Russian inflation at high plateau, as consumer activity loses steam

The preliminary estimate for Russian inflation was an above-consensus 8.4% year-on-year in December, supporting the central bank's hawkish mood for 1Q22. Meanwhile, retail trade growth seems to have underperformed in November despite the increased reliance on borrowing. Household income and consumption may require additional fiscal support

Deck of charts

On Wednesday, Russia reported this year's last set of macroeconomic data, covering preliminary estimates of December CPI and November actvity indicators. The deck of charts below summarises the key observations and takeaways.

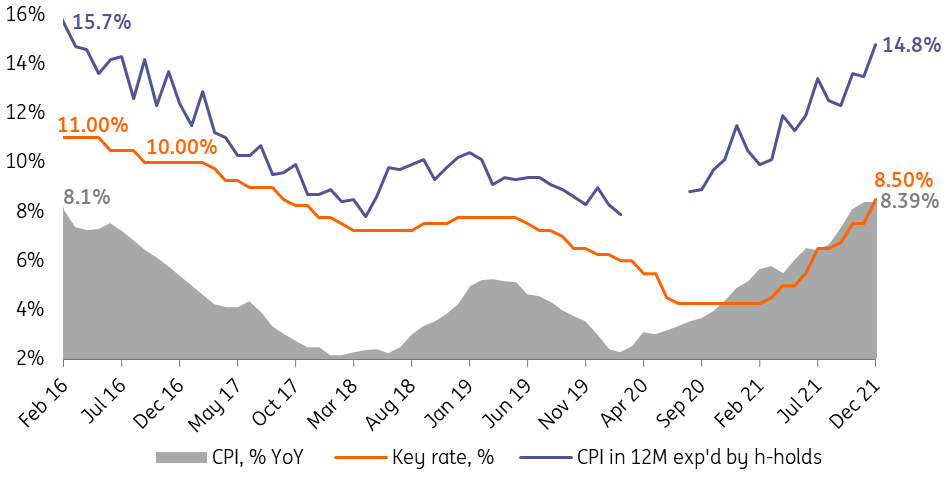

Figure 1: Consumer inflation remains at 8.4% YoY, above consensus, turning an alleged peak into plateau and supporting 0-50bp upside to the key rate

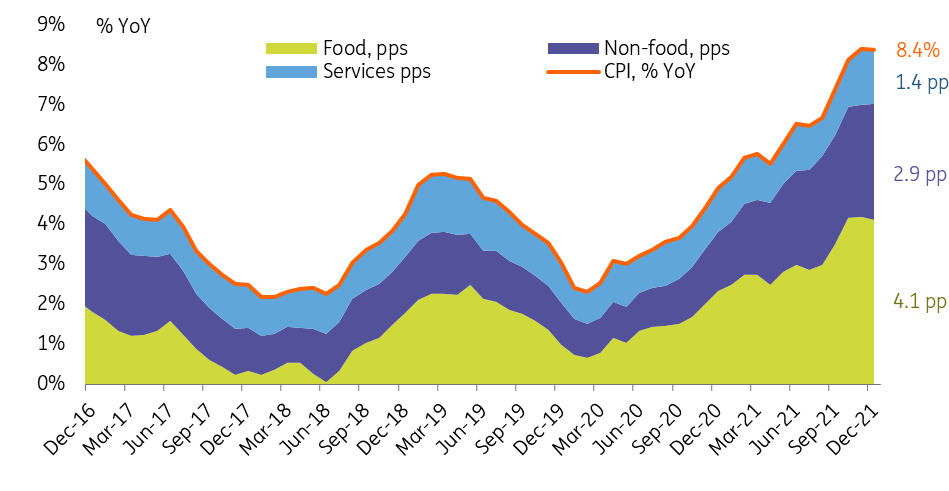

Figure 2: Food remains the main driver of inflation, but the role of more sticky non-food increased from 30% to 35% over the year

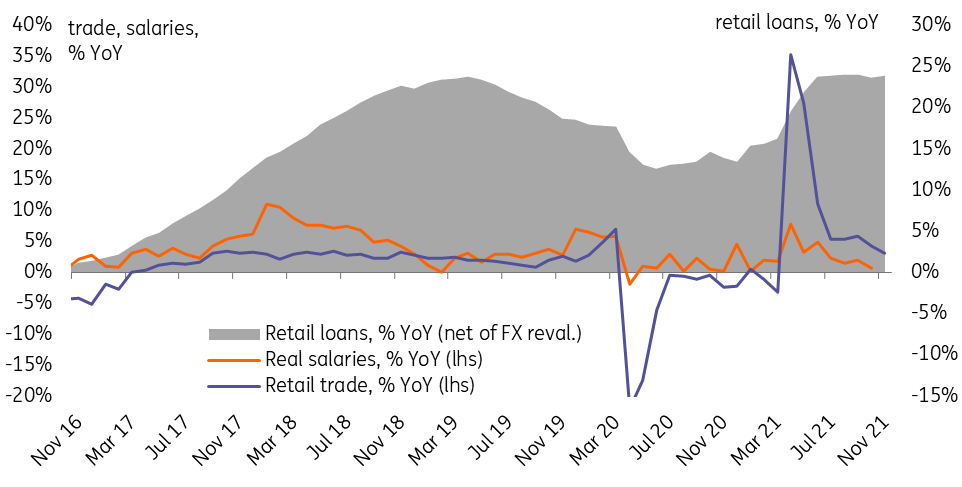

Figure 3: Retail trade decelerates to 3.1% YoY in November, below consensus, amid decelerating income growth and despite still active borrowing

