Reserve Bank of Australia will not be hiking rates just yet

Despite a hot labour market, surging inflation, hikes from other central banks and rising bond yields, the Reserve Bank of Australia can still point to restrained wage growth as a reason for maintaining its accommodative policy stance, therefore failing to give any help to the Australian dollar. We don't think wages growth will stay low this year though

Reasons to be dovish – there aren't many

Over the last few months, the Reserve Bank of Australia (RBA) has set out the conditions it requires to be fulfilled for it to hike policy rates. These are:

- Actual inflation is sustainably within the 2-3% target range.

- Wages growth will need to be at least 3% (reference Wage Price index).

- The actions of other central banks.

- How the Australian bond market is functioning.

A quick look at these conditions shows that most of them have been met.

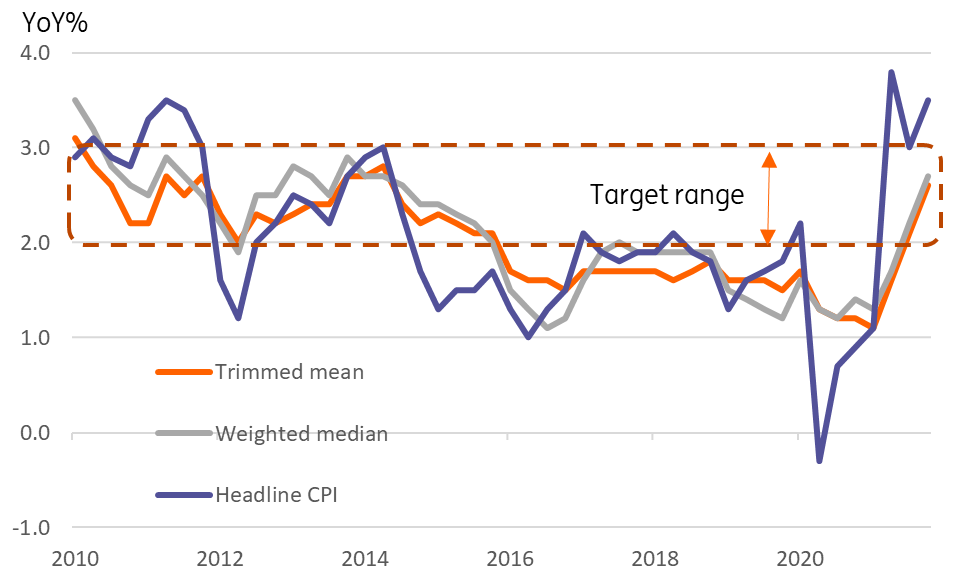

Inflation: high and likely staying above target

Headline inflation for 4Q21 was 3.5%, and there is further upwards pressure on inflation in the near term as re-opening the economy delivers a positive demand shock to the economy, and high commodity prices feed through into consumer prices. Both trimmed mean and weighted median measures of inflation are similarly above the mid-point of the RBA's 2-3% target range. The key though is the RBA's use of the word "sustainably". That could be interpreted in a number of ways, but persisting inflation above the target range for more than one quarter would probably go a long way to ticking this box.

What may be more compelling for the RBA, though, would be signs that wages growth was sufficiently high to keep inflation propped up. And for that to happen, it has indicated that wages growth will need to rise to 3% or above.

The 4Q21 wage price index was released recently and increased, but only to 2.3% from 2.2%. We won't get any more data on this for another quarter. We think that there is a good chance that wages growth picks up more rapidly this year, though wage inflation may still be just short of the 3% rate for 1Q22, and we may need to wait until the 2Q figures are released for this condition to be fulfilled.

Australian inflation headline and core measures

The actions of other central banks

When the RBA talks about taking into account the actions of other central banks, it is really talking about the US Federal Reserve. The Fed hasn't started hiking yet, but it is a foregone conclusion that this will commence in March, and possibly even with a 50bp hike. Front-loaded hikes over the rest of the year look very likely to follow.

The RBA has for a long time been careful to position itself on the dovish side of the Fed to help keep the Australian dollar (AUD) from appreciating too far. But given the likely actions of the Fed, and indeed the Bank of England, Reserve Bank of New Zealand, and Bank of Korea, the gulf between the RBA and other central banks will widen substantially in the near future, enabling it to hike without any undue readthrough to the currency.

