Russian balance of payments is solid but not bullet-proof

Russia's current account was strong last year and is likely to remain supported in 2022, at least by growing fuel exports. But persistent FDI-heavy net private capital outflow suggests that the ruble's insulation from adverse externalities is not bullet-proof

| 41.8 |

4Q21 current account surplus, $bnup from $36.9bn in 3Q21 |

| As expected | |

Russian current account strong thanks to robust fuel and non-fuel exports

Bank of Russia reported preliminary estimates of balance of payments for 4Q21 and full-year 2021, shedding some light on the key drivers of ruble performance so far.

The current account surplus reached US$41.8bn in 4Q, driving the full-year figure to US$120.3bn in 2021, a historical high for Russia in nominal terms and close to the 2018 level of 7% of GDP. The result is within our forecast range of US$40-45bn for 4Q and US$120-125bn for 2021, close to the market consensus and is almost precisely in line with Bank of Russia's expectations. Here are the key observations:

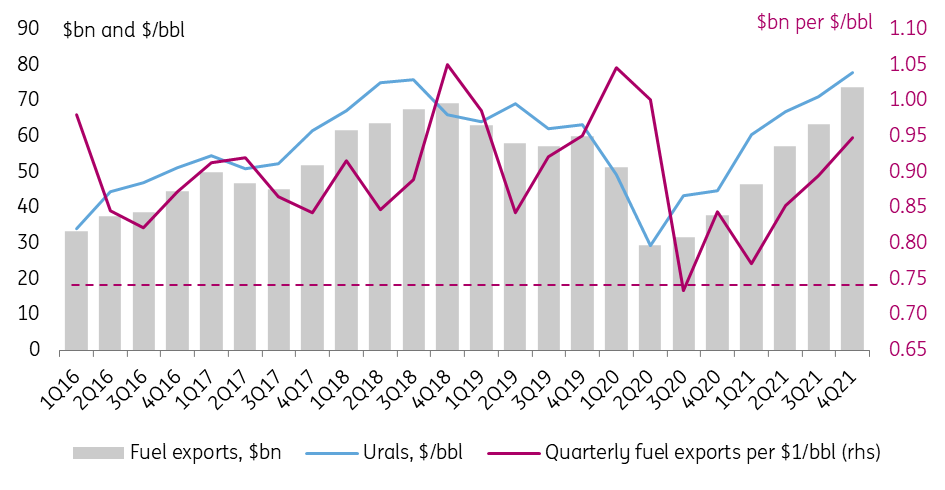

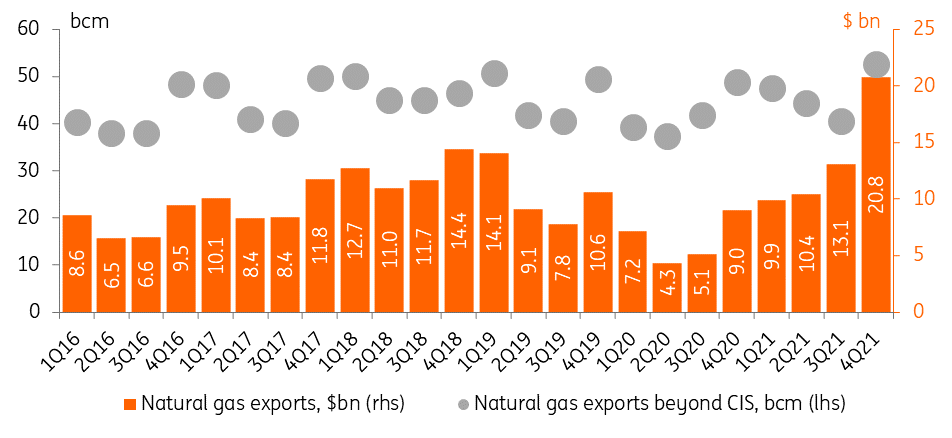

- Russian merchandise exports continue to strengthen thanks to both the fuel and non-fuel sides. Fuel exports increased by US$10bn quarter-on-quarter (Figure 1) in 4Q21, but unlike previous quarters, this time it was caused not by higher oil export volumes and prices, but as result of robust growth in proceeds from natural gas (Figure 2). In fact, up to 80% of the quarterly fuel export increase in 4Q21 was assured by the natural gas exports. The data on physical volumes for 4Q21 has yet to be released, but the preliminary statement by Gazprom, Russia's sole natural gas exporter, implies that gas supplies to non-CIS countries (usually accounting for 80-85% of Russia's total natural gas export volumes and even higher share of proceeds), increased in 4Q21 to around 53 bcm, which is 12 bcm higher than in 3Q21 and 3 bcm higher than the previous record held for 4Q. As a result of a recovery in volumes (which were up around 3% YoY in 2021) and spiking prices, the share of gas in Russia's annual fuel export proceeds increased from 15-20% seen historically to 23% in 2021, which however is still modest compared to oil.

