Russian budget: Guiding for consolidation

The 2020-23 budget proposals suggest a likely unwinding of stimulus in 2021 in order to address the spike in the breakeven oil price and erosion of state savings. The Finance Ministry plans to fund the contracting, but persistent, budget deficit with debt –now guided to reach 19-21% of GDP. For now, we do not see this ambitious debt guidance as set in stone

The Russian government is in the process of drafting the 2020-2023 budget. While the document has not been finalised yet, and the official draft should be signed into law only at the end of the year, the preliminary data available through the media reports, including macro and budget parameters, allow us to draw a preliminary picture.

Here are our key observations and takeaways from the presented numbers:

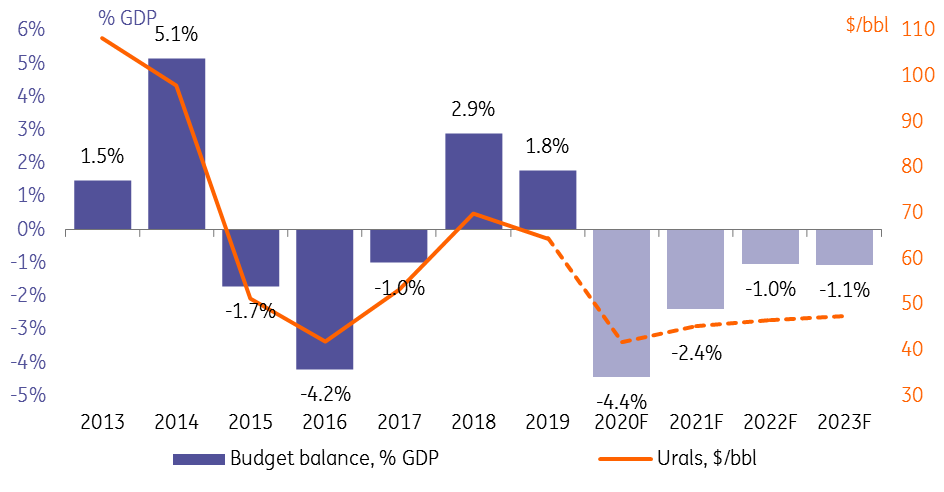

- 2020 budget fulfilment appears to be moving along in line with expectations. The updated official forecast suggests a shift from a 1.8% GDP surplus in 2019 to a 4.4% GDP deficit in 2020, close to our -4.5% GDP forecast. The drop in oil output and prices explains 2.4 percentage points of the overall deterioration in the budget balance vs. 2019, while the increase in spending accounts for 4.5ppt, representing the main bulk of the fiscal stimulus.

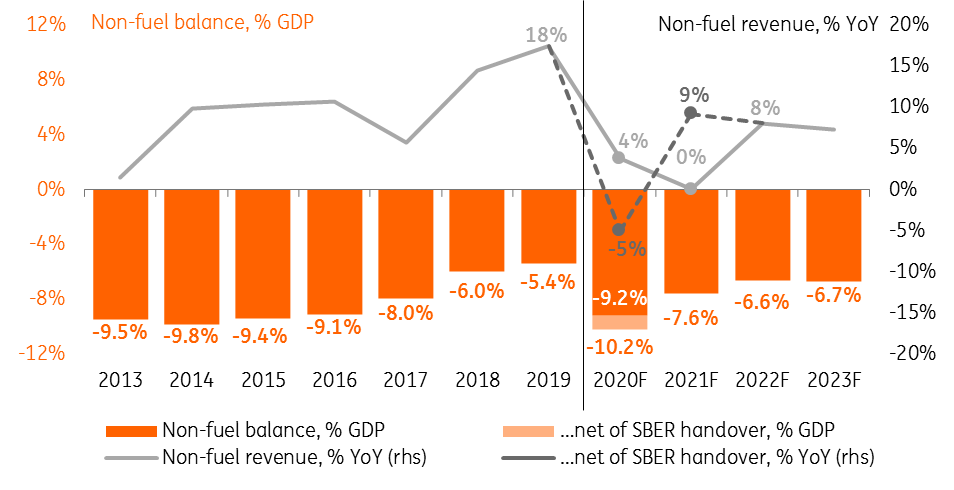

- The revenue side of the budget this year is supported by one-off 1.0% GDP proceeds which were generated from the handover of the controlling stake in Sberbank from the Central Bank to the Finance Ministry. This was an off-market transaction, without which the non-fuel revenues of the budget would have shrunk by 0.2ppt GDP in 2020 vs. 2019.

- The non-fuel revenue (including the one-off proceeds) is expected to increase 4% year-on-year in 2020, while expenditure growth is targeted at 24%. Both guidelines appear generally realistic given their 8M20 performance of +6% YoY and +26% YoY, respectively. Meanwhile, given the performance in July-August, we would not exclude underperformance on both sides, which would be largely neutral for the final result.

- 2021-2023 budget parameters suggest that the government is looking to consolidate fiscal policy, as the deficit is expected to shrink from 4.4% of GDP in 2020 to 1.1% of GDP in 2023 under the assumption of a very modest increase in oil prices (Figure 1). 75% of this contraction is to be assured by a tightening in the non-oil deficit to levels which are only slightly wider than the historic lows of 2018-19 (period of tight budget policy).

- Adjusted for the 2020 one-offs, the 2021 non-fuel revenue growth is targeted at 9% YoY (Figure 2), exceeding the officially forecasted 3.3% GDP growth and 3-4% CPI expectations. The Finance Ministry announced initiatives to boost taxation on the non-fuel mining sector and excise on tobacco, in addition to the earlier decisions to raise income tax on the wealthy and on dividend transfers abroad. The combined fiscal effect is unlikely to be large, much less than a percentage point of GDP, but it highlights the generally hawkish approach to taxation.

