Robots extend reach in the food industry

Robot use in food manufacturing is increasing. While robots are more common in the US than in the EU, several EU countries boast the highest levels of robotisation. Better technology, the need to stay competitive and worker safety are driving the shift, with Covid-19 accelerating the process

The rise of robotics in food and beverage manufacturing continues

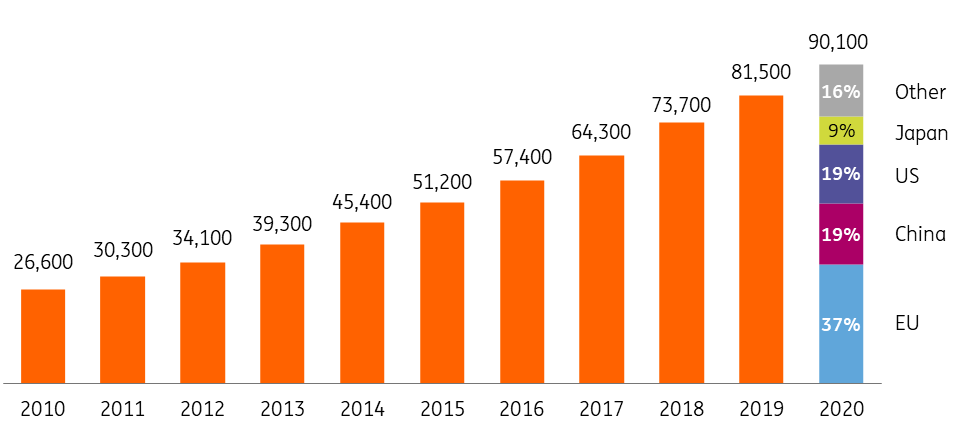

The ongoing process of automation in food and beverage manufacturing is reflected in the steady growth of industrial robots*. The total global operational stock of robots grew by 8.600 in 2020, according to the latest data from the International Federation of Robotics (IFR). As a result of the continuous growth, robot stock has almost doubled since 2014. The majority of newly installed robots among food manufacturers in 2020 was destined for the EU (27%), China (26%) and the US (22%). While robots are becoming more common in food manufacturing, their presence is limited to a minority of businesses with, for example, only one in ten food producers in the EU currently making use of robots.

* An industrial robot is defined as an “automatically controlled, reprogrammable, multipurpose manipulator, programmable in three or more axes, which can be either fixed in place or mobile for use in industrial automation applications.

Global robot stock grows at a steady rate

Operational robot stock in food and beverage manufacturing

The reasons behind the ongoing automation and robotisation in food manufacturing

Covid has fuelled discussions on automation and robotisation. This is especially relevant for activities that have proven hard to automate in the past, like meat processing. But in addition to Covid there are several structural reasons why food and drink manufacturers would consider investing in robots. These can be grouped into three categories with the case for robotisation being especially strong when it serves several goals.

- Cost competitiveness: labour costs are increasing and food manufacturers are struggling with labour availability due to the upturn in the economy and an ageing workforce. Hence automation can help to improve productivity, reduce production cost per unit and make companies less dependent on labour for specific tasks.

- The need to further improve product quality: customers such as retailers are setting stricter product specifications and automated production processes can improve food safety (less contamination) and product consistency.

- The type of work: many jobs in food production take place in cold conditions or involve repetitive tasks and heavy lifting. In these cases, robots can help to improve employee wellbeing and workplace safety.

Labour costs in food manufacturing are increasing*

Unit labour cost, index 2010 = 100

Robot density varies considerably between countries

The general use of robots is an indicator of the level of automation in food production in a country. To compare the level of robotisation, it’s common to look at robot density, which can be expressed by the number of robots per 10,000 employees. Our analysis shows that food manufacturers in the US employed on average 89 robots per 10,000 employees, compared to 75 in the EU-27 in 2020. However, within the EU there are considerable differences between countries with robots being much more common in countries like the Netherlands, Denmark, Sweden and Italy.

US robot density is higher compared to EU, Japan, UK and China…

Robot stock in food & beverage manufacturing per 10,000 employees in 2020

...but robot density in the US is lower compared to some individual EU countries

Robot stock in food & beverage manufacturing per 10,000 employees in 2020

Country differences occur due to labour costs and specialisation

To explain the differences between countries, two variables deserve to be highlighted.

- Firstly, relative labour costs are important. EU data shows that countries with higher labour costs generally also have a higher robot density (see chart). We would expect some differences between states in the US due to variation in labour costs, but because robot data at the state level is lacking it’s not possible to do a more detailed analysis.