- One of the very positive takeaways of from the 2021 exports is that in addition to a massive US$90bn increase in the annual fuel exports, non-fuel exports also increased by US$66bn, or 36% year-on-year. Based on preliminary data from the Russian Customs for January-November 2021, it was mostly a result of higher global prices for agriculture, fertilizers, and metals, but a noticeable 12% YoY increase in physical volumes of ferrous metals as well as a 31% YoY for machinery and equipment also played part. The volumes of fuel exports showed mixed performance, as crude oil exports dropped by around 5% YoY in 2021 after an 11% drop in 2020, while overall natural gas export volumes recovered around 3% in 2021 after a 10% drop in 2020.

Figure 1: In 4Q21, Russian fuel exports continued to grow

Figure 2: Natural gas made a noticeable contribution, thanks to both volumes and prices

Import recovery is moderating, but the growth may outstrip expectations this year

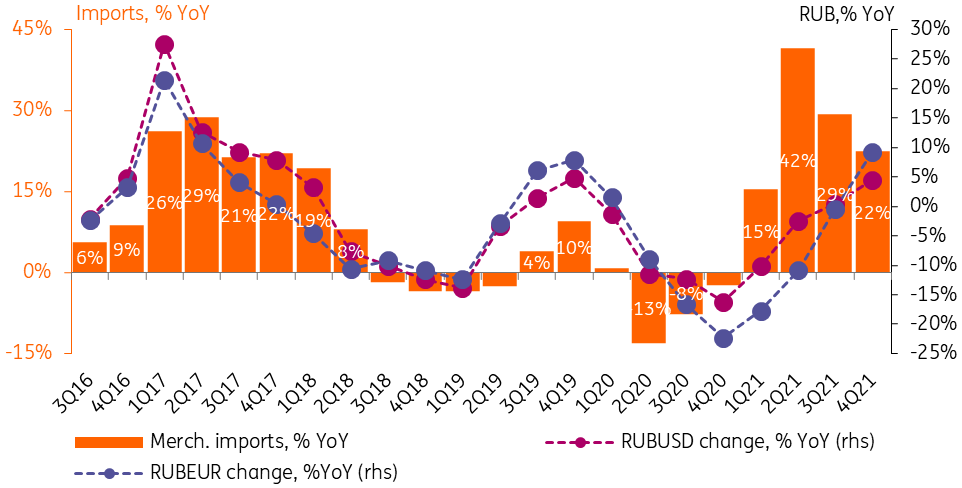

- Imports of goods and services did not provide any material surprises in 4Q21 and 2021, posting a recovery after a stringent 2020 but moderating towards the end of 2021 as the higher base effect is gradually kicking in. Looking at a combination of non-fuel exports and imports, it appears that they were largely neutral for the quarterly current account dynamic in 4Q21 (Figure 3). The deceleration in imports growth coincided with a similar dynamic in non-fuel revenues, and as result the increase in the quarterly current account surplus was assured by the widening fuel exports.

- Going forward, the merchandise imports (accounting for 80% of Russia's total imports) should moderate vs the 27% growth seen in 2021, but the dynamic may still surprise for two reasons. First, the ruble managed to show a relatively strong performance vs the US dollar and Euro (around 30% of Russia's imports originate in EU) in 2H21 (Figure 4), making imports a bit more affordable. Second, merchandise imports could be seen as a partial substitute for foreign travel and despite some easing in travel restrictions is still struggling to return to pre-Covid levels. We do not exclude that the merchandise import growth this year will exceed the Bank of Russia's projections and reach 5-10%.

Figure 3: Non-oil components of the current account seem to be stabilising

Figure 4: Imports may continue to recover thanks to ruble's relative strength to other currencies

Current account is likely to remain strong in 2022 but its support to the ruble is not all powerful

For 2022, even if we see some moderation in non-fuel exports and continued growth in imports, we still expect the current account to remain strong thanks to a strong pricing environment and planned increase in the physical volumes of fuel exports. First, ING's current commodities base case implies average Urals price of $73-75/bbl in 2021, and given the spike already seen early this year those expectations may seem conservative. Second, according to the Ministry of economic development's September 2021 projections, 2021 fuel export volumes should increase by 6-7% amid further easing in OPEC+ restrictions and mounting gas supplies. Oil exports growth is drafted at 10-11%, while natural gas supplies are seen growing by 8% this year. This should bring Russia's annual fuel exports per US$1/bbl tothe pre-Covid range of US$3.5-4.0bn.

