Reserve Bank of India accelerates policy easing in another off-cycle move

We think the Reserve Bank of India's latest rate cut will reignite pressure on the Indian rupee and drive the USD/INR exchange rate towards 79 over the next three months

| 4.0% |

RBI repurchase rateAfter 40 basis point cut today |

A 40 basis point cut to benchmark rates

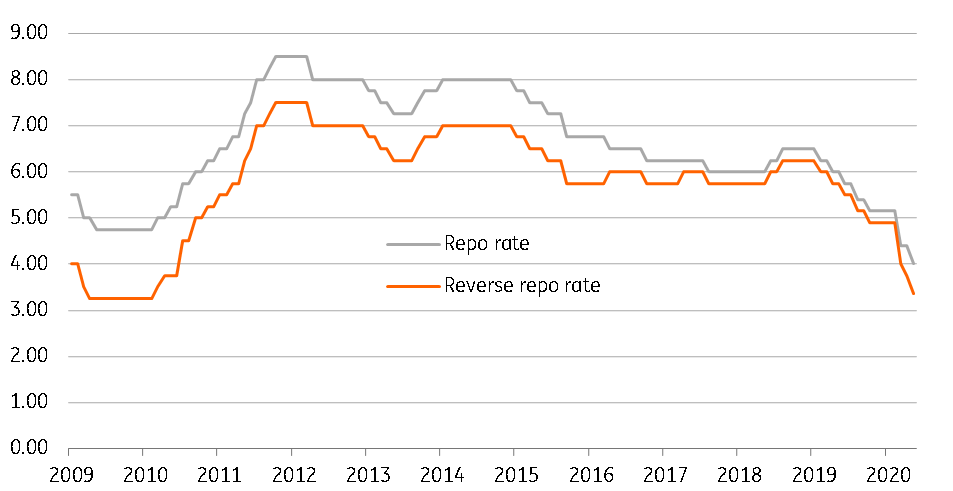

In an unscheduled policy announcement today, the Reserve Bank of India (RBI) decided to cut the benchmark policy rate by another 40 basis points, bringing the repurchase rate to an all-time low of 4.00% and the reverse repo rate to 3.35%, just shy of the previous low of 3.25% reached during the 2009 global financial crisis. It was a unanimous decision by all six Monetary Policy Committee members, though one opted for a smaller 25bp cut.

Today’s rate cut follows a 75bp cut in the repo rate (90bp in reverse repo rate cut) in an unscheduled meeting in late March, followed by another 25bp reverse repo rate cut (no change to repo rate) in mid-April. All this was in addition to liquidity support measures worth 3.2% of GDP unveiled by the central bank since March, including targeted long-term repo operations (TLTRO).

The announcement also included a further extension of liquidity support measures already in place, including the extension of a 3-month loan moratorium by another three months, an easing of pre and post-shipment export credit rules with an increase in the credit period to 15 months from one year and INR 150 billion credit line to EXIM Bank as well as higher lending for corporates.

RBI policy rates

What’s driving the RBI’s policy easing?

The move may have caught the markets off-guard, but it shouldn't be a complete surprise given the economy’s increasing struggle with Covid-19 - India has already displaced China as Asia’s epicentre of the pandemic. This comes as recent data showed a more than 60% plunge in exports and 17% manufacturing fall, keeping the economy on track for what we expect will be the worst economic slump in recent history.

Our view of as much as a 5% YoY GDP contraction in the current quarter remains subject to downside risk, while negative growth in the entire fiscal year ending in March 2021 looks like a foregone conclusion.

The macroeconomic impact of the pandemic is turning out to be more severe than initially anticipated, and various sectors of the economy are experiencing acute stress. - RBI policy statement.

Moreover, we also view today’s move as an affirmation that the recently announced 10% of GDP stimulus package (including all previously announced monetary easing form the RBI) isn’t enough to help the economy withstand the Covid-19 storm. The much-touted big stimulus package is more about long-term structural economic reforms rather than an immediate real boost to the economy. As such, the central bank is carrying the burden of supporting growth.

More rate cuts, much weaker rupee

Clearly, elevated consumer price inflation currently carries no significance in the RBI's policymaking, nor does the persistently weak currency (INR), a state of affairs that’s likely to persist until we see hints of a post-Covid economic recovery. Today’s policy statement described the inflation outlook as “highly uncertain” amid ongoing supply chain disruption.

We believe more policy rate cuts remain on the cards given that there is no change to the central bank’s accommodative policy stance just yet. We don’t rule out another 25-50bp rate cut at the next scheduled meeting in early August, or even earlier if the situation continues to worsen in the months ahead.

We also see the latest rate cut reigniting the depreciation pressure on the Indian rupee and driving the USD/INR exchange rate towards 79 over the next three months. The currency stabilised in a 75-76 range in May after heavy losses in the previous two months, as the spread of Covid-19 outside of India slowed down, lifting global risk sentiment and portfolio inflows. The RBI reportedly stepped up foreign asset purchases this month, signalling its comfort with a weak currency.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article