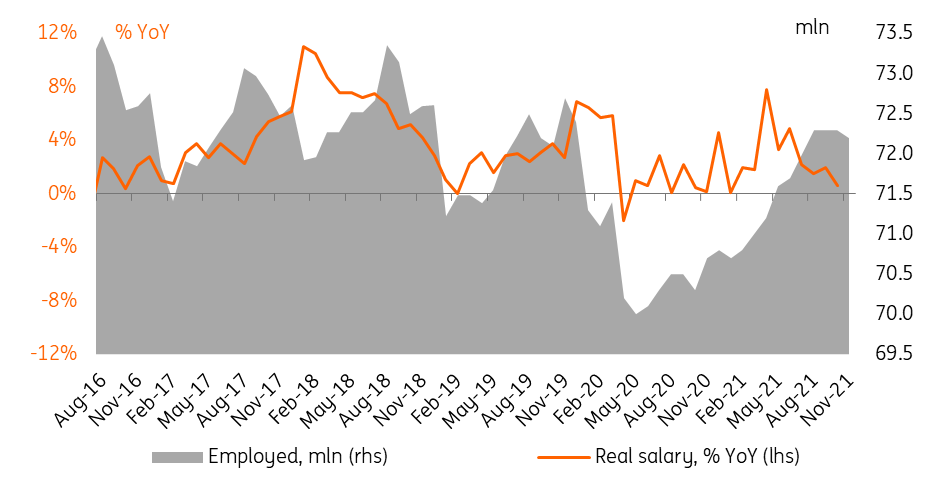

Figure 4: Employment back at pre-Covid peaks, real salary growth so far close to zero amid accelerating inflation

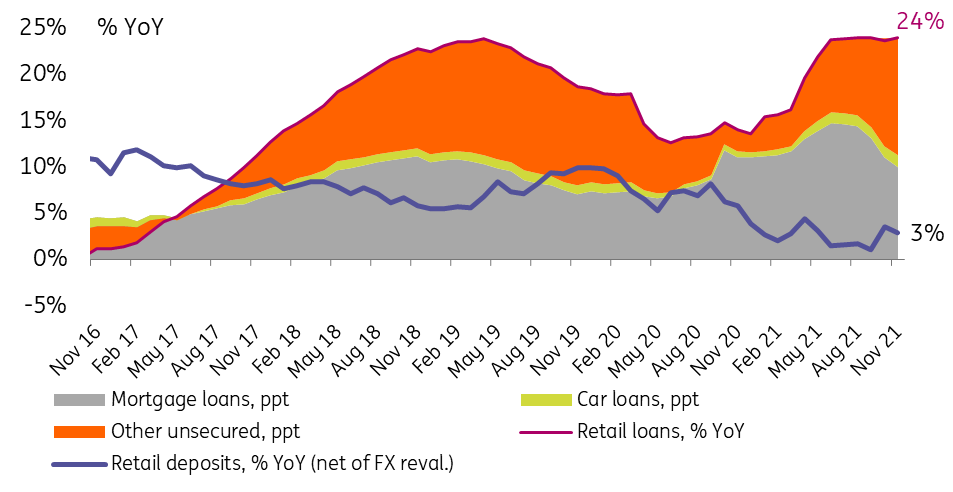

Figure 5: Retail lending growth remains elevated, increasingly focused on consumer loans, while deposit growth remains negative in real terms

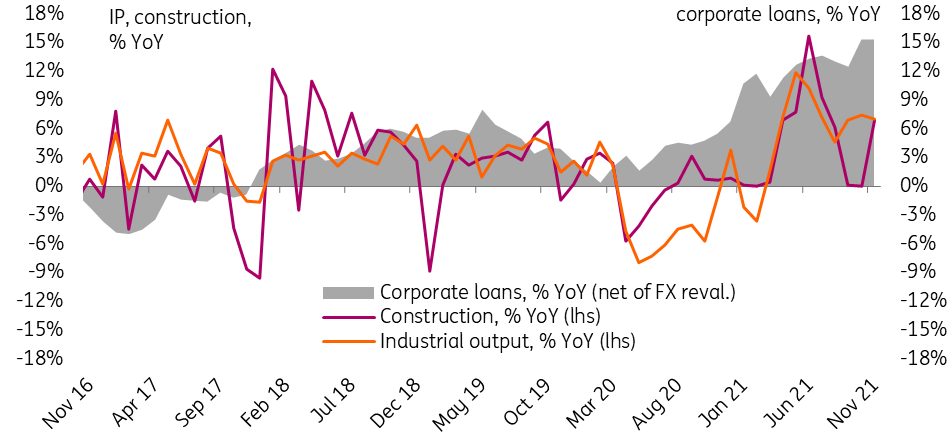

Figure 6: Producer trend solid, as export-focused industrial production is joined by local construction, amid accelerating corporate lending

Given that the softening in the income and consumption trend is taking place amid elevated lending growth and low propensity to save, we believe fighting stickier-than-expected inflation will remain a priority for the central bank, which aims for 4.0-4.5% CPI by the end of next year. We reiterate our expectations of 0-50 basis point upside to the key rate from the current 8.5% level. The fiscal policy, on the other hand, which currently assumes in our view an unrealistic 4% inflation next year and little participation in the household income growth, is likely to face some update in the spending plan, especially given the high likelihood of overall surplus to be seen this year and next under current oil prices.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article