Why we’re revising our yuan forecast down again

We are revising our USD/CNY forecast to 7.0 by the end of 2018. But there's no panic in the market and we don't expect a repeat of August 2015

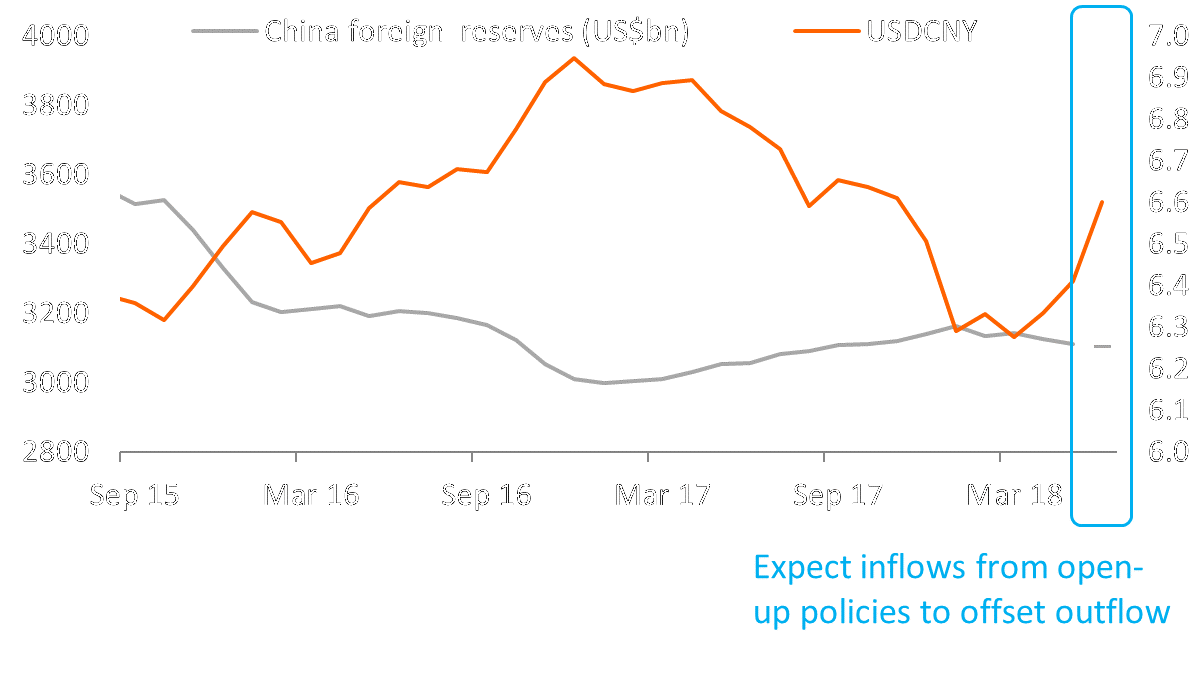

Policies could attract foreign investments, reduce outflow worries

Our previous argument for a slight yuan depreciation was based on the concern that a weaker yuan could lead to massive capital outflows, which would then push the yuan down even further, resulting in a vicious cycle.

But new policies to open up the market for foreign investments reduce the risk of outflows. These policies could also help to offset any outflows that do occur as a result of the weaker yuan.

New policies cover a whole range of sectors including agriculture, rare earth, automobiles, shipbuilding, aviation, railway, shipping services, surveying and financial services. The scope is not only larger than expected, it targets sectors affected by tariffs. Foreign companies facing tariff risks could move production to China to avoid tariff hurdles.

These measures, together with potential inflows from more A-share inclusion into MSCI and China Depository Receipts (CDR) in 2H18, have led us to reassess our outlook for capital outflows. We were overly pessimistic.

Limiting offshore dollar bond issuance signals further yuan weakening

It is reported in the media that China is going to restrict offshore dollar bond issuance to no less than 365 days. The objective is to reduce repayment risks as the yuan weakens against the dollar over 12 months' time.

We see this as a signal that the central government is increasingly prepared for a weaker yuan.

