Recovery signs in Brazil all around

Activity rebound should not dissuade the central bank from cutting the policy rate at least once more, next week

A wide range of economic indicators are displaying stronger signs of a rebound in economic activity in Brazil.

Low inflation and (at least) one additional rate cut next week also suggest that underlying monetary conditions should remain expansionary for quite some time. Elections and the outlook for the social security reform should remain, however, as primary catalysts for asset prices in the coming months.

Entering 2018 on stronger footing

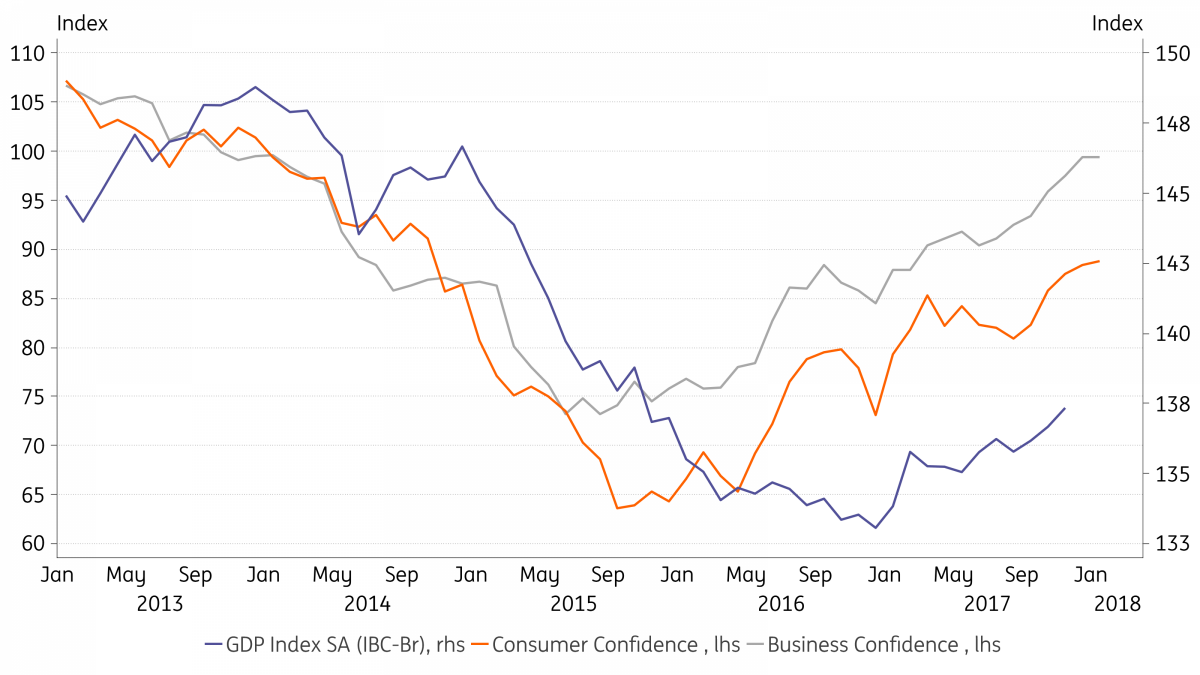

Signs of a rebound in economic activity have strengthened over the past couple of months in Brazil. The recovery is evident in a wide range of indicators, from typically lagging variables such as job creation to leading indicators such as business confidence. Recent data added some upside risk to our forecast that GDP growth will accelerate to 2.5% this year, up from our estimated 1.1% growth last year.

