Russian balance of payments calls for caution over RUB

Balance of payments for 4Q19 suggests weakness in the current account and tells us that as much as US$25 bn of net portfolio inflows into local currency state bonds (OFZ) may be needed in 2020 in order to avoid ruble depreciation. Meanwhile, a possible easing in the budget rule and buyoant global markets may somewhat soften this view

| $71bn |

2019 current account surplusincluding $16bn in 4Q19 |

| Worse than expected | |

Current account surplus underperformed in 4Q19 despite favourable oil prices

The Russian current account surplus totalled US$16.3 bn in 4Q19, significantly below the US$21.8 bn Bloomberg consensus and our US$25.0 bn expectations despite a benign oil price environment and physical fuel exports performance. We see three key reasons why the current account was a disappointment.

- Imports showed a strong recovery to 10% year on year in merchandise (after -1% YoY in 9M19) and to 6% in services (after 4% in 9M19), most likely reflecting a year-end pick up in corporate and consumer activity amid some relief in budget spending discipline after a tighter than expected 9M19.

- Non-fuel exports (43% of total exports) showed a 3% YoY drop in 4Q19 after a flat YoY performance in 9M19, confirming weakness outside the Russian traditional export speciality.

- Outflow of investment and secondary income exceeded expectations. Given Russia's declining foreign debt and interest payments, this outperformance could not have been caused by higher debt servicing charges, but rather reflected an increased outflow of dividends in favour of non-resident shareholders amid growing profits in the corporate sector.

Russian current account surplus contracted by US$43 bn YoY in 2019, of which only US$19 bn was due to the decline in the oil price.

Overall, the current account surplus contracted to US$71 bn in 2019, from US$114 bn in 2018. The above mentioned non-fuel reasons, according to our estimates, contributed to US$24 bn out of a total US$43 bn contraction YoY. The remaining US$19 bn was trimmed due to the decline in the annual average oil price by US$6-7/bbl.

Figure 1. Current account pressured by import growth and weak non-fuel exports

Recovery in imports, weak non-fuel exports, higher dividend outflow could reduce the CA surplus by 30-40% in 2020

We believe the pressure factors seen in 4Q19 have a high chance of continuing to take effect in 2020, which could reduce the current account surplus from US$71 bn last year to around US$45 bn under a hypothetical scenario of an unchanged US$65/bbl oil price. We see the following arguments in favour of such expectations:

Under unchanged oil prices, we expect the current account surplus to shrink to US$45 bn in 2020, with zero surplus seen in 2Q20 on dividend seasonality.

- Imports are likely to continue to recover, along with the pick-up in domestic economic activity. To remind, the recent reshuffling at the top of the Russian decision-making apparatus (see our note 'Russia reshuffle: mind the budget policy' from 16 January) suggests a likely material inflow of budget support, including a backlog of spending allocations not used in the previous years in the amount of 0.3-1.0% of GDP and possible local investments from the National Wealth Fund (sovereign wealth fund) of up to 0.3% GDP. Also, it still remains unclear whether the new social policy initiatives worth 0.3-0.6% GDP will represent extra spending or a redistribution of existing allocations. Overall, the likely stimulus to the state infrastructure spending and household income should trigger an acceleration of nominal import growth (mostly intermediary and investment goods) from 2-4% in 2019 to at least 10% in 2020, being the key and most certain driver of the current account breakeven oil price on the way up (meaning higher vulnerability to oil price fluctuations).

- Non-fuel export prospects are uncertain, as the price outlook for non-fuel commodities, including metals and agriculture (accounting for one-third of Russia's non-fuel exports) is mixed, while exports of higher value-added products will largely depend on the success of export stimulus programmes that the government has yet to implement (with little track record so far).

- Investment income outflow to remain high given the financially successful 2019 for the corporate sector. To remind, corporate profits were up 47% YoY in 2018 and continued to grow 8.5% YoY in 10M19 on a lack of fixed investments, which were down 0.1% YoY in 9M19. The peak of actual annual dividend pay-out and cross-border transfers for 2019 financial year is expected in 3Q20, though technically it will be reported in 2Q, leading to zero expected current account surplus in 2Q20. The recent news flow suggests that the largest publicly traded corporates maintain a preference for generous dividends, supporting the rally on the equities market.

https://think.ing.com/snaps/russian-government-resigns-what-to-expect-now/

Figure 2. Imports have further upside, which may increase vulnerability of current account to commodity market volatility

FX interventions in 2020 may exceed the current account surplus, unless the budget rule is eased

The contraction of the current account surplus, not prompted by a decline in the oil prices, means that all else being equal it will not be accompanied by a respective contraction in the FX purchases mandated by the budget rule. To remind, the extra fuel revenues (ie, mostly oil price) are the only meaningful variable determining the amount of FX interventions at the moment.

