Russia: Consumption picks up in October

Retail trade and construction growth exceeded expectations in October, most likely thanks to the increase in public sector salaries and the government's year-end investment spending splurge. This, combined with the stabilization in CPI growth in November lowers the urgency of a key rate cut in December

| +1.6% YoY |

October retail trade+1.5% YoY for 10M19 |

| Better than expected | |

October retail trade exceeded expectations, likely on salary growth in the public sector

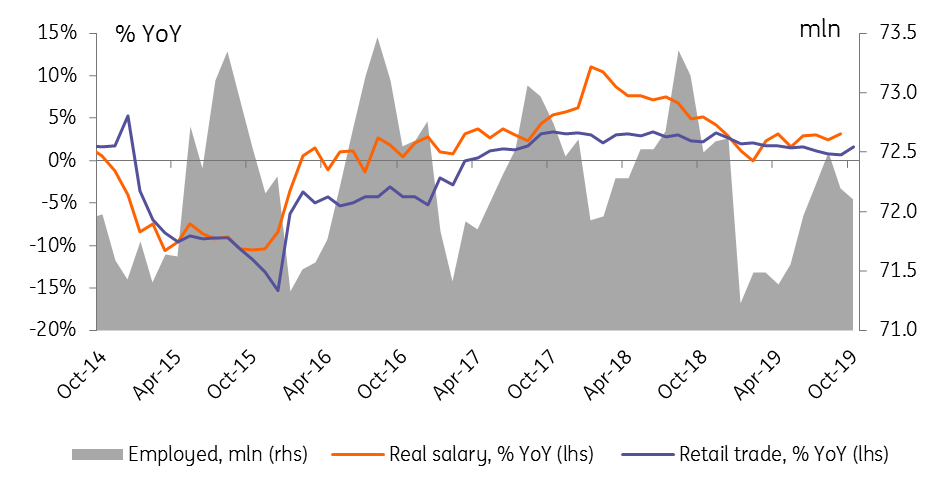

Russian retail trade growth accelerated from 0.7% year-on-year in September to 1.6% YoY in October, exceeding the 1.0% consensus expectations and our more cautious 0.5% YoY. Both food and non-food segments saw equally higher growth rates. It appears that the macro prudential tightening, which has likely lowered the supply of consumer loans in October (Bank of Russia has yet to release banking sector data), was offset by stronger support from income fundamentals. According to the recently released report, real salaries growth accelerated from 2.4% YoY in August to 3.1% YoY in September (salary numbers are now released with a bigger lag), and we do not exclude that further acceleration took place in October amid an increase in some segments of the public sector. At the same time, for the medium term we remain concerned with income and consumption fundamentals in general, as this year's number of employed is 0.5-1.0 million lower than last year on demographic/migration issues.

Income/consumption growth fundamentals

Corporate activity mixed, budget support may start kicking in later

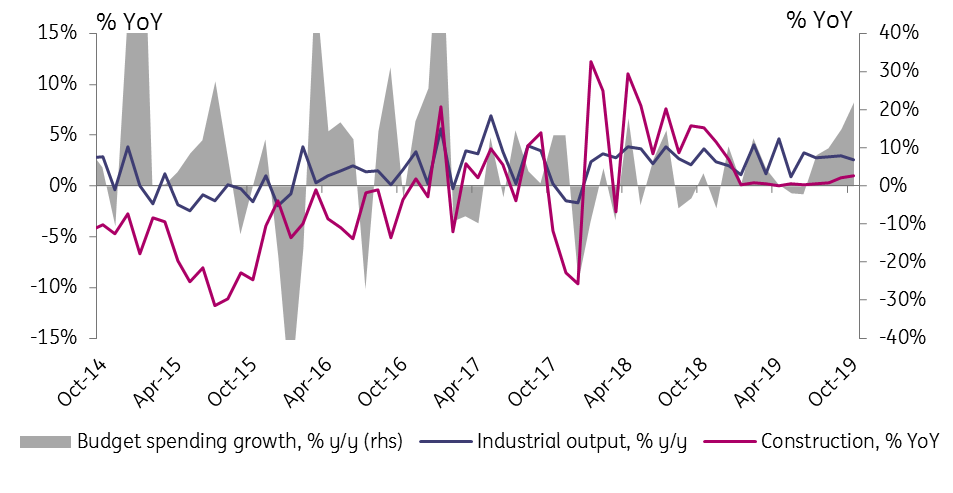

Corporate activity showed a mixed picture in October, as industrial output growth decelerated slightly, and the only strong support factor was oil downstream, while construction growth apparently accelerated moderately from 0.8% YoY in September to 1.0% YoY in October. This took place amid a rapid acceleration in budget spending to 22% YoY in October, as the government is playing catch up on investment spending as the year-end approaches. With 74% of the annual spending plan fulfilled in 10M19 vs. 76% in 10M18, a further increase in budget support in November-December should be expected, even if 100% fulfilment of the annual plan is not guaranteed.

Next year, the government may try to catch up on the RUB1.0 trillion (c.1.0% of GDP) spending backlog from 2018-19 and is discussing additional off-budget investments from the National Wealth Fund in the indicative amount of RUB0.3 trillion, which, if successful, could serve as a support factor to the corporate activity. To remind, this is the basis of our expectations of a moderate acceleration in GDP growth from 1.0% in 2019 to 1.5% in 2020.

Key indicators of the Russian producer trend

Better-than-expected consumption growth in October despite tighter consumer lending conditions, combined with the long-awaited acceleration in budget spending growth lowers the urgency for monetary policy easing. The stabilization of CPI growth at around 3.6% YoY in the middle of November following a continuous slowdown may serve as an additional argument against any rate cut in December. That, however, does not remove the downside potential for the key rate (currently at 6.5%) for the medium term. We continue to expect 6.0% in 1-2Q20. A lower rate is possibe if CPI, expected to decelerate to 2.5% YoY in 1Q20 on base effects, fails to see material acceleration towards the central bank's 4.0% target.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article