Hong Kong: Cutting GDP forecast on trade war woes

Hong Kong GDP growth in 2Q was weaker than expected, which could be an early sign of the negative impact from the bilateral trade war between Mainland China and the US. The linked exchange rate system adds further pressure and the government must spend its big fiscal surplus to cushion the impact

GDP grew 3.5% YoY in 2Q18, as expected

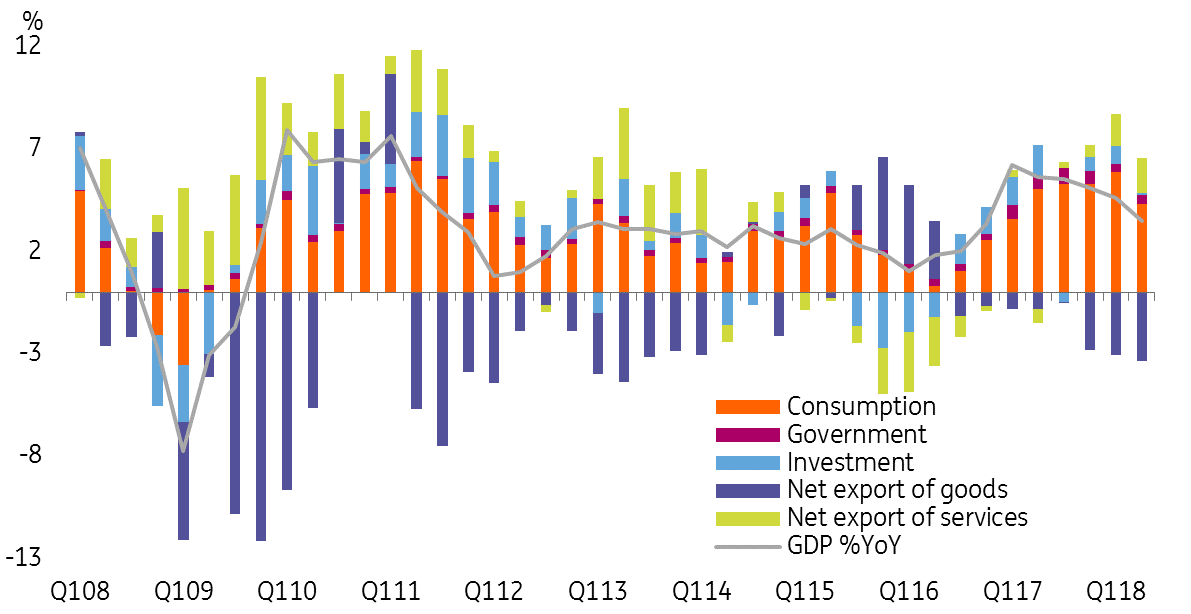

The moderate but slower than expected growth in 2Q18, at 3.5% YoY in 2Q from 4.6% in 1Q, mainly came from consumption, which contributed 4.3 percentage points to growth- offset by the net trade deficit.

Investment was weak, growing only 0.4% YoY, indicating that high house prices have deterred further real estate development.

Consumption continued to be the main growth driver

Future growth could be weaker amid trade war

Over 50% of trade in Hong Kong is related to Mainland China so a bilateral trade war between China and the US will negatively affect Hong Kong's trade, logistics and ports.

From the Statistics Department of Hong Kong, employment in trade and logistics was near 20% of total employment in 2016. Even accounting for a slowdown in the sector, as competition from the Mainland has been fierce, we believe that the proportion is still at least 15%. These workers face the possibility of lower salaries or even losing their jobs. And while the overall labour market is currently solid, with unemployment at 2.8%, employees in this sector could turn to low skilled work, which would put at risk the salary trend of low-income labour.

This, in turn, could reduce consumption demand, which has been the main growth driver of the economy.

