Russia: Faster inflation, stronger activity, harsher monetary policy

The new spike of inflation in June to 6.4-6.5% YoY combined with stronger-than-expected activity in 5M21 has reinforced the CBR's hawkish stance. We raise our CPI, GDP, and key rate forecasts for this year, expecting a 75bp key rate hike on 23 July and a shift of the key rate ceiling at 6.5-7.0%. Near-term trajectory is still subject to Covid uncertainties

Inflation trend continues to disappoint

This midsummer week has been exceptionally busy with economic data and official statements during the International Financial Congress organized by the Bank of Russia (CBR). In this note we are summarising the key recent events and their implications for our views on inflation, activity, and monetary policy.

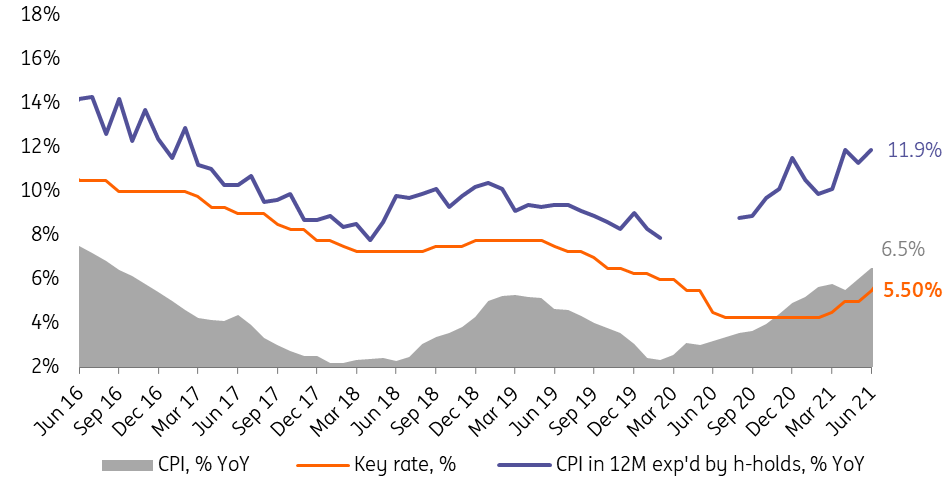

First, inflation continues to exceed expectations. According to the most recent weekly data, the annual CPI rate has increased from 6.0% year-on-year in May to 6.4-6.5% YoY as of 28 June, with the final June estimate to be released on 7 July, and we expect it to touch 0.6-0.7% month-on-month, or 6.5% YoY. This is higher that the 6.2-6.4% YoY we expected intially and the continued weekly growth in CPI goes against standard seasonality. The acceleration appears to be broad-based, ie, seen not just in the food segment, but also in non-food and services. As a result, a seasonal weekly or monthly deflation in the summer months now looks like an optimistic scenario. The stronger-than-expected CPI, which seems to reflect global price pressures and local factors, is accompanied by elevated inflationary expectations by households (Figure 1).

