Russia 2018 Balance of Payments: no need to panic about the capital outflow

Russia saw net capital outflows of US$36.5 billion in 4Q18 and US$67.5 billion in 2018, a 4-year high. As the central bank has restarted sterilizing excess current account surplus with FX interventions in 2019, corporates may now lower their appetite for accumulating international assets

| $115bn |

2018 current account surplusincluding $39bn in 4Q18 |

| Better than expected | |

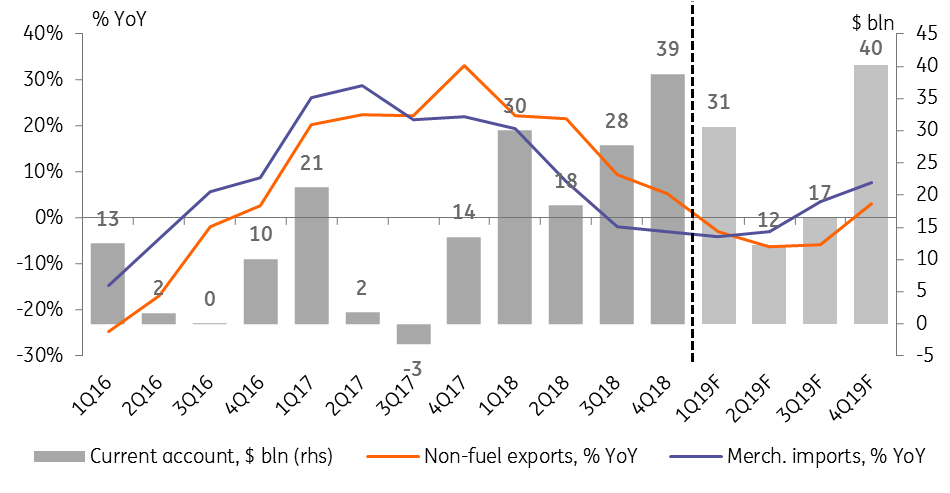

Current account supported by restrained imports on recent RUB depreciation

Despite the drop in oil prices at the end of 2018, Russia managed to post a strong current account surplus of US$39 billion in 4Q18, bringing the full-year figure to US$115 billion, slightly exceeding our US$110 billion expectations. Most of the strong widening in the 2018 surplus vs 2017's modest US$33 billion was driven by fuel exports (up US$68 billion YoY), which benefited from the US$16/bbl increase in the annual average oil price and the possible increase in physical volumes of exports. Non-fuel export growth decelerated from 25% in 2017 to 14% in 2018, still increasing by US$32 billion YoY. At the same time, merchandise import growth decelerated materially from 24% in 2017 to just 5% in 2018 (including a 2-3% YoY drop in 2H18) reacting to RUB depreciation throughout the year.

For this year, under ING's house view on commodities, corresponding to average annual Urals of $67/bbl, and imports still pressured by the recent RUB depreciation and weakening demand, we expect the current account surplus to total US$100 billion, with 1Q19 and 4Q19 being the seasonally strongest with US$31 billion and US$40 billion, respectively.

