Russia: Balance of payments improves slightly in 3Q20; risks to RUB remain high

In 3Q20, the current account improved, while private capital outflow slowed, which is a promising sign for the ruble in 4Q20. We continue to hope for the return to USDRUB 70-75 in the medium term. Yet with a near-zero current account and jittery corporate capital flows, even a small global or country-specific portfolio volatility can make a difference

| $2.5bn |

Russian current account surplus$24.1bn for 9M20 |

| As expected | |

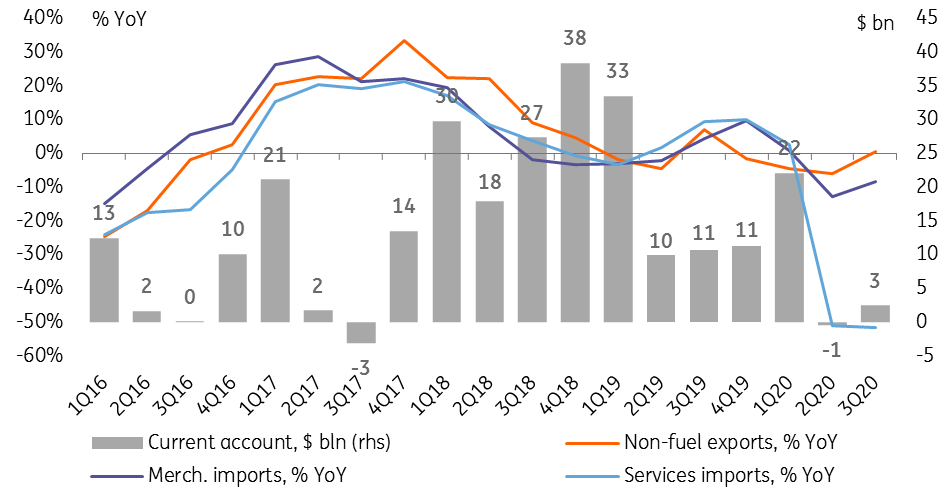

3Q20 current account improves despite OPEC+ restrictions

The Russian current account was preliminarily estimated at US$2.5bn in 3Q20, which is close to our mid-consensus US$3.1bn expectations and suggests an improvement compared to the US$0.5bn deficit recorded for 2Q20 (the latter has been downgraded from the initial US$0.6bn estimate).

Reduced physical exports are costing Russian exporters US$10bn of lost fuel revenues per quarter

- At a first glance, the improvement in the current account would seem natural given the rebound in the Urals price from US$29/bbl in 2Q20 to US$43/bbl in 3Q20, however, the positive effect of higher oil prices has been upset by the lower physical volume of exports. As a result of OPEC+ commitments, Russia's quarterly fuel export revenues per US$1/bbl dropped to a 12-year low of US$0.7bn from the previous US$0.9-1.0bn range. In other words, at current oil prices, the reduced physical exports are costing Russian exporters US$10bn of lost fuel revenues per quarter. As a result, fuel revenues showed only a modest US$2bn increase in 3Q20 to US$31bn. Some relaxation in OPEC+ cut requirements is possible only after 2020, and recent media reports suggest that Saudi Arabia is considering to extend the current limitations into 2021.

- Non-fuel revenues, on the contrary, gained US$5bn quarter-on-quarter and stayed flat year-on-year in 3Q20 after a 5-6% YoY drop in 1H20. We attribute this to possible stabilisation in exports of grain and metals, however the by-product structure should become available by the federal customs later.

- Merchandise imports increased by US$6bn QoQ, narrowing the annual drop from -13% YoY in 2Q20 to -8% YoY in 3Q20 on a recovery in demand. This trend should proceed further into 4Q20, potentially pressuring the current account, however the noticeable RUB depreciation combined with preliminary signs of softening demand in October suggest that the recovery in imports may be delayed somewhat.

- Services balance showed a US$3bn deficit in 3Q20, very close to the 2Q20 figure, as the persistently closed borders for major tourist destinations kept both exports and imports of services close to their 2Q20 levels. Imports of services remain at 51-52% below last year's levels. The re-opening of Turkey and less affordable resort destinations since mid-August seems to have had a modest effect on the balance of payments, and the renewed Covid-19 and lockdown fears may limit the demand for outward tourism in 4Q20.

- The investment income outflow (interest payments and dividends) decelerated by US$2bn in 3Q20, staying 25% lower than last year's levels. This may partially reflect the lower dividend payout by some players, however this does not seem to cover the largest corporates. Moreover, we remind of the delayed dividend payout by SBER, the largest state lender, till October, of which up to US$2.0-2.5bn could be attributable to non-residents. We therefore do not exclude dividend pressure on the current account to remain in 4Q20.