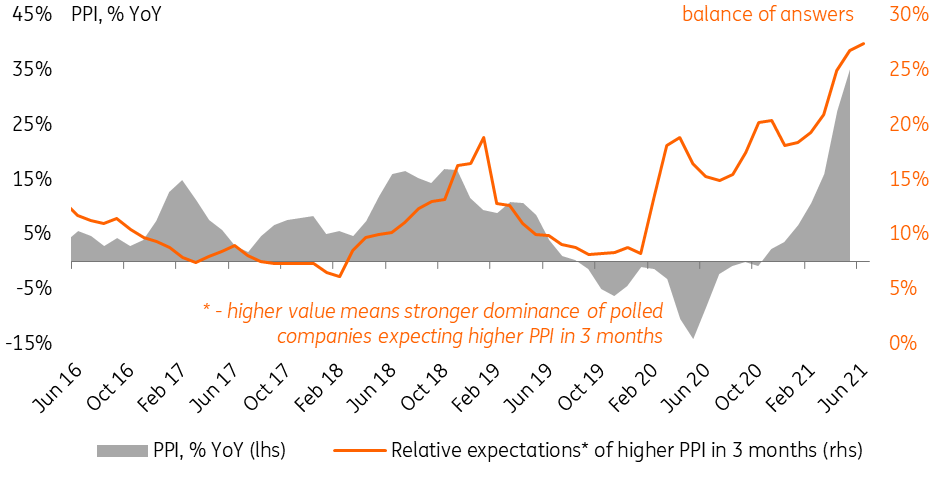

The producer price inflation is also accelerating, with the May figure jumping to 35.3% YoY, reflecting global commodity price growth and supply chain disruptions in the finished goods. Corporate price expectations are also on the rise, breaching multi-year highs (Figure 2). While the government is attempting to curb the local price growth through a mix of adminisitrative controls for socially-sensitive goods and export quotas and duties, this has yet to be proven efficient against the global inflationary wave.

We raise our year-end CPI projections from 5.0% to 5.7%

We continue to believe that local inflationary pressures should somewhat ease, thanks to the reopening of outward tourism to Turkey and other popular destinations, and thanks to a more-or-less stable ruble. But given the increased global CPI risks, and signs of more robust local economic recovery, we are now less certain in the fast deceleration in the annual rate, even accounting for the higher base effect. We raise our year-end CPI projections from 5.0% to 5.7% and see risks of 2022 CPI exceeding the CBR's 4% target.

Figure 1: CPI and households' inflationary expectations keep climbing

Figure 2: PPI and corporate inflationary expectations are also on the rise

Economic recovery in 1H21 is more robust than expected

Second, the economic recovery so far has proved more robust than initially expected. The recently released activity data for May and 5M21 has exceeded both our and consensus forecats on all counts, challenging our cautious annual GDP growth forecast of 2.5%.

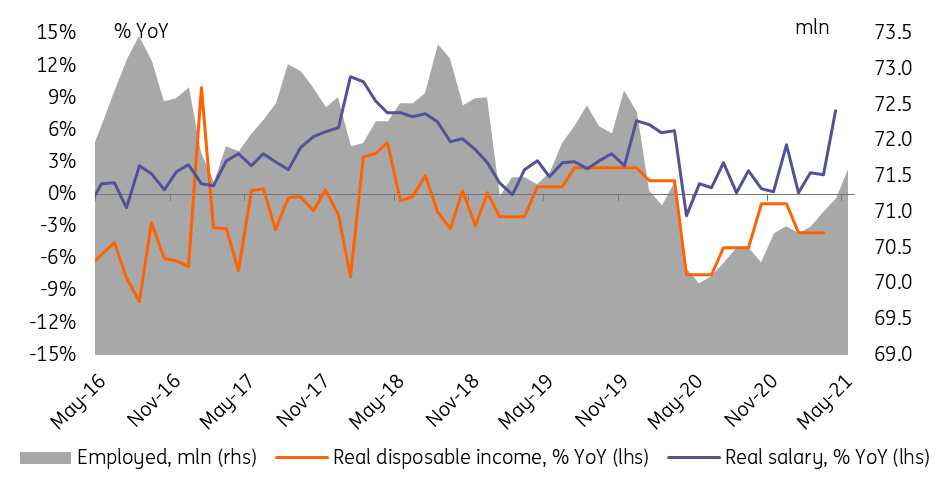

On the consumption side, retail trade posted a 27.2% YoY jump in May and 10.0% YoY increase in 5M21 after the 3.2% drop in 2020. Although this high result is largely thanks to the low base effect of the lockdown-damaged 2Q20, we also see positive trends on the labour market and income sides. Firstly, the unemployment level dropped to 4.9% as the number of officially employed recovered to 71.6 million, which is still lower than 2019, but already higher than the levels seen in the beginning of 2020, just before Covid. Secondly, despite the pick-up in inflation, real salary growth totaled 7.8% YoY (13.8% YoY in nominal terms) in April and 2.9% YoY (8.6% YoY) in 4M21 after 3.8% (7.3%) growth in 2020 (Figure 3).

