Revising down our China GDP forecast

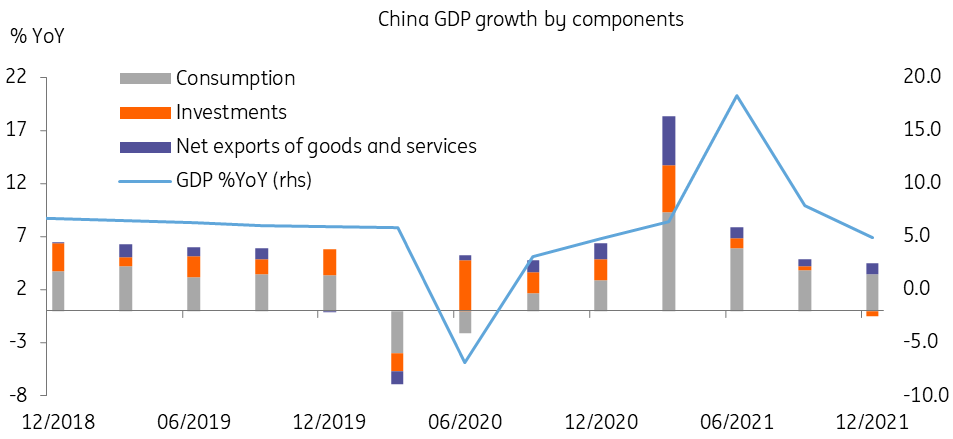

We are revising down China's GDP forecast as monetary and fiscal policy is insufficient to make up for shortfalls elsewhere - consumption is lacking a growth driver

How's the Chinese economy doing?

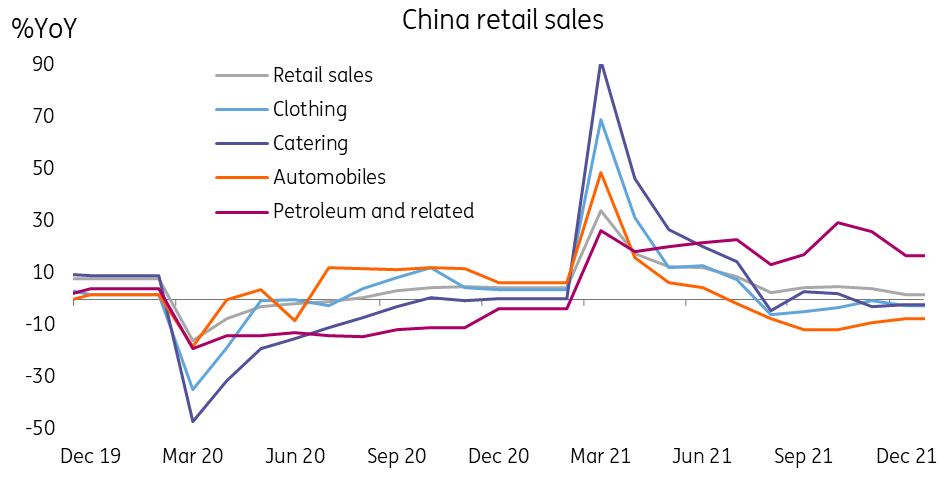

China has been proud of its attempt to successfully reform into a more consumption-based economy. But consumption is currently rising very slowly, growing only 1.7% year-on-year in December. In contrast, fixed asset investment grew 4.9% year-to-date YoY, and production grew 4.3% YoY in December.

Industrial production is somewhat difficult to control given that it is partly affected by export demand. But domestic demand for production comes from consumption and investment, which can be affected by government policy.

Consumption growth is very flat, which could be a sign that jobs and wages have not grown fast enough to trigger more consumption.

