Riksbank preview: A hawkish 50bp hike to support the krona

Sweden’s economic outlook remains challenging, but core inflation is too high and the Riksbank looks determined to support the krona. We expect a 50bp hike next Wednesday and a signal that rates could peak near 4%. This can help the krona, though short-term headwinds remain out of the Riksbank’s control

The wage bullet was dodged, but core inflation is too high

The big news since Sweden’s Riksbank last met in early February is that the long-awaited wage negotiations have resulted in a deal which is generally being viewed as good news for the central bank. A two-year pay deal of 7.4% – while higher than the last settlement agreed a few years ago – suggests the risk of a wage-price spiral is minimal. Headline inflation will almost certainly be lower when the next deal is negotiated.

On paper, the latest inflation data was also welcome news, in that annual CPIF slipped back to 8% in March, some way below December’s 10.2% peak. But the reality is that core inflation is still well above the Riksbank’s February forecast – too high for comfort, and points to another 50bp rate hike this month.

That’s despite the activity data looking bleak. February’s monthly GDP held up, but the fourth quarter of last year looked dreadful and real wages remain under pressure.

Core inflation remains well above the Riksbank’s February projection

Housing concerns linger, despite some tentative stabilisation

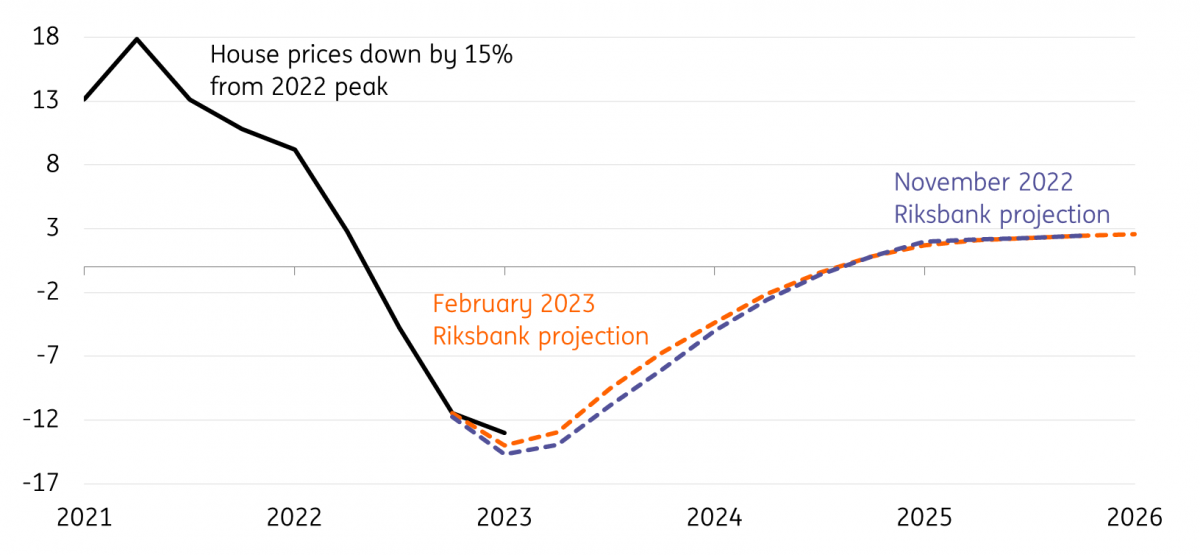

The housing market is also a key concern. More than 60% of Swedish households hold mortgages expiring within one year or less, and house prices are down roughly 15% from the 2022 peak. March data show the first signs of tentative stability, with apartment prices rising for the first time in a year, but it’s too early to say the market has reached a trough.

House price growth in Sweden

Riksbank still sounding hawkish, mostly to help SEK

Even if a concerning backdrop for the housing market and the broader economy points to a more cautious approach to tightening, Governor Erik Thedéen has been resolutely hawkish since taking office earlier this year. He highlighted in February that despite recognising Sweden is indeed “interest rate sensitive”, the consequence of “entrenched inflation” would be even more costly.

Part of this hawkish narrative is undoubtedly linked to the currency. Recent Riksbank comments have signalled unease with krona weakness, which is close to post-global financial crisis lows on a trade-weighted basis.

We’re therefore expecting a 50bp hike next week, and we think the updated rate projections could go beyond what markets are pricing and signal a peak rate of roughly 4%, up from just below 3.5% last time. Remember that the Riksbank meets only five times a year, much less than other central banks, and has to make each meeting count. Policymakers have emphasised in the past that staying out in front of the European Central Bank is a priority.

