Sweden: Krona at multi-year low and decline isn’t over yet

SEK continues swimming naked. Despite reaching a new multi-year low vs the EUR, we look for further SEK weakness (to EUR/SEK 11.00) as both domestic and external factors weigh on the currency

A new multi-year low

EUR/SEK broke above the May high of 10.6960 reaching the highest level since 2009. This is in line with our bearish SEK view and our non-consensus target of EUR/SEK 11.00 by the year-end.

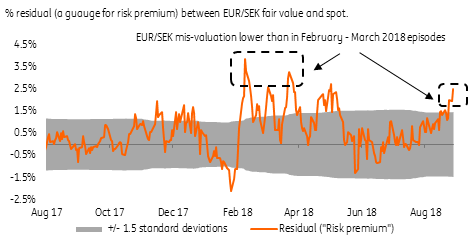

SEK risk premium still below February / March 2018 levels

Domestic and external factors are still SEK negative

As per Swedish elections: Muddy waters, we see the Swedish krona very vulnerable in the current environment as both domestic and external factors point to more SEK weakness. On the domestic side, the upcoming elections on 9 September should keep SEK risk premium in place (and even lead to further widening as the SEK discount vs EUR remains lower compared to the episodes earlier in the year – as shown in Figure 1.

In addition:

- the dovish Riksbank (we don’t expect the central bank to provide help to the battered SEK on the 6th September meeting – if anything we see a risk of a modestly dovish language),

- slowing economy (as per today’s very weak July retail sales),

- deteriorating Swedish current account vs EZ (Fig 2), and

- cheap funding costs

should all keep SEK under pressure for the remainder of the year.

On the external side, the spectre of trade wars is a clear negative for SEK as Sweden is a small open economy, thus vulnerable to concerns about the direction of the global trade.

Swedish current account advantage deteriorating

SEK to continue underperforming NOK

In the relative value space, we continue to favour long NOK/SEK positions as (a) elections will weigh on SEK and (b) the Norges Bank rate hike in September will support NOK. NOK/SEK to break above the 1.10 level rather soon.

SEK is cheap but lacks a catalyst for a reversal

SEK is cheap but no catalyst for a reversal

While we recognise the SEK medium term undervaluation vs EUR (13% based on our BEER valuation framework – as per Fig 3) - at this point there is a little catalyst for this mis-valuation to be corrected.

As is the case for sterling or the Turkish lira – two prime examples of undervalued currencies both in the G10 and EM FX space, where the sharp mis-valuation is unlikely to correct in the absence of a profound catalyst.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 August 2018

In case you missed it: Deal or no deal? This bundle contains 7 Articles