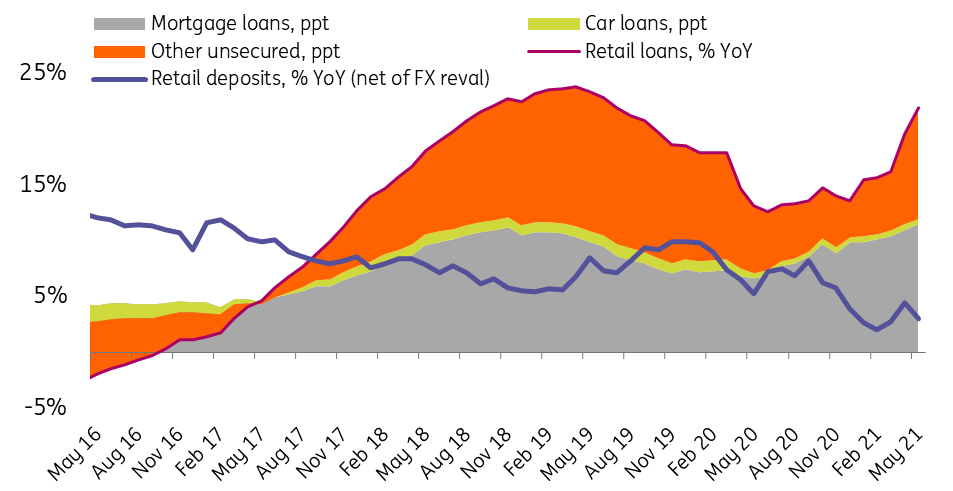

We continue to believe that the ban on mass foreign travel, which was in place till the end of June, played its positive part, and now, following the removal of most of the obstacles, the support factor to local consumption will start to fade away. At the same time, we also note, that the extension of the subsidized mortgage programmes and expectations of additional state support during the election year can be positive for consumer sentiment. Looking at banking statistics, we see the pick-up in retail lending (on both mortgage and consumer lending) and slowdown in retail deposit growth, suggesting a higher propensity to consume (Figure 4). As a result, even assuming some moderation in the consumption growth in 2H21, we now expect annual retail trade to post 7.5% growth in 2021, with overall private consumption growing 8%, accounting for the rebound in domestic services. That is roughly double of what we hoped for earlier.

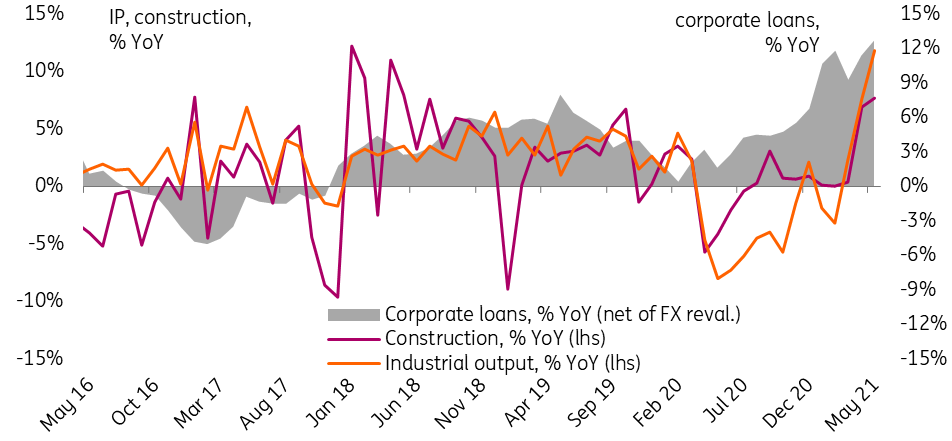

On the producer side, we are also positively surprised by the fast recovery in the industrial production – at 11.8% YoY in May and 3.2% YoY in 5M21 after 2.6% drop in 2020. Non-oil commodity extraction and manufacturing appears to be the driving force behind it, as the high external demand for metals and recovering local consumer demand are offsetting the negative effect of OPEC+ restrictions that are about to be eased. We also note that the industrial recovery is accomapnied by faster growth in construction and a pick-up in lending activity (Figure 5) which is hinting at a broad-based recovery. For 2H21 prospects we are more cautious given that the overall industrial output level has already reached the pre-pandemic levels and a lack of signs of new fiscal stimuli, but still the strong 5M21 result allows us to increase annual industrial output forecast from 3.0% to 5.5%.

We improve our 2021 GDP forecast from 2.5% to 3.8%.