Key current account parameters

| $67.5bn |

Net private capital outflowincluding $36.5bn in 4Q18 |

| Worse than expected | |

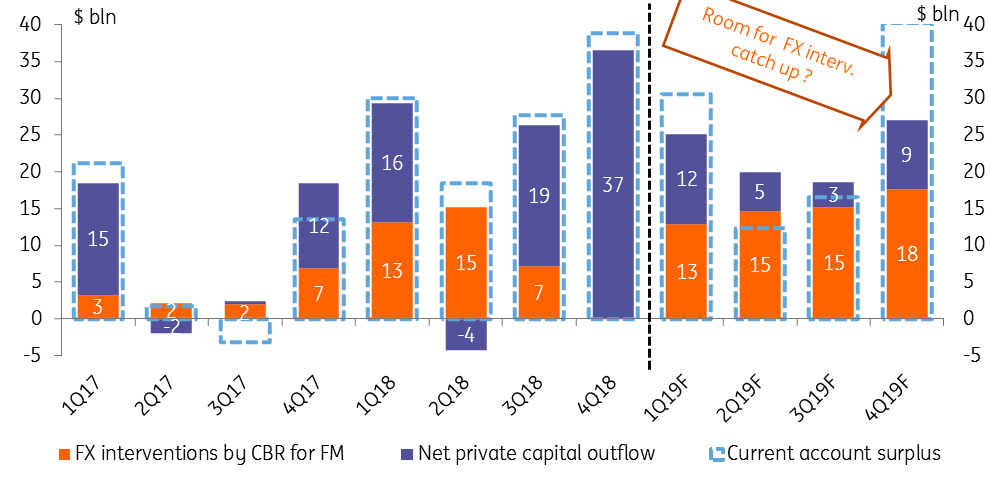

Spike of capital outflow in 4Q18 reflects accumulation of international assets

The reason why RUB did not benefit from the strong current account surplus in 4Q18 and from a halt in the Central Bank of Russia's (CBR's) purchases of FX for the Finance Ministry was a material acceleration in the net private capital outflow to US$36.5 billion, which is the biggest quarterly outflow in 4 years. The resulting annual outflow of US$67.5 billion is also second only to the panic-driven US$152 billion seen in 2014.

While this acceleration is clearly not positive and reflects persistently low demand for capital in the private sector, there are a couple reasons why we are not in a rush to take this spike as a sign of systemically higher nervousness:

- the net private capital outflow in 4Q18 and 2018 still does not exceed the current account surplus as was the case in 2013-14. In fact, taken as a percentage of current account surplus, this year's capital outflow of 59% is the lowest since 2010

- out of the US$36.5 billion outflows seen in 4Q18, US$20.5 billion represent an increase in international assets, which may reflect non-repatriation of export FX revenues during the halt in CBR FX purchases, which were widely seen as temporary. A somewhat similar situation took place in 1Q18, when the entire US$16 billion net outflow was driven by the accumulation of international assets, when FX interventions of US$13 billion were not enough to sterilize a seasonally strong US$30 billion current account surplus

- the government net capital outflow (not included into the private capital flow figure) driven mostly by the portfolio outflows from the local state bonds (OFZ) and indicative of overall mood towards Russia, decelerated from US $7.9 billion in 2Q18, to US$1.3 billion in 3Q18 and US$0.4 billion in 4Q18

Overall, we see net private capital outflow slowing down to around US$30 billion this year, as following the restart of FX interventions there will be less 'excess' FX to place abroad, while the corporate foreign debt redemption scheduled for 2019 is half as large as in 2018.

Utilization of current account

BoP favours RUB depreciation in mid-year and a possible catch-up on FX interventions in 4Q19

For now, we have the following takeaways from the BoP trends:

- Given the seasonally strong current account in 1Q19, the CBR's FX interventions and expected net capital outflow is not large enough to prevent likely RUB appreciation towards our target RUB63-66/$ range in case global EM risk-on continues and there are negative surprises on sanctions

- In 2Q-3Q19 due to a shrinking current account RUB will be the most vulnerable to external negativity, if it arises

- 4Q19 has a potential for a huge US$10-15 billion "excess" current account surplus (ie, even after adjusting for expected private capital outflow and FX interventions attributable to 2019). This might create room for the CBR to start catching up on the US$31 billion in FX purchases postponed from 2018.

- As a result, almost the entire current account surplus will end up being sterilized by capital outflow and FX interventions, keeping global portfolio flows an important variable for RUB. For now, ING's global house view implies global risk-on in the medium term that should result in appreciation of RUB's FX peers by 4% to USD in 2019, which allows us to keep our constructive view on the ruble. However, possible negative surprises related to global growth and geopolitics prevent us from being very bullish either.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RussiaDownload

Download article