Residential real estate market cools in the eurozone

House price growth was quite strong in many eurozone countries in 2018. For this year and next, we forecast that growth rates will ease in most countries

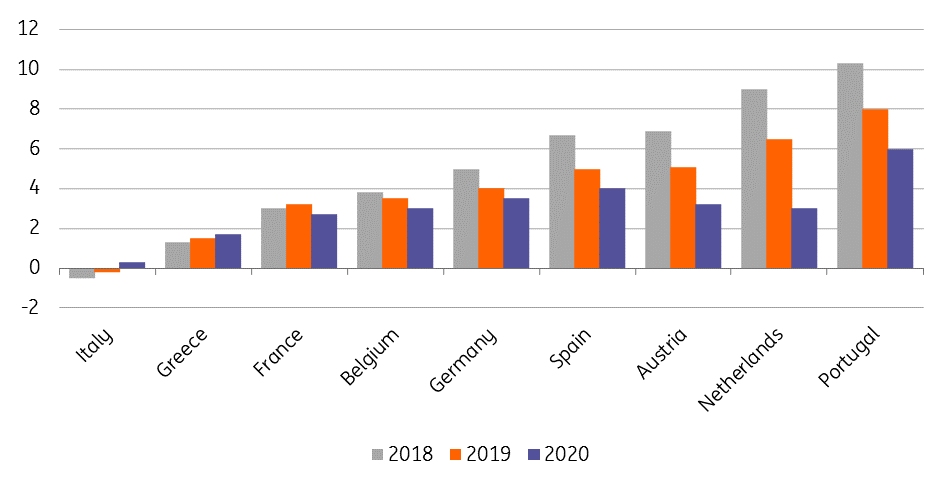

ING house price growth forecasts

Germany

German property prices and rents have been on the rise for a number of years now. House prices, as measured by the House Price Index (HPI) from Destatis, rose by 5% in 2018 compared to the year before. Since 2013, house prices have increased by almost 30%. Individual cities have seen much bigger price jumps. The sharpest price increases were recorded in Stuttgart, Munich, Berlin and Frankfurt.

Despite the price increases, loan-to-value ratio levels remain relatively well-behaved, suggesting that there still is room for prices to rise and the risks of a textbook bubble are limited. At the same time, recent political developments in the Berlin real estate market show that rents have become unaffordable for parts of the population. Caps on rent or new construction of social housing could dampen price increases.

France

In France, real estate prices continued to grow in 2018 at the same pace as in 2017 (3%). Existing house prices were still growing at 2.9% in the first quarter of the year. Outside Paris, prices have been growing at a steady 2.5% in the last two years while Paris has shown a deceleration since 4Q17, with prices slowing down from 4.7% to 3.9% YoY since then. On average, nominal prices are only 17.8% higher than 10 years ago, which shows a rather tepid catch up, especially outside the largest urban zones. Low interest rates are supporting prices, but not as much as one might have expected from a 150bp mortgage interest rate drop since 2015. In the new building market, household investments are still 10% below their 2008 levels and existing housing still lacks dynamism in the country as a whole. After rising by an estimated 3% in 2019, we think price growth could decelerate in 2020 and 2021 along with the economic downturn while remaining well above the rate of inflation.

Italy

A deceleration in the pace of economic growth is taking a toll on house prices. But very favourable market conditions- as confirmed by low price-to-rent and price-to-income ratios- continue to make the purchase option attractive, fuelling transactions. In 1Q19, house transactions grew at a 9.6% YoY pace (up from 8.1% in 4Q18). Given the high percentage of purchases funded via mortgages, credit availability remains a key determinant of market developments. Recent evidence from the BoI Bank Lending Survey points to the first tentative sign of tighter conditions: this bears attention, given the uncertain macroeconomic backdrop. The May 2019 BoI-Tecnoborsa survey signals an increasing share of real estate agents expecting prices to stabilise, while that of those expecting prices to rise remains stable. Declining selling times and average final discounts offered by sellers on the original price, in principle, suggest that excess supply might now start to clear but not enough to push average 2019 house price inflation back into positive territory.