In a status quo scenario (ie, the oil price remains at around US$65/bbl, and the budget rule is intact) we see 2020 FX purchases at US$50 bn (expected current account surplus of US$45 bn), very close to 2019 interventions of US$51 bn (Figure 3). This results from the two counterbalancing effects. On the one hand, the annual increase in the base oil price (the level above which extra fuel revenues and FX interventions are formed) by US$0.8/bbl to US$42.4/bbl in 2020 should result in a contraction of annual FX purchases by around US$2 bn; moreover, the expected local investments from the National Wealth Fund by around RUB300 bn should further reduce annual FX purchases by US$4-5 bn. On the other hand, this year's FX interventions will be US$4-6 bn higher than last year, as in January 2019 FX purchases were still on hold due to adverse market conditions.

At the same time, we acknowledge the increasing likelihood of the budget rule being eased (ie, the threshold oil price being increased beyond the regular 2% per year) soon in order to accommodate new economic policy initiatives and market reality. The higher the threshold oil price embedded in the budget rule, the bigger proportion of fuel revenues are allowed to be used to finance current expenditures, and therefore the lower is the amount to be received by the sovereign wealth fund (meaning lower market FX purchases needed to mirror this process). We see two practical reasons why the government would want to increase the budget rule:

- to accommodate the likely increase in spending plan, which may now be increased by RUB400-500 bn in 2020, given the new social policy initiatives announced by the president last week.

- to account for the likely under-collection of oil revenues, stemming from actual ruble exchange rate being stronger than drafted into the budget. According to our estimates, should USDRUB remain at the current 61-62 range in 2020 instead of depreciating to the drafted 65.7, the budget will under-collect RUB500-600 bn in annual revenues.

In any of the two abovementioned events the unchanged budget rule would dictate an increase net borrowing, which is already planned at a high level RUB1.7 tr for this year. The increase in the threshold oil price by US$1/bbl lowers the annual borrowing need by RUB110-120 bn per annum and reduces the amount of annual FX purchases by US$1.7-1.9 bn. Therefore, it would be reasonable to expect that in order to address either of the two challenges (extra spending, fuel revenue under-collection) the budget rule oil price could be increased by around US$5/bbl, lowering the expected amount of annual FX purchases by up to US$10 bn, or to US$40 bn in 2020.

Even if the budget rule is somewhat eased, FX purchases will offset around 90% of the current account surplus in 2020, higher than 73% in 2019.

The scenario of reduced FX purchases would provide some relief to the balance of payments, however, as can be seen from the modest expected size of the current account, not by much. FX interventions would still offset up to 90% of the current account surplus in 2020, which is higher than 73% in 2019. In order to keep the relative pressure of FX purchases in line with the 2019 level, the budget rule would need to be eased more dramatically - with the threshold oil price being increased by US$8-10/bbl. Such a drastic move, however, might cause the investment community to question the sustainability of Russia's previous commitment to macro stability.

Figure 3. Current account surplus to be fully sterilized by FX purchases in 2020

| $26.7bn |

2019 net private capital outflowincluding $5.9bn in 4Q19 |

Private capital account: structural outflow continues

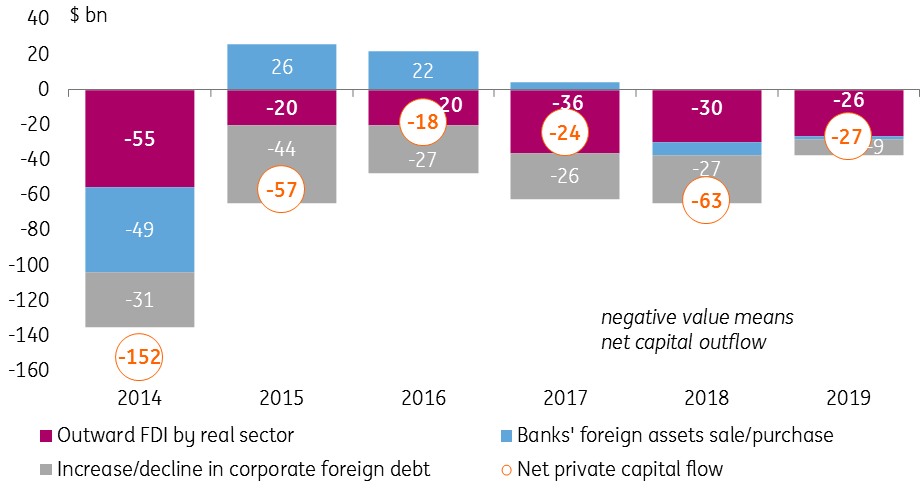

Given the shrinking in the current account amid high FX purchases increases, the role of the capital account is a source of potential support to the overall balance of payments. Indeed, the net private capital outflow shrank materially from US$63.0 bn in 2018 to US$26.7 bn in 2019, however the ability to further reduce this number remains uncertain. Looking at the structure of the private capital account in 2014-19 (Figure 4), we have the following reservations:

- Outward FDI by the non-financial sector remained in the same US$20-30 bn range seen in the last 5 years, suggesting a stable outflow regardless of the oil price environment and geopolitical situation.