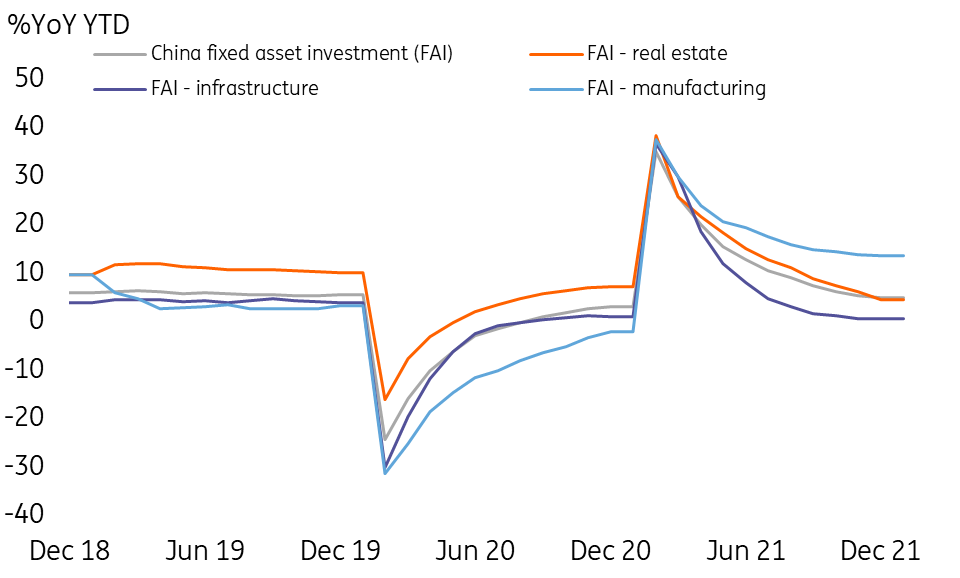

Among investment, consumption and production, investment growth has been the strongest, but it is still very slow by Chinese standards, which usually sees growth in the mid-teens. This part of the economy has been affected by the deleveraging of the real estate sector. Local government officials have been busy restructuring their own real estate market policies, and infrastructure investment plans have been left behind.

China GDP by components

China retail sales

Monetary policy isn't really proactive

The market has been expecting the People's Bank of China (PBoC) to boost economic growth as it has said that it will take a proactive approach to monetary policy. But the PBoC did not cut rates in February even though bond defaults are on the rise again after the Chinese New Year holidays.

This rise in default rates could result in increases in credit costs in the bond market, which will feed back to the loans market. If the PBoC continues to stay on the sidelines for another month because they want to see the effects of earlier policy changes, they will leave themselves behind the curve, which is not ideal for the current economic situation.

In March, we believe the PBoC will deliver a 5bp to 10 bp cut in the 7D reverse repo, Medium Term Lending Facility rate (MLF), and 1Y Loan Prime Rate (LPR). But there could be no, or only a tiny change to the 5Y Loan Prime Rate. The market would like to see the curve remaining steep, rather than flattening.

The central government is responding with fiscal policy but local governments are not

Infrastructure investment will be the main growth engine for 2022 as consumption is not going to grow quickly whilst social distancing measures remain in place.

The central government delivered a pre-approved amount of CNY1.46 trillion of special bonds for local governments so that infrastructure investment can kickstart the economy from January 2022 and after the Chinese New Year.

This is a pre-approved limit that the local governments can use before a complete set of fiscal spending is approved for each of them. Unfortunately, we have not yet seen any infrastructure investment so far. If local governments do not act with the same sense of urgency as the central government, the pre-approved limits are worth little for the economy.

Infrastructure investment is growing too slowly

Revising our GDP forecast

We will soon see a set of economic targets from the government work report in the "Two Sessions" meetings, which will offer guidance for local government officials. Those responsive actions usually take around three months to become economic reality.

Consequently, we are now revising our GDP forecast for China in 2022 to 4.8% from 5.4%.

This revision is based on the assumption that infrastructure investment could drive economic growth in 2Q to 4Q, with jobs, wages and consumption all benefiting from economic growth by the fourth quarter. Inflation is not a concern for China as CPI was only 0.9% YoY in January. The PBoC can therefore keep cutting the 7D reverse repo and 1Y MLF for a total of about 60bp during 2022, and we expect these cuts to be front-loaded in 1Q to 3Q. We also expect some targeted RRR cuts to support SMEs. In this calculation,,we have not included any significant escalation of trade tensions between China and the US, which means that even these revised figures could prove too optimistic.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article