Over 50% of Hong Kong exports shipped to Mainland

Linked exchange rate means interest rates go up even in bad times

In the face of an expected economic downturn, monetary policy will be ineffective because:

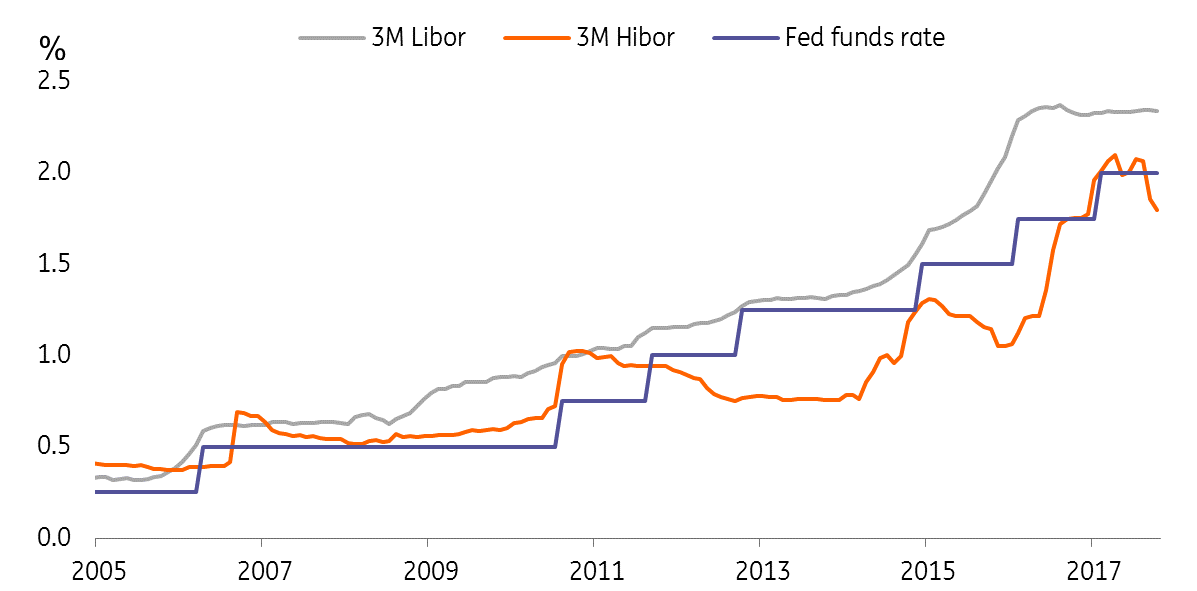

- Hong Kong does not have its own independence to drive interest rates lower. Quite the reverse, interest rates will go up in order to align with US dollar rates, under the linked rate system. Recently, more banks have revised their lending rates upward.

- The HK dollar is already near its weak bound of 7.85, it can't be weaker, so the exchange rate couldn't help the economy.

The linked exchange rate system delivers a sucker punch to Hong Kong in the Mainland China-US bilateral trade war.

HIBOR would follow the next Fed hike

Risks rising

Risks from the linked exchange rate system could emerge in the fourth quarter when the trade war escalates further with tariffs on another $200 billion of goods.

We can think of at least two areas of the economy that will be hurt:

- The business sector. A high lending rate would deter investment for future growth and increase the existing interest cost of businesses.

