Russia Balance of Payments: Portfolio flows remain key

In 2Q19, Russia's current account surplus was lower than expected for reasons other than the oil price. This means no respective decline in the mandatory FX purchases and therefore leads to the ruble's higher dependence on portfolio inflows to OFZ, which seems to have narrowed in June from April and May despite the global risk-on

| $12.1 bn |

2Q19 current account surplus$45.8 bn for 1H19 |

| Lower than expected | |

2Q19 current account weak on non-oil&gas side...

The 2Q19 current account surplus of US$12.1 billion was significantly below the US$19.1 billion consensus and our forecast of US$17.0 billion. All the reasons for the underperformance were on the non-oil&gas side, which we believe to be a reflection of weakness in the local industrial output amid budget policy seasonality and strengthening of RUB by 10% to USD since the beginning of the year:

All the reasons for the current account weakness were on the non-oil&gas side, which we believe to be a reflection of weakness in the local industrial output amid budget policy seasonality and strengthening of RUB by 10% to USD since the beginning of the year.

- The drop in the non-oil&gas merchandise exports deepened from -2% year on year in 1Q19 to -5% YoY in 2Q19

- Persistent 3% YoY drop in merchandise imports (instead of a deeper drop)

- Stagnating balance of services

- Some increase in the dividend payments in favour of non-residents (the main bulk of those transactions is normally accounted for in June, however, the actual payments may take place later - in July-August)

While the weak trends in the non-oil current account are unlikely to prevent its seasonal widening to US$15-20 billion in 3Q19, our full-year US$100 billion expectations will now require some effort to be met.

Key current account parameters

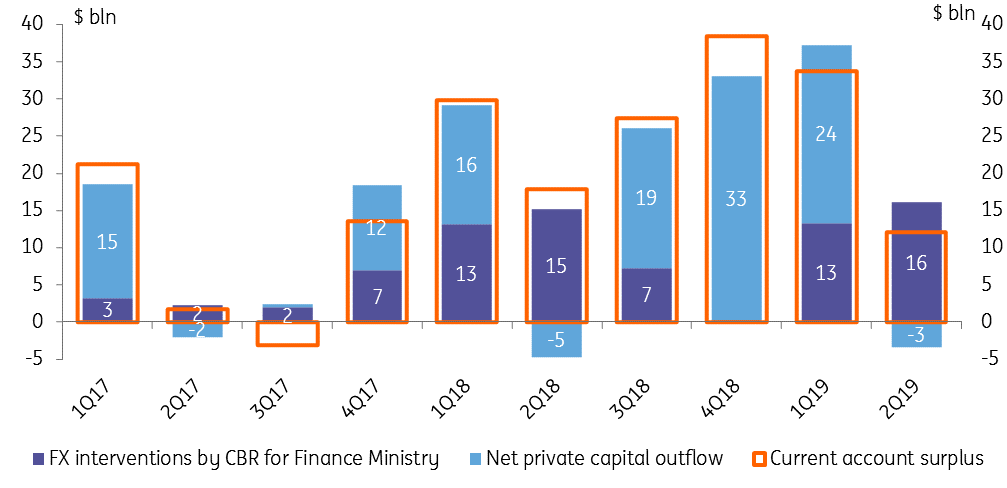

...and fully sterilized by FX purchases

It is important for the FX market that the current account weakness is on the non-oil&gas side, because it means that it does not lead to any reduction in the mandatory FX purchases by the Central Bank of Russia (CBR) to fulfil the budget rule (the latter depends only on the expected extra oil&gas revenues of the budget). In fact, in 2Q19 the FX purchases of US$16 billion exceeded the current account surplus for the first time in 2 years. Only the small (and seasonal) net private capital inflow of US$3 billion allowed to balance those flows.

Given the current oil price trend, we expect FX purchases to sterilize 75-100% of the 3Q19 current account surplus. Meanwhile, the net private capital outflow should return, mainly reflecting the accumulation of international assets by corporates and households.