Better-than-expected local demand trends, combined wtih strong exports (Bank of Russia has recently improved its 1Q21 current account surplus estimates from US$17bn to US$23bn on a stronger export revenue side) in the first half of 2021 allow us to improve our GDP outlook for this year. While we continue to expect moderation of GDP growth in 2H21 and see risks coming from the third wave of Covid amid the low vaccination rate in Russia, we improve our 2021 GDP forecast from 2.5% to 3.8%.

Figure 3: Employment and income trends are recovering

Figure 4: Consumption is increasingly relying on borrowing and savings

Figure 5: Producer side has been recovering amid faster lending and higher demand in construction and consumer-focused sectors

There is now more room for key rate hikes in the near-term

Third, the tone of the Russian central bank, which started the key rate hike cycle in March and has been guiding for further hikes ever since, has made more hawkish signals this week.

During her speech at the International Financial Congress CBR Governor Nabiullina indicated that the monetary authorities believe that the Russian CPI spike is more long-term in nature than in some other countries. The key concerns are that that the pick-up in actual CPI is accompanied by the spike in inflationary expectations by households and corporates, and there are signs of narrowing in the output gap, including due to short labour supply in some sectors. Also, the governor expressed increased confidence in the local economic recovery and stressed that the current local monetary conditions remain accomodative. Finally, the CBR officials mentioned during the congress that at the upcoming 23 July meeting the CBR will be considering an increase in the key rate, currently at 5.5%, by anywhere between 25 and 100 basis points, and added that further tightening after that might be required.

We now believe a 75bp hike is the most likely scenario for the 23 July central bank meeting.

Initially, we took the CBR statements as guidance for another 50bp hike. However, the higher-than-expected CPI and GDP data that followed, has challenged this view. We now believe a 75bp hike as the most likely scenario for the upcoming meeting, with upward revision in the CBR's CPI and GDP growth forecasts. The expected key rate ceiling for the medium term, earlier seen at 6.0-6.5%, has now apparently shifted to 6.5-7.0%. We see 6.75% as the year-end target for the key rate for 2021.

Importantly, the CBR has launched a monetary policy review after 5 years of inflation targeting (IT), to reassess the key parameters. The key parameters for the IT are estimates of potential growth rate, inflation target (4%) and equilibrium real key rate (1-2%). The governor mentioned that the initial decision to give a discretionary 4% CPI target (as opposed to a range) was made to avoid expectations' anchoring at the upper border, now that the market is more developed, in the CBR's view. Later, the CBR officials did not exclude that following a year-long internal and public discussions some changes are possible to the CPI target and the way it is presented (circa mid-2022). We believe that a shift to a CPI target range is possible, which would allow the CBR more flexibility in its inflation targeting efforts. However, an actual change in the target is unlikely before the current 4% target (and the market's confidence in CBR's control over inflation) is sustainably achieved.

