Riksbank preview: Echoing the European Central Bank?

We doubt the Riksbank’s meeting will be quite as exciting as the European Central Bank's last week. But we could still see Swedish policymakers bring forward the date of the first projected rate rise and kick-start balance sheet reduction. This should help the undervalued Swedish krona (SEK) regain some ground

Riksbank to add some hawkishness to its message

Last week’s hawkish antics from the European Central Bank (ECB) make this Thursday’s Riksbank meeting all the more interesting. While in practice Sweden’s central bank is likely to continue positioning itself towards the dovish end of the developed market spectrum, there’s a strong chance policymakers endorse an earlier tightening path this week.

As ever, a lot is going to hinge on the jobs market, and more specifically the next set of wage negotiations due to conclude next spring. These take place every three years, and there’s a growing chance that the next outcome is stronger than the last, which was agreed (belatedly) during the height of the pandemic.

Labour shortages are the most acute since 2018

While the unemployment rate still has a lot of room to come lower, the most recent Economic Tendency survey suggests labour shortages are as acute as they were back when the jobs market cycle last peaked in 2018. Inflation expectations, while not exactly soaring, have also picked up a little over recent months as the headline consumer price index with a fixed interest rate (CPIF) has risen. This is going to be important data to keep an eye on, given Sweden’s comparatively high collective bargaining coverage.

The combination of this, coupled with the more hawkish ECB, suggest Sweden’s central bank could bring forward the date of its first projected rate rise when we get new forecasts this Thursday. We now expect the first repo rate hike from the Riksbank in around a year’s time, roughly coinciding with the first ECB deposit rate rise.

Inflation expectations will be a key input into next year's wage negotiations

Admittedly we highly doubt the central bank will endorse anything as dramatic as that this Thursday. The most recent set of minutes from November’s meeting suggest no member of the committee was in any hurry to hike, and forecasts from that meeting showed no change in the repo rate before late 2024. We suspect policymakers could bring that forward into the first half of 2024 or perhaps even late 2023 in new projections due this week.

Either way, it’s becoming increasingly clear that the central bank plans to shrink the size of its balance sheet – or use quantitative tightening – before hiking rates. At least three committee members saw that process beginning this year, according to those November minutes. Formally the Riksbank had said it planned to keep its bond holdings roughly unchanged in volume through 2022.

However, there’s a decent chance that policymakers decide to scale back the volume of planned reinvestments for the remainder of 2022, which will enable a gradual reduction in the size of the balance sheet (primarily by allowing non-government bonds to roll off).

Foreign exchange: Room for recovery in the krona

While the risk of a first hike in Sweden by the end of 2022 has become more material, the market’s pricing for Riksbank’s tightening (80bp in the next 12 months) appears way too aggressive. From a foreign exchange perspective, however, this is a consideration for the medium term: small hawkish steps by the Riksbank should be enough to keep fuelling expectations on 2022 tightening for now.

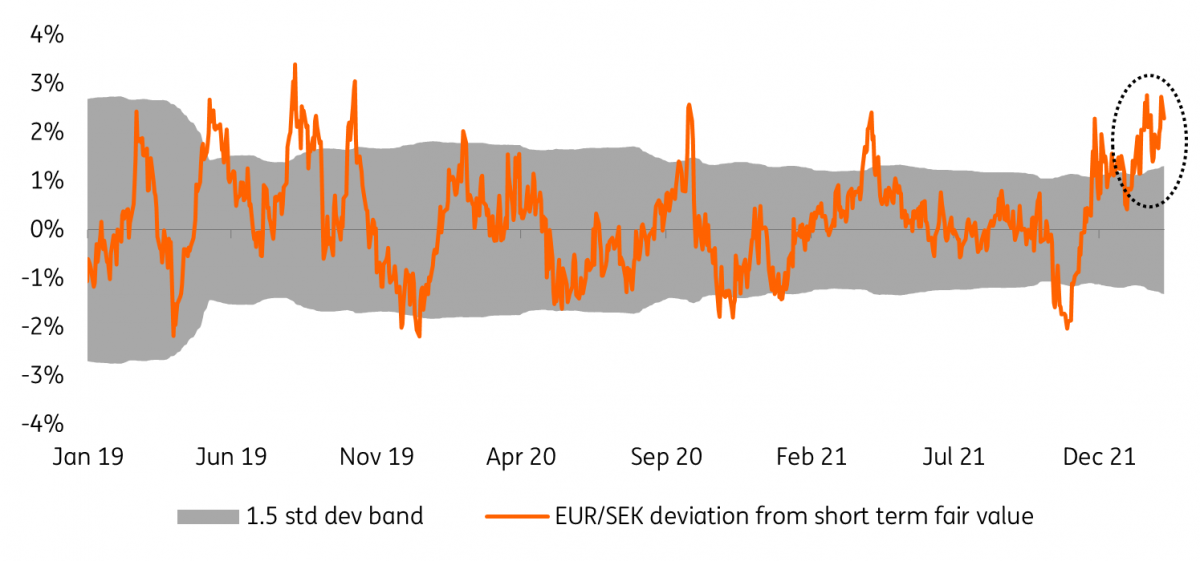

EUR/SEK is currently overvalued in the short term

Accordingly, we see some upside potential for the krona this week as the Riksbank may send implicit or explicit signals it is expecting to tighten earlier than previously expected. We think this should help EUR/SEK initiate a convergence towards its short-term value after a relatively long period of material overvaluation (chart above).

That said, we think that some residual overvaluation remains warranted due to the underperformance of US tech stocks (to which SEK has a high sensitivity) and geopolitical tensions affecting Europe.

EUR/SEK could re-test last week’s lows (10.36) after the Riskbank’s meeting this week, but we expect to see a return to the 10.20-25 region only towards the end of this quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article