- Secondly, the level of specialisation plays a role. Exporters of food products need to be able to offer a better price for their products than foreign competitors (unless they have a premium product like champagne). So among export-oriented dairy producers in the Netherlands or pork producers in Denmark, the need for robotisation is likely to be stronger than for similar companies that mainly serve large domestic markets like the US and Germany.

The Netherlands and Denmark have high labour cost and robot density

Level of labor costs (per full-time equivalent) and robot density (per 10,000 employees) compared to average total labor costs and robot density in food and beverage manufacturing in the EU

Outlook 2025: drivers for robotisation continue to be in place…

According to the IFR, new robot installations across all industries are expected to increase by 6% per year in the coming three years. Improvements in technology create additional opportunities for companies to implement industrial robots, and prices of robot devices have been declining. These trends, and the challenges of rising labour costs and product quality, provide a strong case for the future growth of robots in food production. In the US, more than one in three CEOs of large US food manufacturers indicate they are investing in robotics and artificial intelligence. Industry majors like JBS and Tyson have both invested in robotics firms and companies like Bell & Evans, Swift Prepared Foods and Koch Foods all recently announced investments in new highly automated production plants.

…leading to gradual growth of robot density in the US and EU

The historic growth of both the robot stock and employment in food manufacturing in the US and the EU has been quite steady. This also reflects the nature of the sector as a business where volatility in demand is relatively low and the asset to employee ratio high. In our view, the historic trends for robots and employment offer a good starting point to forecast future robot density. We do expect future growth in the US and the EU to continue to be a gradual process because food production is already largely industrialised. In our forecast, robot density is expected to rise to about 135 per 10,000 employees in the US and to 110 in the EU by 2025. In terms of operational stock, we expect the number of industrial robots in food manufacturing in the US to range between 23,500 and 32,000 and between 45,000 to 55,000 in the EU by 2025.

Robot density in the US expected to grow at a faster rate compared to the EU

Robot stock in food and beverage manufacturing per 10,000 employees

Bigger robot force will be providing a wider range of tasks

It is likely that not only the number but also the diversity of robots in food processing plants will become bigger. In many cases, robots first appeared at the beginning and at the end of the production line, fulfilling fairly simple tasks like (de)palletising packaging material or finished products. Food manufacturers continue to invest in these types of robots, but developments in software, artificial intelligence and sensor- and vision-technology enable robots to perform tasks that are more complex. These tasks can range from performing a specific cut in the meat industry to picking and packing confectionery, and to placing different toppings on fresh pizzas or salads.

Robots do much more than just stack boxes

Examples of robot operations by degree of difficulty and their place in the food production process

Implementation costs remain a challenge…

Automation is more difficult, and thus costlier, when products are less alike. So implementing robotics at a poultry, pork or beef processing facility where the shape and size of every animal is different and each cut needs to be very accurate is likely to be more difficult than at a soft drink bottling plant. Another factor that can add to the cost is the range of products that a company produces. Companies that run a large and diverse range of products on a single production line will face more difficulties to implement robots. This is often the case at producers of fresh and convenience products like fresh meals. While robots can be programmed to perform a variation of tasks, this requires dedicated software and more customisation, and those elements account for the majority of the total cost of installing a robot.

… so food manufacturers will cherry-pick projects

Food producers are seeing more possibilities to use robots along their food production lines. But compared to hiring additional staff, robot projects require large upfront investments to improve margins over time. So food manufacturers will cherry-pick investments that either have a quick payback period or that help to solve the biggest bottlenecks in their production processes. The latter often requires a longer lead time and more intensive collaboration with equipment suppliers. Because of the larger claim on capital, a higher level of automation requires production plants to operate at continuously high capacity to have a healthy return on fixed cost.

Robots are also getting more common elsewhere in the food supply chain

The rise of robotics in the food industry is not limited to the industrial robots in food manufacturing. According to IFR data, more than 7,000 agricultural robots were sold in 2020, an increase of 3% compared to 2019. Within agriculture, milking robots are the biggest category but only a fraction of all cows in the world is milked this way. Furthermore, we see a lot of activity around robots that can harvest fruit or vegetables. For these robots the need to be able to move around freely in an outdoor or greenhouse environment is challenging, as is selecting and picking only the produce that is harvest-ready. But a breakthrough on this would ease the difficulties in attracting seasonal labour. Downstream in the food supply chain, robots are increasingly used in distribution centres such as automated guided vehicles that stack boxes or pallets, and robots that collect groceries for home delivery. Robots are also making an appearance in (fast-food) restaurants to fulfil tasks like taking orders or cooking simple dishes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article