Covid and vaccination is the near-term factor of uncertainty for Russia

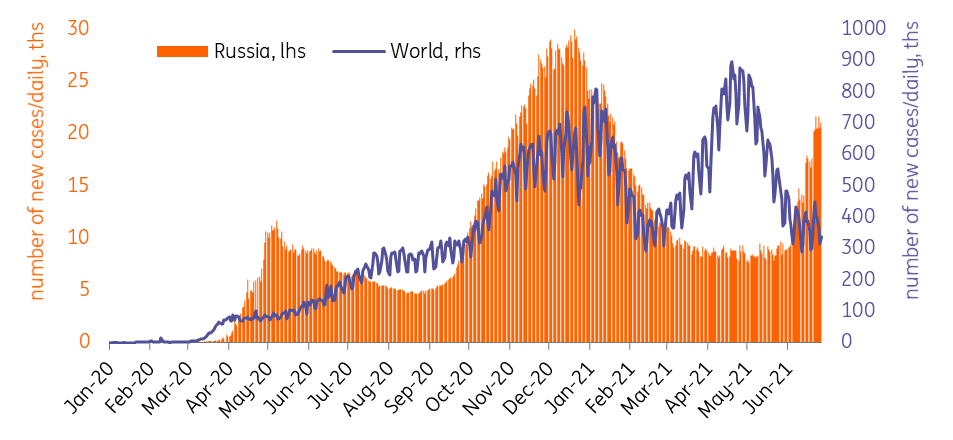

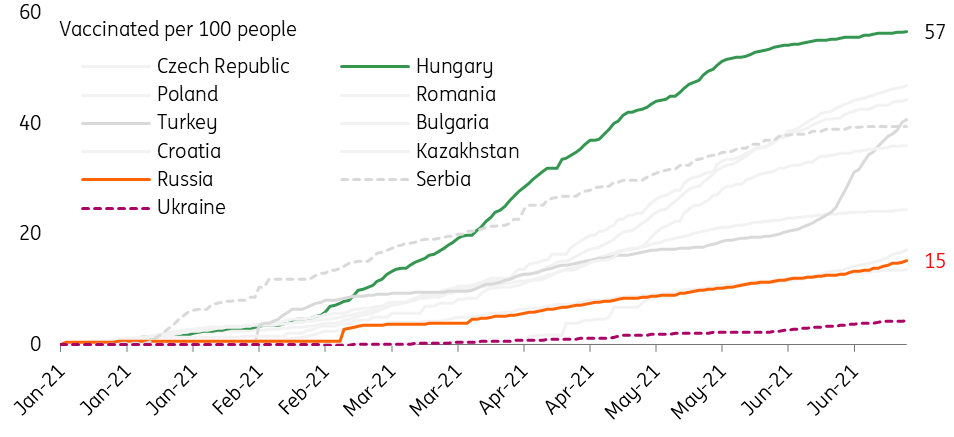

Noteworthy, the level of uncertainty for the near-term forecasts remains high, with Covid remaining the most important watch factor. Russia has entered the third wave of Covid infections with some delay relative to the rest of the world, but the deterioration of the epidemic situation has been rather rapid, with a number of new daily cases doubling from 10,000 to 20,000 in just one month (Figure 6). The key uncertainty is the risk of new lockdowns. On the one hand, the number of new cases is so far are below the levels seen in the second wave, during which Russia so no material mobility restrictions. Also, the healthcare system and the economy are now better prepared for Covid than it was during the first wave, when strict lockdowns were required in April and May. On the other hand however, the number of new cases are growing rapidly, the hospital capacities are reportedly being filled fast, the new Covid variant is said to be more aggressive than the previous, while the vaccination rate in Russia is just 15% (Figure 7), lower than in most of peer countries, despite the state efforts to boost the process. As a result, some regions, including the capital, are already seeing partial restrictions on some non-essential offline activities.

Our base case is that strict quarantine measures will be avoided, but in case they are needed, the experience of 2020 suggests that each month will cost around 1 percentage point of annual GDP. We believe the government is keeping this risk in mind in determining its budget policy. Despite higher than expected oil and non-oil revenue (leading to an improvement in our 2021 revenue projections by around 1% of GDP this year), the top politicians have so far avoided announcing any material increase in this year's spending plans despite the upcoming parliamentary elections in September. We believe that the additional revenues are kept in reserve in case of new shocks. We still believe that by the year end the non-oil portion of the extra revenues will be released to some extent, regardless of Covid. As a result, despite the stronger revenue side we cut our full-year budget deficit projections very modestly – from 1.2% to 0.5% of GDP. In case of adverse Covid scenario some additional fiscal response will follow, while the CBR will have to temporary moderate its appetite for tighter monetary policy stance.

Figure 6: Russia has just entered the third wave of Covid

Figure 7: Low vaccination rate is a concern

Longer-term views unchanged

Based on the year-to-date performance, we raise our 2021 expectations for year-end CPI to 5.7%, for full-year GDP to 3.8%, and for the year-end key rate to 6.75%, with the third wave of Covid outbreak being the most important near-term factor of uncertainty for economic activity, inflation, the monetary and fiscal policy.

The cautious longer-term view on activity remains unchanged however, as we are yet to see the new sources of economic growth after the post-Covid recovery is over, while the scope for monetary and fiscal support is limited, while the room for further increase in the private secotor leverage is uncertain. The cautious view on the ruble, which suggests limited room for appreciation (year-end target of USDRUB 73, followed by gradual depreciation afterwards), also stands, given the global USD trends, fast recovery in Russian imports as well as private capital flow trends.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article