Spain

The housing market was strong again in 2018, with price growth of 6.7% compared to 6.2% in 2017. Slower economic growth did not seem to have a negative impact on house price growth. According to the Spanish National Bank, the weighted average of mortgage rates continues to hover around 2.6%. The average term of new mortgages, however, increased again in 2018 (to 283 months, from 277 in 2017 and 280 in 2018), according to the European Mortgage Association. This helped to support the purchasing power of consumers. For 2019 and 2020, we think growth in house prices will ease and forecast 5% growth in 2019 and 4% in 2020.

Netherlands

We expect home sales to continue to decline, with a total of 210,000 sales in 2019 and 195,000 in 2020 (2018: 218,000). During the first quarter of 2019, home sales declined by 9.0% compared to the year before. The sales drop is partly due to continuing price increases, which are eroding affordability. At the same time, the catch-up effect of households that postponed moving plans during the crisis and have pushed up housing transactions since 2013 is now marginal. In addition, confidence in the housing market (the home owners confidence index as measured by the Homeowners’ Association VEH, and the Delft University of Technology) is decreasing and turned negative for the first time in four-and-a-half years this year. In this light, it is not surprising that house price increases are flattening compared to 2018 (when prices increased by 9.0% on average). For 2019 and 2020, we expect average price increases of 6.5% and 3.0%, respectively. Upward price pressure is expected to persist due to the tightness of the housing market. The construction of new-build homes in the next couple of years will not be sufficient to change this tightness in the housing market, in our view. Low mortgage rates and increasing household income leave room for further price increases.

Belgium

House prices grew by 3.6% in 2018. Relatively good activity figures and low interest rates will continue to support the real estate market in the coming quarters. Recent high frequency data for the first quarter of 2019 supports this thesis. Belgium's central bank, however, estimates that residential house prices are about 6% overvalued and is also concerned about rising private debt levels. New macroprudential measures are therefore a possibility. We forecast growth of 3.5% and 3.0% in 2019 and 2020, respectively.

Austria

Domestic demand and demand for gross fixed capital investment remain Austria’s economic growth drivers, with construction investment providing a particularly positive impetus. However, vigorous building activity and excessive demand has caused prices to rise, with residential property price increases being more pronounced in 2018 than in 2017 (+6.9% compared to 3.8%). Construction has become significantly more expensive, not only in 2018, but also in the first quarter of 2019, indicating that residential property prices remain at elevated levels for the time being. Yet, with building permits declining by 14% in 2018, there should be a gradual phase-out of construction activity and prices in the medium term.

Portugal

Portuguese residential real estate grew by 10.3% in 2018, which is even higher than the 9.2% growth in 2017. Strong macroeconomic conditions coupled with foreign demand underpin these strong growth figures. We expect strong price growth to continue, but at a slightly lower pace. We are looking for house prices to grow by 8% in 2019 and 6% in 2020.

Greece

The economic recovery, which has accompanied Greece's exit from its third ESM programme, is still in place, although the rate of growth is decelerating. Over 1Q19, employment expanded by 2.2% YoY, further fuelling consumer confidence gains. Non-performing loan disposal initiatives from the main systemic banks should, in principle, help to improve lending conditions, but so far this has failed to show up in lending data: lending for house purchases was still contracting at a 3.9% YoY clip in April 2019. The reduction in the ANFIA taxation on real estate assets included in the 2019 budget remains a market positive, though. Even though external factors pose a downside risk to GDP growth, we still expect last year's recovery in Greek house prices to continue at a slightly quicker pace in 2019.

This article is taken from the Eurozone Quarterly, which you can find here

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 June 2019

ING’s Eurozone Quarterly: Avoiding a more serious slowdown This bundle contains 13 Articles