- Banking sector is unable to become the source of improvement in the capital account: after a brief period of being sellers of foreign assets in 2015-16 (driven by the post-2014 readjustment), the banking sector is now maintainting a stable position.

- The potential for capital account improvement due to foreign debt dynamic is nearly exhausted. Around half of the reduction in net capital outflow (US$18 bn out of US$36 bn) in 2019 vs. 2018 was thanks to the much lighter debt redemption schedule. In 2020, the schedule is even lighter, which allows us to expect just around US$4 bn net corporate foreign debt redemption in 2020 vs. around US$9 bn (exact numbers to be confirmed later this week) in 2019, however, in absolute terms this figure makes little difference from now on.

We expect net private capital outflow to reach around US$20 bn in 2020 unless the non-financial sector's preference for international assets is somehow changed.

As a result, as a base case scenario, we expect net private capital outflow to reach around US$20 bn in 2020, with an accumulation of international assets, observed over the previous years among the corporate sector and households, being the key watch factor.

Figure 4. Structural net capital outflow remains stable at US$20-30 bn pa

Ruble increasingly relies on portfolio inflows into sovereign debt

With the 2019 current account of US$71bn being offset by US$51bn FX purchases and $27bn net private capital outflow, ruble performance has been heavily affected by the portfolio inflows into the local currency state bond market, OFZ (Figure 5).

Based on our 2020 expectations of an even smaller current account (US$45 bn) offset by FX interventions (US$50 bn) and net private capital outflow (US$20 bn), this year the ruble will require net portfolio inflows into the state debt market at around US$25bn in order to avoid depreciation. While we do expect some inflow to take place in 2020, we believe even repeating this year's positive result, which is represented by net portfolio inflow of US$22 bn into the government debt, including US$16 bn into OFZ (local currency state bonds), will be a challenge.

This year the ruble will require net portfolio inflows into the state debt market at around US$25bn in order to avoid depreciation.

- The experience of 2015-19 (Figure 6) suggests that under favourable global and local market conditions, non-residents account at best for around two-thirds of the overall OFZ market growth. This means that given the expected net OFZ supply of RUB1.7 tr in 2020, the most optimistic net portfolio.

- Meanwhile, 2019's strong inflows into OFZ for the most part reflect a recovery from a US$9 bn net outflow seen in April-December 2018 amid sanction scare, which eventually subsided. While the beginning of 2020 looks favourable, there is a risk of the sanction theme re-emerging in 2H20 due to the US electoral cycle.

- Additional consideration that has been pushing foreign investors into OFZ in 2019 was the noticeable decline in CPI and rate expectations, which was partially explained by the tighter-than-expected budget policy. Now, with overall economic policy signals shifting from macro stability towards more fiscal stimuli, the downside to the rate level may now appear limited (even to market participants).

- As over the course of 2019 large international investors likely restored their overweight positioning in Russia, a further increase in portfolio inflows would require a general improvement in the EM risk appetite.

Figure 5. Portfolio inflows into OFZ has contributed greatly to RUB performance in 2019

Figure 6. Net portfolio inflows account for up to two thirds of OFZ market growth

We continue to see RUB depreciation in 2020, although some domestic and external factors may soften this view

Although we see that the recent reshuffling in the Russian government may create some positive signals in terms of a likelihood of structural reforms, any strengthening in the fundamentals of Russia's balance of payments are unlikely to take place very soon. For 2020, we expect the current account to be eroded by growing imports and stagnating non-fuel exports, and around 100% of it is likely to be sterilized by the FX purchases mandated by the budget rule. Meanwhile, households and corporates are likely to remain net exporters of capital until they see some track record in structural transformation. In this environment, the portfolio inflows into OFZ, which we expect to continue, are unlikely to be enough in scale to assure a strong ruble performance for the second year in a row. We therefore continue to expect ruble depreciation, with sharp moves possible in 2-3Q on current account weakness and USDRUB66.0 seen as a year-end target.

Meanwhile, we do acknowledge that this view seems pessimistic, especially following the strong USDRUB rally from 64.0 to 62.0 last December. Moreover, this view is conservative even compared to ING's global FX forecasts, which currently suggests that Russia's direct EM/commodity peers are supposed to show flattish performance relative to USD. As a result, the risks to our core RUB forecast are skewed towards a more modest scale of depreciation. The first factor that could result in an improvement is the potential easing in the budget rule, which would lower the amount of annual FX purchases by US$5-10 bn and potentially improve the ruble forecast levels by 1-2 rubles per US dollar. The second factor would be continued strength of EM risk appetite and no deterioration of the sanction context.

Figure 7. For now, RUB forecast appears pessimistic relative ING's view on Russia's FX peers

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article