In practice though, taking rates that high could prove challenging given the economic and housing backdrop, and we’d argue that even another 25bp hike in June is not guaranteed (though it’s our base case for now). There has been some public debate about a potential Riksbank FX intervention, though for now we think it’s unlikely. It would be a high-risk move, but policymakers may not completely rule it out. Ultimately, an implicit threat of interventions may help support the krona.

Riksbank interest rate projections and our forecast

The impact on SEK can be positive, but market factors remain dominant

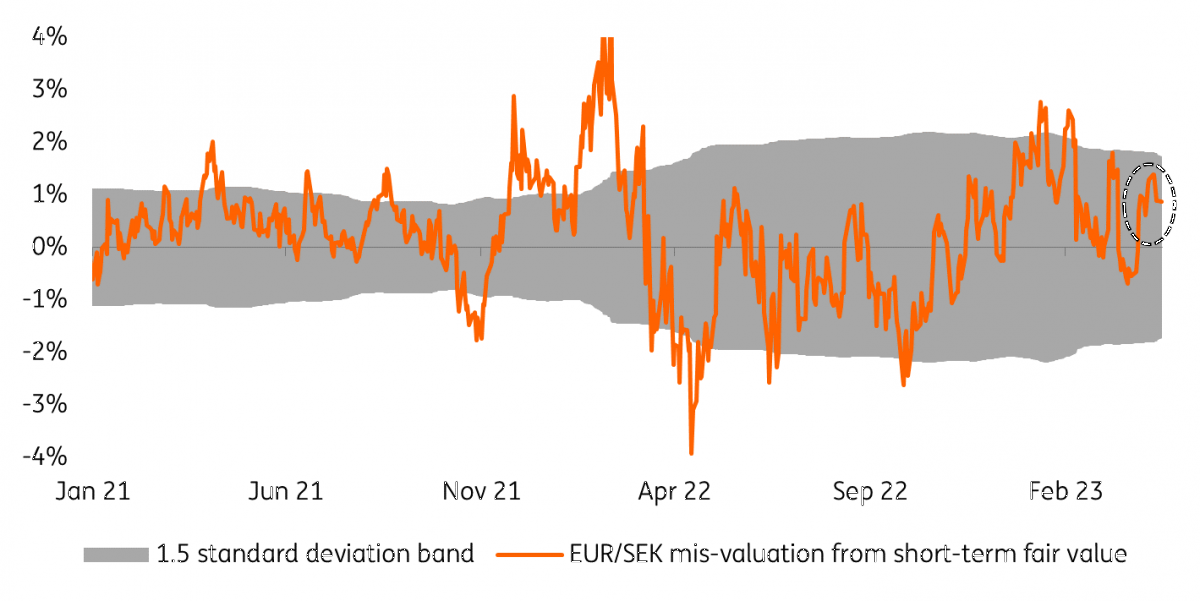

The key question is: will a hawkish surprise or at least a reiteration of a hawkish stance be enough to either lift or at least prevent the krona from slumping further? One important point about SEK is that it no longer embeds the amount of idiosyncratic risk related to the domestic economy it did back in February. This is demonstrated by our EUR/SEK short-term fair value model, which no longer shows pronounced overvaluation (I.e. risk-premium related to Swedish economic concerns). This means two things: first, that the Riksbank’s hawkishness has helped re-establish some confidence in the krona, and second, that the recent SEK weakness is primarily due to market dynamics – not least, EUR strength.

EUR/SEK no longer overvalued

Ultimately, the Riksbank can have a positive impact on the krona by sounding hawkish, and we think that the balance of risk is tilted to the downside for EUR/SEK next week. Still, a sustained improvement in global risk sentiment and an easing in idiosyncratic appreciating EUR pressure are necessary conditions for SEK to enter a more sustainable upward trend, especially considering how much risk premium can be built back into the krona in relation to Swedish economic troubles.

All in all, we still think that the path for a krona recovery in 2023 will be a narrow one, but 75bp of extra tightening and a hawkish (currency-oriented) stance by the Riksbank, paired with Europe’s good economic performance (to which SEK has a high-beta), can favour a sustainable return to sub-11.00 levels in EUR/SEK in the second half of the year. We target 10.75 as the year-end value.

In the shorter run, ongoing tightening by the US Federal Reserve and the residual effects of the banking crisis could still weigh on sentiment and offer support to EUR/SEK around 11.20/11.30, with spikes to 11.50 possible in periods of risk aversion and/or resurging risk premium on the krona.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article