Full-year current account surplus will definitely exceed the CBR's conservative US$2bn forecast

Overall, the current account surplus of US$24.1bn for 9M20 and the trends observed in 3Q20 in particular suggest that the full-year current account surplus will definitely exceed the Central Bank of Russia's conservative US$2bn forecast. Nevertheless, the risk of below-zero quarterly result for 4Q20 remains, assuming the oil price remains at the current US$40-45/bbl range and merchandise imports continue their gradual recovery. Our base-case current account expectations for 2020 is US$20bn (-US$4bn in 4Q20).

Figure 1: Fuel exports failing to benefit from oil price recovery due to drop in physical volumes

Figure 2: 3Q20 current account supported by recovery in non-fuel revenues, still low imports of services, but imports of goods are recovering

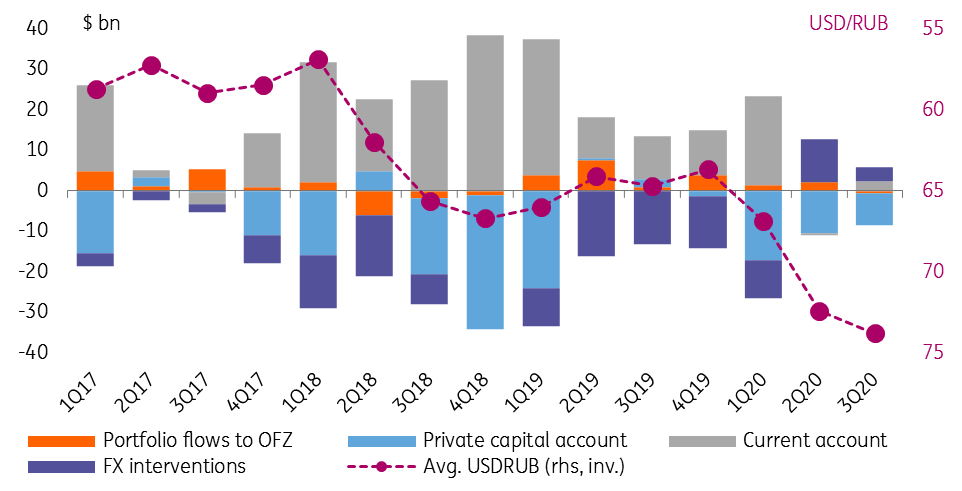

Capital account showing cautious signs of improvement

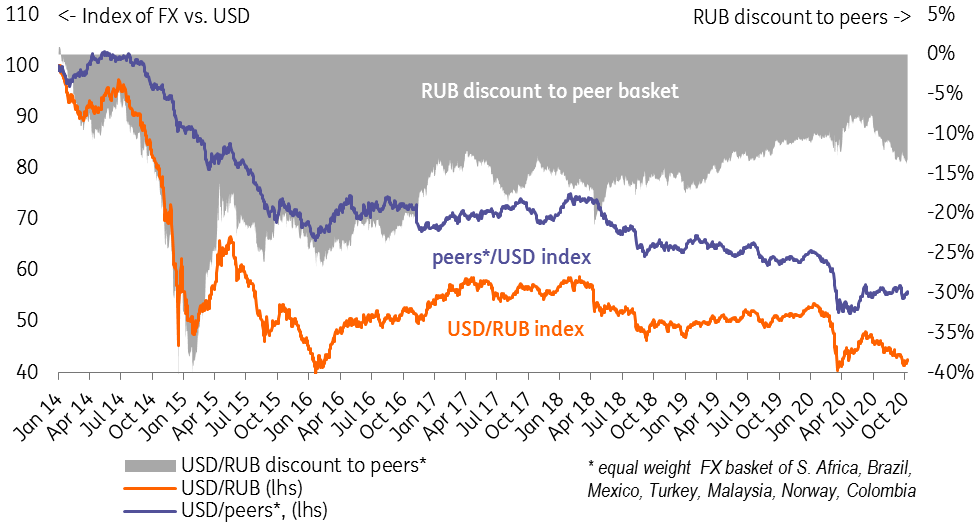

A broader look at the key balance of payment items give a slightly positive spin on the disappointing RUB performance seen in 3Q20. While following 2Q20 data we were concerned that the local currency weakeness reflected negative trends in the corporate capital account, it appears that the latter has shown some improvement in terms of volumes and structure. This means that the 8% USDRUB depreciation seen in 3Q20 (vs. 1% appreciation of RUB's peers to USD over the same period) has been driven mostly by the portfolio outflows and caused by the worsened country risk perception by the non-residents. The outflows seems to have been small, but effective given the narrowing of the other flows.