- The spending side will carry the main bulk of the tightening, with expenditures set to decline from 21.1% GDP in 2020 (Figure 3) to 17.9% GDP in 2023, below the 2018-19 levels. Meanwhile, the fate of the accumulated spending backlog remains uncertain. While previously we assumed that the 1.0% GDP underspent in 2016-19 would be powered through in 2020 as an anti-crisis measure, the updated numbers suggest that the backlog may remain. Media comments by MinFin officials give little guidance on the matter, but it appears that the officials are not sure that even the current year's spending allocation would be fulfilled. We do not exclude that some progress in unwinding the backlog could be achieved next year, in order to prevent spending from falling in nominal terms. However, the recent decision to postpone some of the goals set for the National Projects (mainly public spending on infrastructure) from 2024 to 2030 may pose an obstacle.

- Through fiscal consolidation, the MinFin is hoping to bring down the budget breakeven oil price from US$80/bbl this year back to the US$50-60 range seen in 2017-19. Under the assumption of stable Urals at around the sovereign fund (NWF) spending threshold level (base Urals) the size of the NWF should stagnate at the 9-10% of GDP level, while this year's swap of FX cash for Sberbank rouble equity makes the liquid FX portion of the fund limited at 6-7% of GDP, in our estimates (Figure 4), below the line which allows using NWF for other purposes. Meanwhile, even with the budget rule suspended the 2020-2023 deficit is supposed to be almost fully financed by debt, which the MinFin expects to jump from 12-13% of GDP in 2019 to 19-21% of GDP in 2020-23.

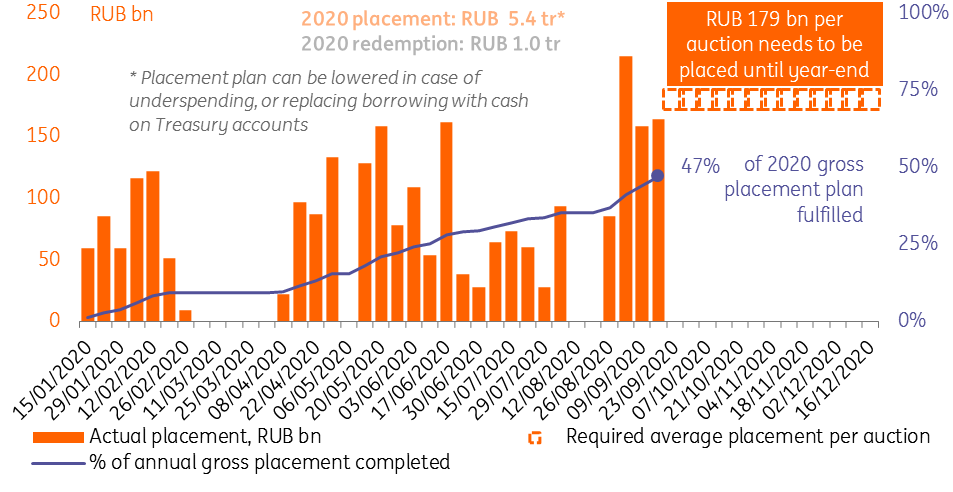

- The most aggressive annual borrowing plan has been announced for 2020, with a RUB4.4 trillion net placement (RUB5.4tr gross). This is a significant jump from the previous years and suggests that in order to fulfil it the MinFin will have to place RUB2.2tr until the year-end, or almost RUB180bn per auction, having placed around RUB70bn per auction year-to-date (Figure 5). The most recent placements were successful in terms of volumes, as the Minfin switched to floaters that are popular among local players amid accelerating inflation. While the further prospects of local and foreign demand for Russian debt are the subject for a separate discussion, we believe that the MinFin does not have a strict commitment to the announced plan. The actual placement could be lower in case of a lower-than-expected deficit (underspending), or if the MinFin substitutes borrowing with spending the cash from the interim treasury accounts amid the suspended fiscal rule. We do not exclude that the actual borrowing needs for 2020 are 0.5-1.0tr lower than announced.

- Looking at borrowing prospects for 2021-23, they appear to be subject to a number of uncertainties around the broader budget parameters (Figure 6). The size of the actual deficit may be lower in case of a weaker USDRUB, higher oil price, underspending, and financing of the deficit could be subject to ad-hoc decisions. As a reminder, the fiscal rule has been first indirectly eased through the Sberbank handover transaction and then officially suspended for 2020-21 in order to accommodate higher spending. This suggests that the freedom in taking decisions on the budget parameters, including on dealing with extra fuel revenues, remains high. As a result, for now we take the announced borrowing plans as just one of the possible scenarios, which could be realised in case of either favourable market conditions that would allow such borrowing or in case of new round of fiscal stimuli.

Figure 1: MinFin is looking to reduce deficit in 2021-23 amid stable oil prices

Figure 2: Non-fuel deficit back on tightening trajectory

Figure 3: It remains unclear if MinFin can power through the spending backlog anytime soon

Figure 4: Public debt to jump from 12-13% to 19-21% GDP, while liquid public savings are to stagnate around 5-7% GDP unless oil price outperforms

Figure 5: 2020 placement plan ambitious but doesn't need to be fully met

Figure 6: Unless there is a second wave of strict quarantine and stimulus, defict and borrowing needs could be lower than planned

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article