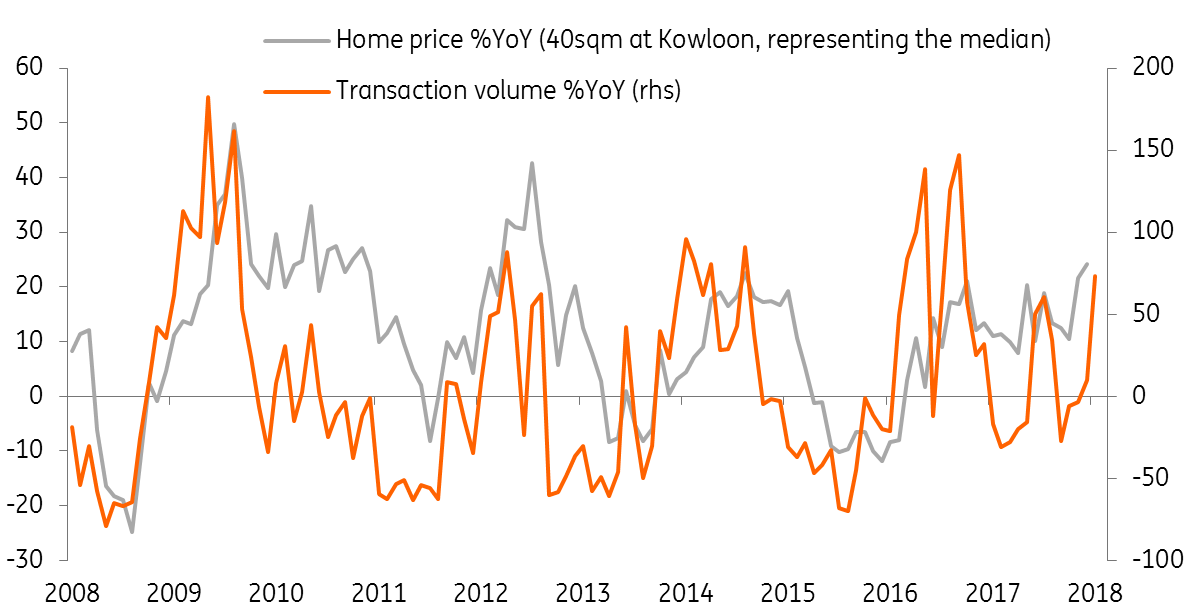

- The housing sector, which has been booming partly due to the low interest rate environment. The regulatory maximum debt-income ratio is 50%. But when interest rates go up and the economy weakens, incomes can fall and unemployment can rise. Monthly repayments could also rise with interest rates and the debt-income ratio at the loan's inception would mask the risk of repayment difficulty or even default. Though we don't expect a housing market crash now, it is increasingly possible in one to two years' time when the job market deteriorates from a trade war.

Housing boom is a hidden risk

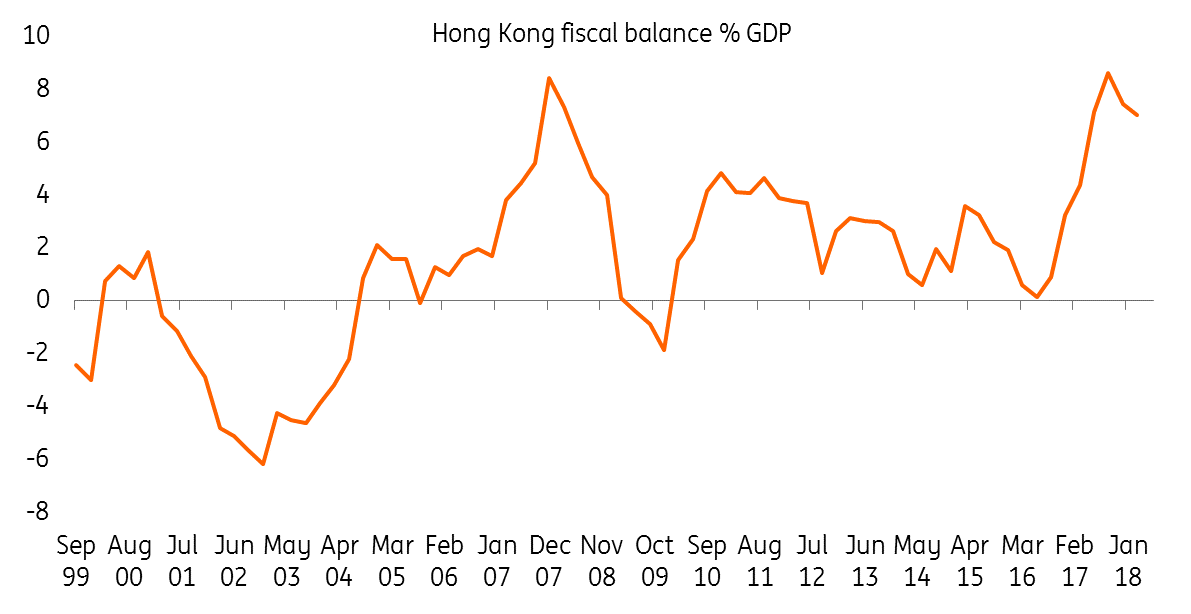

Fiscal stimulus could be big, as surplus near historical high

The good news is that the fiscal surplus is significant, at 7.05% of GDP in 1Q18. History tells us that the government could use this surplus to boost the economy during bad times. We think this time will be no different.

We expect a tax cut on salary earners and corporates and cash handouts to residents. This could alleviate the fall in consumption. We also believe that the government could emulate the Mainland's strategy of boosting investments on infrastructure projects.

Fiscal stimulus to cushion downturn

Revising downward GDP forecast for 2018

We are revising our GDP forecast downward to 3.6% in 2018 from 4.9% due to the escalating China-US trade war and weaker than expected 2Q growth. The linked exchange rate system could bring higher interest rates even during bad times, though we expect the government to use aggressive fiscal stimulus to offset part of the damage.

Download

Download article

10 August 2018

Good MornING Asia - 13 August 2018 This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).