Why we’re forecasting the yuan to depreciate

Even though concerns about depleting foreign exchange reserves could limit the extent of yuan weakening, a depreciation trend is more likely than before. That's why we're changing our USD/CNY forecast to 6.60 for 2018 from appreciation to depreciation

Why China will be more willing to take advantage of a stronger dollar

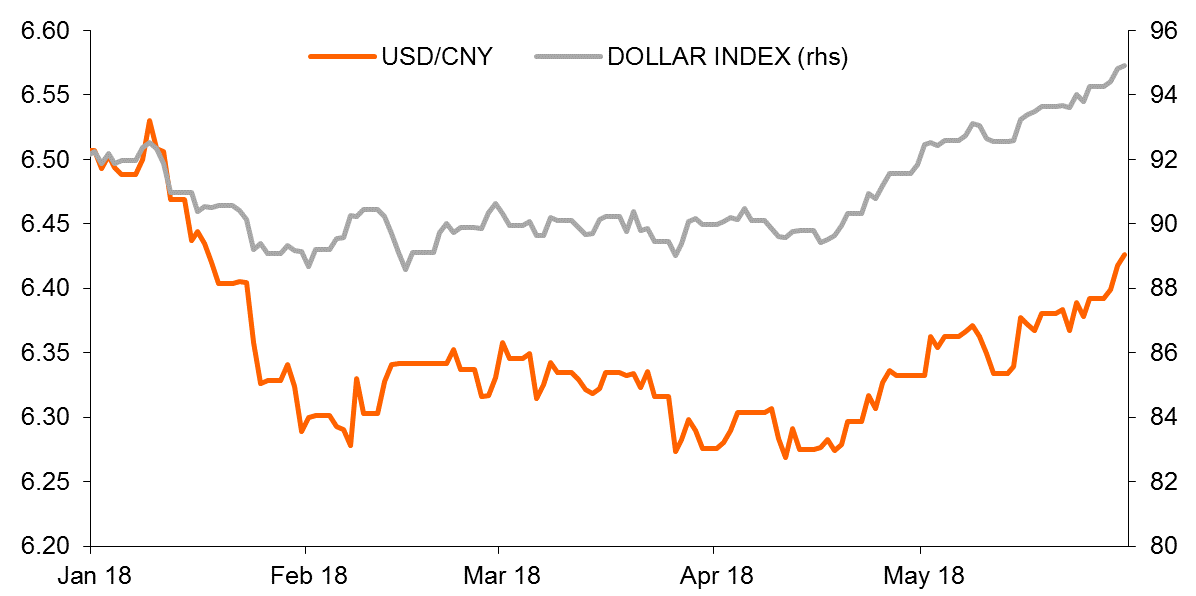

Trade war escalations between China and the US along with rising political risks in Italy and Spain have formed a strong dollar trend, and this is the key reason why we're revising our yuan forecast.

A strong dollar is likely to create headaches for the US administration as this won't help narrow its trade deficit with China. As the greenback strengthens against most major currencies, China should be willing to allow a weaker yuan as it sends a signal to the US that the exchange rate movements are largely a result of a steep dollar rather than any manipulation by China.

In other words, this means China is being passive ending up with a weaker yuan against the dollar. This passive influence by the strong dollar makes us think a slight depreciation of the yuan against the dollar is more likely than we previously believed, even though we thought this was unlikely.

But the central bank won't want capital outflows

But a steep yuan depreciation is not our call.

The dollar index has strengthened more than 1.7% year to date, and the yuan against the dollar has also appreciated by around 1.2% which implies that the yuan still has some room to weaken, especially if the dollar keeps strengthening.

The contradictory movements of appreciation of both the dollar index and the yuan at the same time show the Chinese central bank is unlikely to allow a longstanding yuan depreciation against the dollar. The People's Bank of China (PBoC) will try to prevent the yuan weakening to a level that attracts massive capital outflows and lead to depletion of foreign exchange reserves. It probably wants to avoid a repeat of mid-2014 and 2016 when reserves fell too quickly.

We think if foreign exchange reserves fall below the $2.5trillion level, the weakening yuan will start to stabilise to avoid further capital outflows.

Yuan still appreciating against the dollar YTD even though the dollar has been stronger

Capital inflows are coming but might not be enough to offset outflows

The central bank could get some capital inflows from China's open-up policy in the financial sector and A shares' inclusion into MSCI. These would offset some of the value effects on China's foreign exchange reserves from a strong dollar (i.e. non-dollar asset values come down in dollar terms).

Another way to avoid capital outflows would be to increase interest rates in China to widen the interest rate gap between China and the US. Currently, interest rate spreads have narrowed, which triggers a capital outflow worries.

To reverse the recent trend and increase interest rate spread, China needs to tighten liquidity further and/or raise the 7D policy rate by more than five basis points each time when it follows the Fed's hike. However, by doing so, the interest costs will increase in China. The central bank may be hesitant to do this now as there are increasing default risks from local government related credits, and the timing is nearer to half-year end when liquidity is usually tighter.

In short, creating a wider interest rate spread between China and the US by the Chinese central bank is quite unlikely, at least for now. This makes attracting capital inflows and retaining potential outflows more difficult.

It is also likely that the capital control regulator, SAFE, may start to slow down outflows via administrative measures. This was the main tool used in 2016 and could again be a handy tool now.

Yuan and capital flows are intertwined

Revising yuan forecast

Considering all these factors, we revise our USD/CNY forecasts to 6.60 from 6.33 for 2018. In other words, we expect 1.5% yuan depreciation against the dollar in 2018.

Between now and the end of 2018, there are chances that the dollar strengthens very quickly, which could originate from escalating risks in Europe and USD/CNY could surpass our year-end forecast.

However, we expect that rapid capital outflows (even with administrative measures in place, similar to the scenario in 2016) would then begin, and could trigger falling foreign exchange reserves to the $2.5 trillion level. By then the central bank is likely to stabilise the yuan to stop foreign reserves from continuously falling. So the chance of USD/CNY surpassing 6.60 for a prolonged period is quite small.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 May 2018

In case you missed it: Brave new world This bundle contains 7 Articles