Overall, the current framework of the Russian balance of payments assumes that the current account surplus is used to finance the accumulation of foreign assets by the government and the private sector. Unless there are changes in the budget rule mechanism and/or recovery in the local CAPEX activity by the private sector, there is little grounds to expect the current framework to change anytime soon.

The current account surplus is used to finance accumulation of the foreign assets by the govenment and the private sector.

Current account: where do you go? (i wanna know)

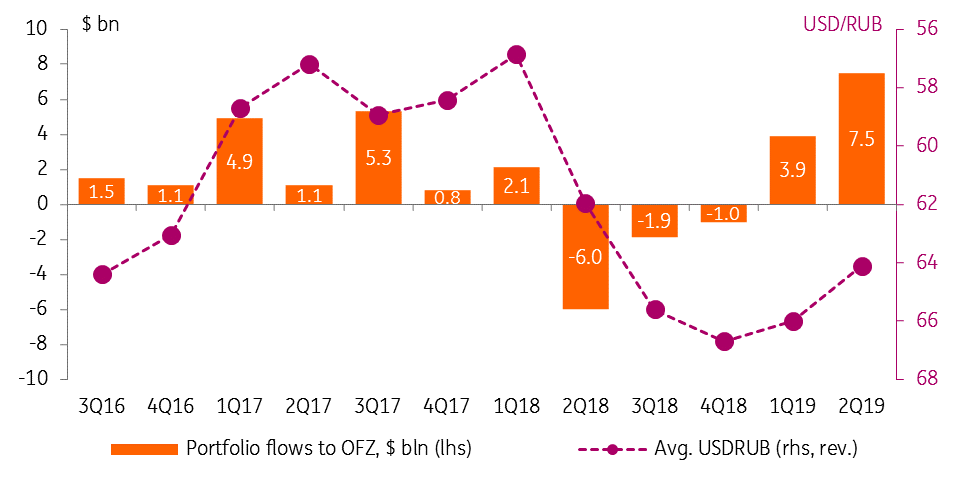

OFZ flows remains the key variable for RUB, inflow slowed in June

So, if the large trade and capital flows balance each other out, why was the ruble so strong in 2Q19, appreciating to USD by almost 4%?

The answer is simple - portfolio inflows to the local state debt market (OFZ). In fact, the government accumulated US$10.0 billion of external liabilities in 2Q19, out of which US$2.5 billion was the June Eurobond placement (irrelevant for the FX market, as the currency went into the Minfin's accounts with the CBR) and the remaining US$7.5 billion reflected inflows of foreign portfolio investments into OFZ. There are several important observations to be made here:

- Portfolio flows remain the main variable and the tipping scale for RUB exchange rate

- 2Q19 was an extremely successful quarter, as the US$7.5 billion inflow to OFZ is the highest since the US$8.6 billion in 4Q12

- The monthly inflow, however, slowed from US$3.0-3.5 billion in April and May to just US$1.0 billion in June - despite the strong global risk-on rally since mid-June

While we continue to see Russia as an attractive macro stability play for global bond investors, there are a number of challenges to continue the strong portfolio inflows, including

- Foreign holders have restored their OFZ holdings close to a historical high of US$41 billion

- Minfin has fulfilled around two-thirds of the annual placement plan in 1H19 and is planning to reduce primary supply to around US$1.5-2.0 billion per month (previously non-residents bought up to two-thirds of the total placement)

- The prospects of further global rally after the recent strong US labor data are under question

Quarterly inflows to / outflows from local state bond market (OFZ) and USDRUB exchange rate

We remain cautious on the 3Q19 ruble trend

Overall, the balance of payments update supports our cautious call on RUB, which after the global rally should depend more on local factors and fluctuate in the RUB63-65/$ range. The longer-term view also remains cautious, subject to the progress in the government's efforts to re-ignite the private CAPEX growth, and depending on how goes the discussion on investing part of the state savings (NWF) locally.

For more details on our RUB view please see our 3 July note "After the rally: Domestic factors to play a greater role in RUB pricing"

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 July 2019

In case you missed it: Powell to the rescue This bundle contains 12 Articles