The good news is that the support from FX sales may increase in 4Q20

- The reason why the improvement in the current account failed to protect RUB from depreciation in 3Q20 was that it was accompanied by the largely expected reduction in the FX sales by the Bank of Russia – from US$10.4bn in 2Q20 to US$3.3bn in 3Q20, driven mainly by the recovery in the oil price. The good news is that the support from FX sales may increase in 4Q20, as in addition to the regular quarterly US$3-4bn sales for the Ministry of Finance, the CBR will be selling the residual US$2.4bn left after the SBER handover deal. As a result, we expect overall CBR FX sales to increase to US$6bn in 4Q20, offsetting the forecasted current account deficit.

The structure of the capital outflow seems to have improved

- Net private capital account (capital transactions by local banks, companies, and population) also does not qualify as a primary suspect in the additional FX weakness in 3Q20. While a still outperforming current account, net capital outflows slowed from US$10.5bn in 2Q20 to US$7.9bn in 3Q20. Most importantly, the structure of the capital outflow seems to have improved: while the 2Q20 outflow mainly reflected accumulation of foreign assets by the non-financial coporations, 3Q20 was driven by the reduction in their foreign liabilities after a spike in 2Q20. The foreign debt data for 3Q20 to be released on 13 October should provide more detail on the capital flow structure. The banking data for July-August combined with anecdotal evidence from the media suggest that the local corporates and households did not show any additional demand for FX, acting rather countercyclically to the RUB performance.

- As a side-note, we doubt that the improvement in the capital account is a result of the government's de-offshorization measures as 1) they do not cover the largest publicly-traded companies and 2) the country breakdown of FDI flows suggest that the tax havens targeted by the increased tax rate have been the source of net FDI inflow for Russia. More likely, the slowdown in the international asset accumulation could be a reflection of increased foreign policy risks, weaker exchage rate and generally exhausted capacity for accumulation.

- Flows related to the local state debt (OFZ) was the only obvious item showing deterioration: after assuring net portfolio inflows of US$2.1bn in 2Q20, non-residents were net sellers of OFZ in 3Q20 by US$0.6bn. The sale took place in July and September, with the former correlated with a realization that the scope for further key rate cuts is limited, and the latter caused by higher sanction risk perception following a string of negative foreign policy events, including potitical crisis in Belarus, poisoning of the Russian opposition politician Alexey Navalny, and the increased likelihood of a Democratic victory at the upcoming US elections. The reason why such a small change in the flows could have triggered a noticeable ruble depreciation is that it took place amid the decline in the volume of other balance of payment transactions – confirming the risks of increased dependence of RUB on the volatile portfolio flows we've been highlighting previously.

The good news for the portfolio flows are that 1) currently USDRUB is already pricing increased sanction risk, which seems to have been stabilized for the most part of September; 2) the recent newsflow from the EU suggests that personal sanctions in the Novichok case are more likely than more market-sensitive sectoral sanctions; 3) political think tanks do not seem to believe that a Democratic victory in the US would guarantee a tightening in the Russia sanctions, at least in the near term; 4) the global risk appetite has improved recently on new rounds of fiscal stimulus optimism, prompting expectations of weaker USD globally in 4Q20. Nevertheless, given the renewed fears of the second wave of Covid-19 it remains clear that the near-term volatility is likely to remain high.

Figure 3: RUB to benefit from higher FX sales and possible from lower corporate capital outflows, but portfolio flows remain a swing factor

Figure 4: Current USDRUB rate is already pricing the increase if of the country-specific risks that became evident in 3Q20

Figure 5: De-offshorization unlikely to contribute to capital inflow, as tax havens are already a source of net FDI inflow to Russia

Staying with our USDRUB70-75 expectations for the medium term

Based on the cautious improvement in the key balance of payment items in 3Q20, the expected increase in CBR FX sales in 4Q20, recent stabilisation of RUB's discount to peers and expected global weakness in USD, we remain cautiously optimistic on the RUB in the medium term. We continue to see a return to the USDRUB 70-75 range as a base case scenario. Nevertheless, given the narrowing of both current account and the corporate capital accounts, RUB's vulnerability to portfolio flows – i.e. to various event risks – is a risk factor to our forecast and an argument for high volatility in the coming month.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article