We expect this year's current account surplus to repeat the 2021 record of US$120bn or even exceed it if commodity prices continue to exceed expectations. Russia's strong current account is one of the pillars of our generally constructive view on the ruble for the medium term. We believe it partially limited the market's nervousness at the beginning of last year and helped to assure ruble's relative strength vs EM/commodity peers in 2H21 in the face of global USD appreciation. Nevertheless, it is also true that the current account alone in the environment of free floating FX regime is not a panacea against currency weakness. We see several reasons to be cautious about the ruble exchange rate going forward.

- Looking at the experience of 2021, it appears that a strong current account did not prevent the ruble from depreciation in the average annual level (Figure 5) even despite some recovery in 2H21, bringing attention to other components of the balance of payments.

- For 2022, we expect more intense sterilization of the current account surplus via the fiscal rule. According to our estimates, the FX purchases may increase from last year's $42bn to $63-75bn in 2021 (depending on whether the government delivers on the promise to invest up to US$12bn p.a. locally out of the sovereign fund) suggesting an increase of sterilization from 35% to 53-63% and increase the dependence of the FX market on capital flows.

- Net private capital outflow remains an issue, as it accelerated to US$72bn in 2021, the highest since 2014. Since the transition to free float the ruble managed to show annual appreciation only at times when the private capital outflow was under US$30bn. While Bank of Russia and some market observers treat the capital outflow as a technical mirror image of the current account, citing high role of foreign asset accumulation (Figure 6), we consider it a more independent input stemming from low appetite for capital locally and foreign policy limitiations. This keeps the local currency undervalued, making it continuously favourable for the trade balance. A mirrored shrinking of the current account surplus and net capital outflow would set the stage for some sustainable ruble appreciation.

Figure 5: Wider current account surplus failed to prevent weaker ruble

Figure 6: Private capital outflow is driven almost exclusively by accumulation of foreign assets

Capital outflow structure is heavy on outward FDI

Looking deper into the structure of foreign asset accumulation, the primary contributor to the net capital outflow, it appears that gross outward FDI by the non-financial corporates is playing the primary part (Figure 7) and making it difficult to reverse. In fact, US$54bn out of this year's US$79bn increase in the foreign assets was assured by the companies' FDI abroad, the biggest number since 2014. Unlike other components of the foreign asset accumulation, outward FDI appear to be rather sticky.

Companies' net outward FDI by the non-financial sector totaled US$23bn in 2021 showing the sixth year of net FDI outflows over the 2013-2021 period, another confirmation of the structural nature of the outflows. This highlights the risk that the private capital flows can be a significant constraint to ruble performance into 2022 as well.

Figure 7: Accumulation of foreign assets is driven mainly by outward FDI, which appears to be sticky

Constructive view is still viable but subject to a number of risks

Overall, the whole point of looking at the balance of payments is to determine whether it provides enough fundamental support to the local FX market to weather an occasional global or country-specific storm.

Ruble-supportive factors include a persistently strong current account, conservative fiscal policy meaning flexibility on FX purchases and public debt placement in case of external shocks, prudent monetary policy preventing real rates from declining, and modest role of portfolio flows on the local FX market. We believe this combination of factors allowed the ruble to show only a modest 1% depreciation to the US dollar over the course of 2021, while its EM/commodity peers lost 6-9% (Figure 8) depending on whether we exclude or include the Turkish lira in the comparison basket. The support of trade-related FX flows is also the reason why against the backdrop of increased country-specific foreign policy tensions the ruble is down only 2% year-to-date, while Russia's 5Y CDS are up 50 to 100 basis points, 10Y OFZ yields spiked 85 basis points, and local equity indices are down 8-10%.

Meanwhile, Russia's capital account is a clear hole in the ruble's defences, as persistent (and mostly one-way) accumulation of foreign assets by the private non-financial sector offsets the lion's share of the current account surplus, leaving the local FX market vulnerable to jittery portfolio flows. The latter can be negatively triggered by global US dollar appreciation, the case for which seems to be strengthening, and of course, country-specific risk-off in case of failure of diplomacy in the Russia-Ukraine tensions.

Another important consideration here is that depite the year-to-date spike, the ruble's country-specific discount to peers is close to historical lows (Figure 8). This means that a diplomatic success or even pause in the foreign policy tensions around Russia are unlikely to bring material upside to ruble, while negative outcomes (military conflicts, new sanctions) would lead to additional pressure.

As a result, our expectations of moderate USDRUB recovery can still materialise this year, but only assuming the return to foreign policy status quo and relatively calm global markets. Moreover, in the longer run, the ruble will remain prone to a depreciation trend unless the local private capital flows see sustainbale improvement.

Figure 8: Ruble is negatively affected by global risk-off at year-end and is under country-specific pressure in early 1Q22

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article