Foreign reserves may fall only mildly even as yuan depreciation speeds up

Reintroducing counter-cyclical factor only if market panics

The central bank may reintroduce the counter-cyclical factor in the currency's fixing formula only if onshore and offshore yuan intraday activities signal panic in the market. The counter-cyclical factor would limit the volatility of the yuan at the start of the day. After the reintroduction of the counter-cyclical factor, intervention via the derivative market or the spot market would be likely to avoid further yuan depreciation.

The yuan is the only a shield in a trade war

Yuan depreciation can't be described as a weapon in a US-led trade war, even if the currency were to fall by more than 7% per year.

Tariffs of 10% to 25% on $450 billion of Chinese goods have a larger impact than just the tariff amount itself. They would reduce trade flows overall. Exporters wouldn't just see a 'mere' 10% to 25% reduction in profit margins, they could miss an entire export order.

A weaker currency would, at most, be a shield, safeguarding wider damage from a trade war and the hurdles faced by Chinese companies' operating in US.

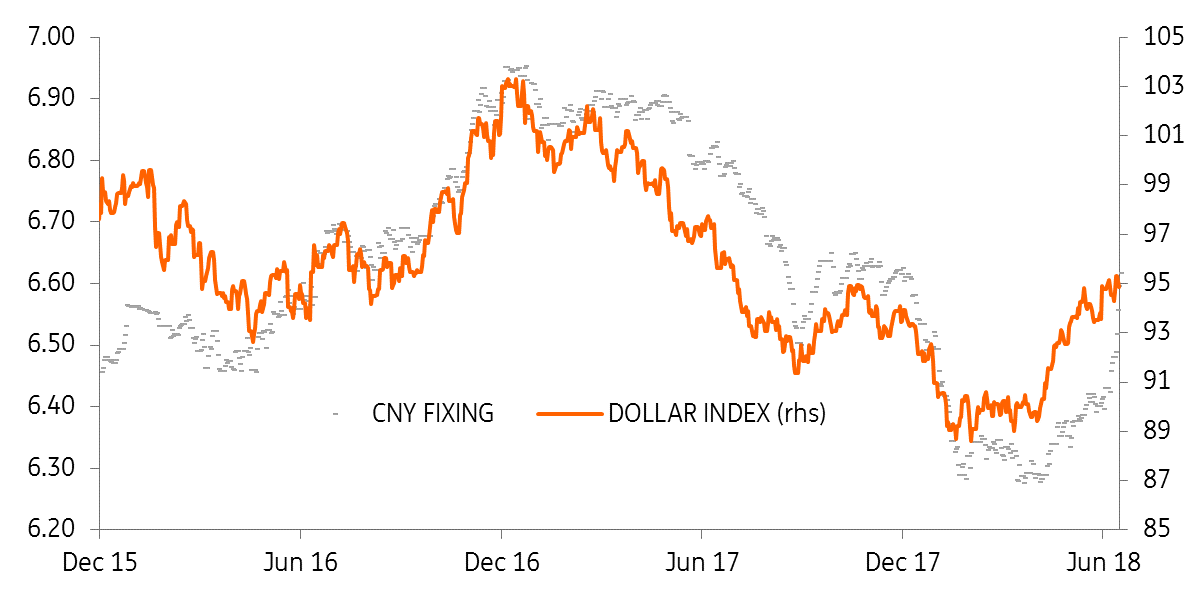

Yuan fixing and dollar index

Forecasting USD/CNY at 7.0

We are revising our USD/CNY forecast from 6.60 to 7.0 by the end of 2018, which is near a historical high since reform. The central bank's attempt to liberalise the yuan on 11 August 2015 drove USD/CNY to 6.9649 in 4Q 2016.

We think that this time USD/CNY at 7.0 won't create panic:

- 11 August 2015 was a crisis caused by the central bank. Today's depreciation is market-driven, reflecting the risks of a trade war. This implies that the central bank is allowing market forces to dictate the speed of the depreciation when there is room to do so.

- Since the escalation of a trade war and announced investment hurdles, China has allowed the yuan to weaken against the dollar, even when the dollar index itself has weakened. This confirms our view that yuan weakness reflects trade war risks.

- We hesitate to predict that the USD/CNY will surpass 7.0 because that could lead to market panic.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 June 2018

Good MornING Asia - 2 July 2018 This bundle contains 4 Articles