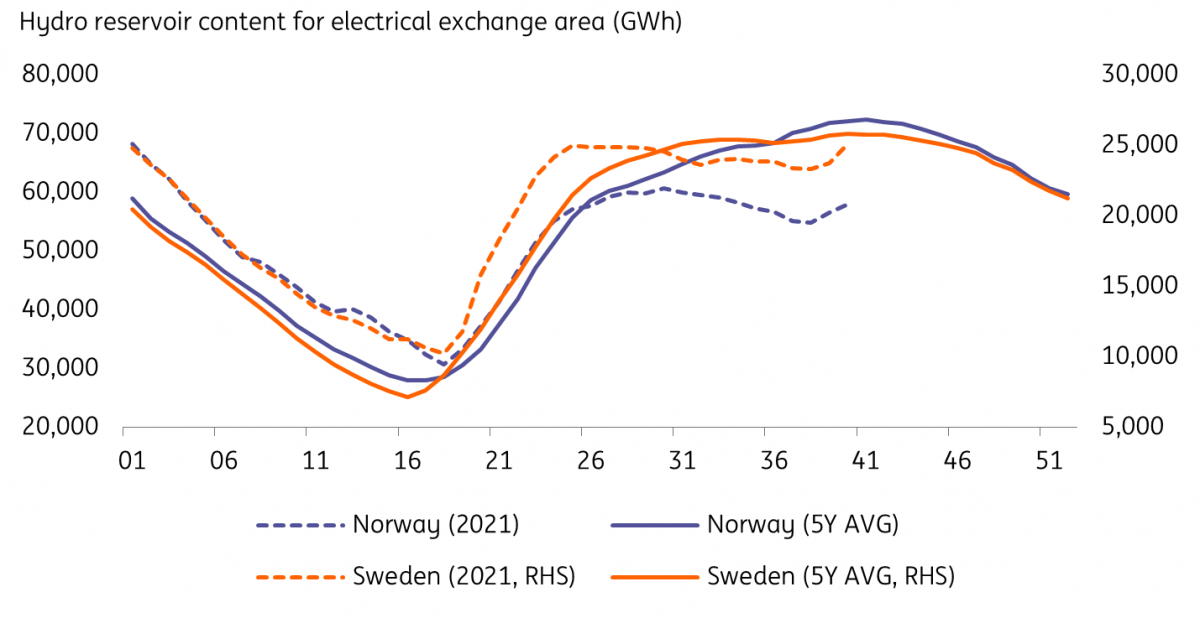

In theory, this could suggest that the impact on energy costs for Swedes should be less pronounced compared with other European countries. In practice, Sweden and Norway’s high dependence on greener hydroelectric power is proving quite problematic, as Nordic hydro reservoirs are currently well below their recent average. As shown in the chart below, reservoir levels are markedly lower in Norway than in Sweden compared to the previous five years, but nonetheless, Sweden looks set to face supply issues which are set to drive domestic energy costs higher. Recently, the Swedes had to restart oil-fired power plants that are normally used as backup energy sources on cooler days to avoid power outages.

Nordic hydro reservoirs are below their 5-year averages

As Sweden can still count on a good share of nuclear power, spikes in energy prices should prove more contained compared to heavily gas and coal-dependent European countries. Ultimately, that may not prove enough to generate a significant drag on growth in Sweden. However, any hit to the European growth would likely hit Sweden’s exports – that are mostly headed to the rest of Europe – and could therefore generate a negative spill-over on SEK.

Inflation is on the rise, but we don’t expect the Riksbank to change stance soon

The main aspect of the energy story that is currently been scanned by financial markets relates to the upside risks to inflation and – most crucially – to how central banks are going to react. In the G10 space, we have already seen two central banks (in Norway and New Zealand) beginning their tightening cycle, while others, such as the Bank of England, seem to endorse the market’s hawkish expectations.

So far, the Riksbank has not provided any hints that it will deviate from its dovish stance. The Bank’s rate projections, which are published at every policy meeting, currently forecast the repo rate remaining flat at 0.00% at least until 2024. That is despite underlying CPIF inflation (on which the Riksbank sets its 2% target) reaching 2.8% in September. The cost-push effect from higher energy prices is clearly starting to emerge as the difference with inflation on CPIF excluding energy is now at the highest since 2008, as you can see in the chart below.

Sweden's inflation and Riksbank's rate expectations

This week, Governor Stefan Ingves and Deputy Martin Floden firmly reiterated the view that the rise in underlying inflation (measured with CPIF in Sweden) will not prove persistent and the effect of temporary factors, such as higher energy prices, should wear off sometime next year. They also suggested the market has overreacted to higher inflation. As you can see in the chart above, the OIS curve is showing 25bp of tightening priced in for the next 12 months and 66bp for the next two years. We are currently expecting the first hike in 2023.

A crucial factor to consider is that the Riksbank will only hold one policy meeting before the end of the year, on 25 November. There will then be a big gap before the following one, on 10 February. In our view, November seems too early for the Riksbank to start turning more hawkish and pencil in a rate hike at any point of its forecast horizon.

That is most likely not because policymakers actually expect to keep the repo rate at 0.00% until 2024, but because given the high frequency at which the RB publishes rate projections and its reluctance to pencil in any hike at all, markets will most likely read even a 2024 projected hike as a strong signal that the Riksbank is moving to the hawkish side of the spectrum. This could result in an even more aggressive hawkish re-pricing for 2022, which is something the Riksbank wants to avoid, even at the expense of further undermining the credibility of its forward guidance, in our view.

Accordingly, we think that any change in the Riksbank’s dovish stance will not occur at the November meeting, and may therefore have to wait for either the February 2022 meeting, or would have to go through other communication challenges at some point between November and February.

SEK may put off further gains to 2022

According to our short-term fair value model, the short-term rate differential has not been a major driver of EUR/SEK in recent history, which is likely given the fact that rate expectations had remained depressed both in the eurozone and Sweden for an extended period of time before the global hawkish re-pricing seen in October. Still, we expect the FX impact of short-term rates to pick up in the coming months: the beta of the short-term rate differential on EUR/SEK reached its peak in the year before the ECB tapering and the Riksbank’s tightening in 2018.

From this perspective, our view is that the market has rushed too quickly to price in a hawkish tilt by the Riksbank and we, therefore, think there is very little room for short-term rates to keep rising in Sweden. The reality check may come only on 25 November when the Riksbank’s rate hike projections are published and the lack of any rate hikes across the horizon (i.e. till 2024) may force some sizeable re-pricing of hawkish expectations and weigh on SEK.

Before that date, we could continue to hear Riksbank’s members pushing back against hawkish speculation, although that seems to be having a quite contained impact on rate expectations (and not only in Sweden). Accordingly, we would not be surprised to see EUR/SEK edge below 10.00 before the RB November meeting, especially if the global market mood remains upbeat. We might also see some inflows supporting SEK ahead of Volvo’s planned IPO (the company aims to raise SEK 25bn), for which the settlement date is 1 November.

Still, as discussed above, we expect markets will be forced to scale down their expectations on Riksbank’s tightening later this year, so we think EUR/SEK will correct higher towards the end of November. EUR/SEK is seasonally weaker in December, so we could see EUR/SEK close the year slightly below the 10.00 mark. As the Riksbank may instead start to provide hawkish hints in 2022 ahead of a 2023 rate hike – which is currently our base case – we expect EUR/SEK to enter a downward path in 2022, aiming towards the middle of the 9.50/10.00 range.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article