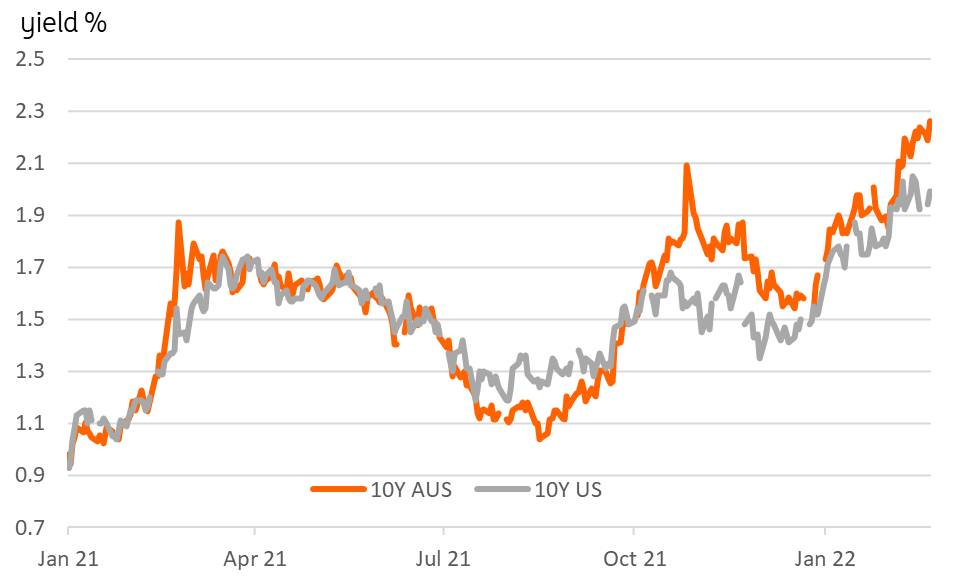

The final factor the RBA mentions is the state of the bond market. This is a bit ambiguous, but you can imagine that what the RBA wouldn't want to see is spreads on Australian government bonds widening over US treasuries – for example, because the market believed that they were falling behind the curve. Right now, spreads are widening, but not all that much. This is still worth watching, however, because financial conditions are the sum of short and long rates and the competitiveness of the currency, so keeping policy rates low for longer than the market thinks appropriate may not actually deliver the accommodative financial conditions that are desired.

Putting all this together, the Reserve Bank of Australia will likely continue its gradual moonwalk back from earlier commitments to keep rates on hold for the next few years, but it can cling to subdued wages figures for now to justify its stance. Even if the wages figures don't exceed 3% until the 2Q22 release (most likely sometime in August 2022), it could come close during the second quarter. With the addition of widening spreads, this could encourage a reappraisal by the RBA as soon as 2Q22, when we believe the cash rate target could be pushed to 0.25% from 0.10% currently.

Australian and US 10Y bond yields

AUD: External factors remain in the driver’s seat

Despite the lack of indications from the RBA that a policy shift towards tightening was imminent, markets have continued to price in 150bp worth of rate hikes in Australia in the next 12 months. This is partly due to the market’s pricing of Fed rate expectations, but it equally highlights some downside risks for AUD if the RBA retains a very cautious and gradual approach to monetary tightening this week.

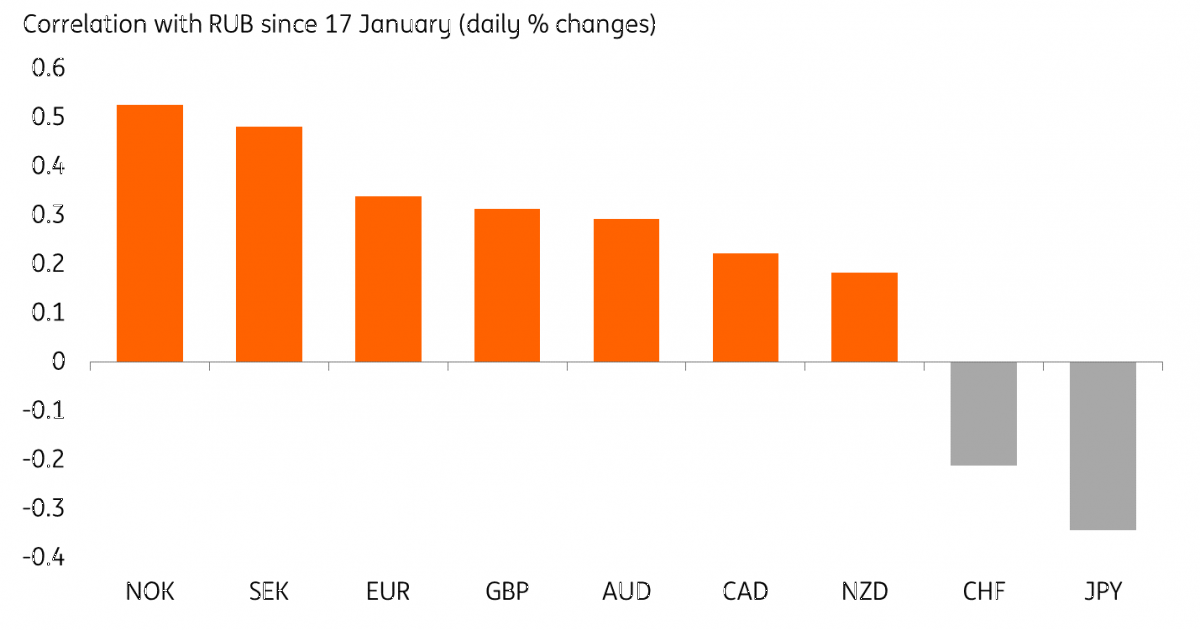

That said, the RBA’s policy expectations have had a quite contained impact on AUD/USD in the past few months, with external drivers and USD swings that have been the major drivers for the pair. This should remain the case in the current market environment, where the Russia-Ukraine crisis means that any FX impact from domestic events will quickly be overshadowed.

As shown in the chart above, AUD is less exposed than European currencies to swings in the Russian ruble (RUB) – which is taken as a benchmark for Russia-Ukraine tensions – but given its high-beta to risk sentiment, AUD is still facing considerable downside risks. Incidentally, the iron ore sell-off as China aims to curb price speculation can also be a drag on AUD. With no help from the RBA, AUD/USD could move back below 0.7100 in the near term as the external environment deteriorates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article