Confidence surges ahead of activity

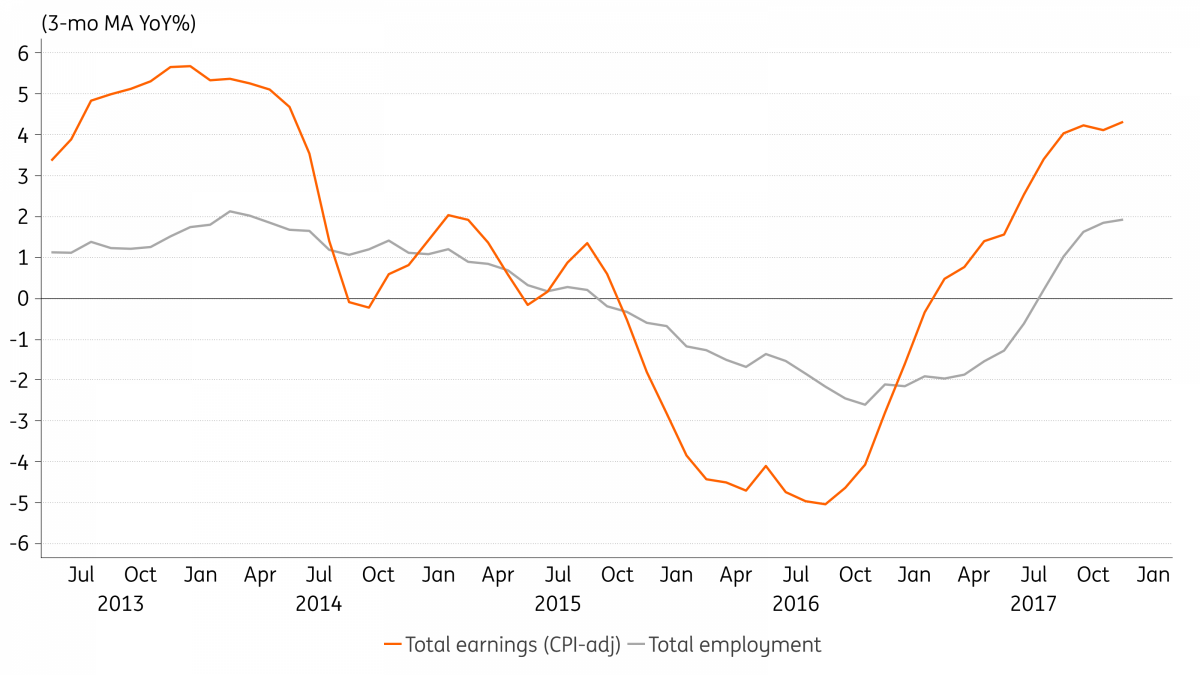

A rebound in consumer demand is the chief driver, reflecting the strengthening of labour and credit indicators. Labour market data stands out primarily due to the considerable rise in inflation-adjusted earnings, but employment is also rising, even if the new jobs have been more concentrated in the informal sector, which is typical at this stage in the cycle.

Labor markets strengthened sooner than expected

Credit markets are also recovering, as seen in the recent surge in new lending to both corporates and households. Delinquency and spreads are also falling, amid signs that the deleveraging process, which has lasted close to two years now, is close to an end.

Bank lending revives at last

Investment should lag the recovery in consumption, but surging business confidence and upbeat commodity prices bode well for a quicker turnaround. Relatively low inventory levels also suggest that the lingering downside from the inventory cycle is much more limited now, even though an inventory build-up is still unlikely. Overall, despite these positive developments, ample spare capacity and heightened political uncertainties suggest that a recovery in investment should take longer to consolidate.

Another rate cut on the way

This recovery has only been possible due to achievements on the monetary policy front. The rehabilitation of the institutional integrity of the inflation-targeting regime, with low inflation and the lowest interest rate on record, is still the most significant achievement of the Temer administration.

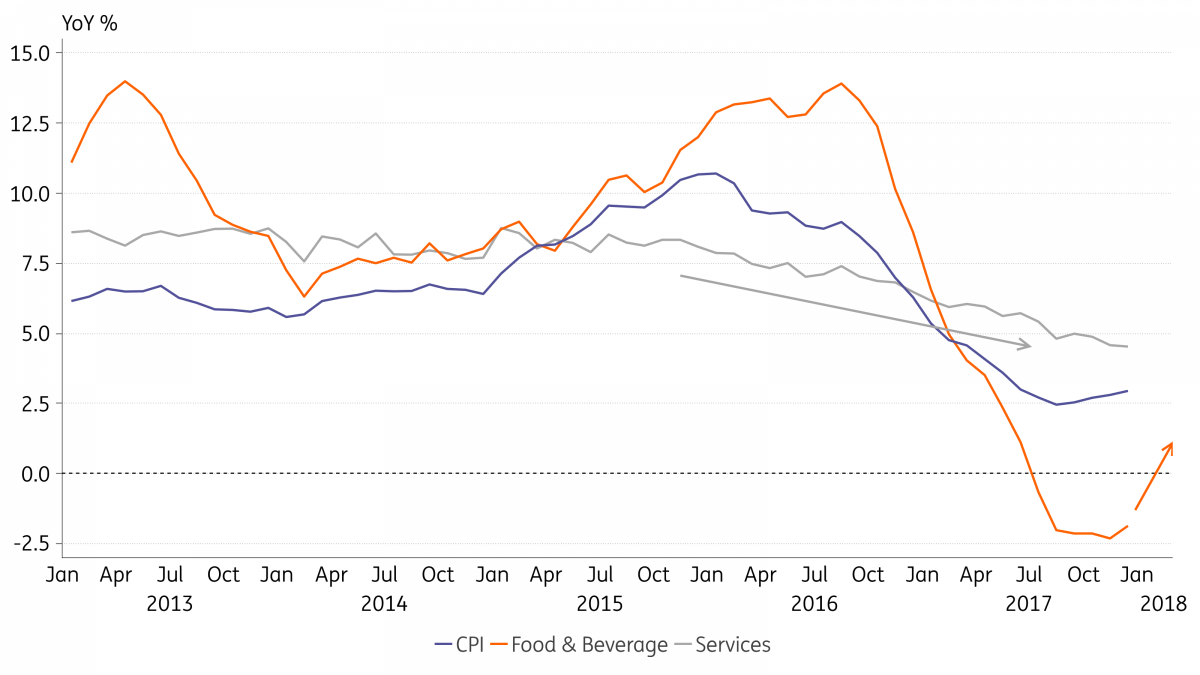

Inflation will rise throughout 2018, after ending 2017 at 3.0%, but it should remain low, finishing the year at 3.9%, i.e. comfortably below the 4.5% target for the year. The normalisation of the food supply shock, which triggered deflation in food prices last year, should be the primary source of upside price-pressures this year. That should be partially offset by the favorable inertia, intensified by persistent local price indexation, and low inflation expectations. A sizeable output gap and the ongoing downtrend in service prices, after years of above-trend inflation, should also contribute to keeping inflation low over the next couple of years.

Food inflation should rise in 2018

The central bank has clearly telegraphed an intention to cut the SELIC policy rate once again, at a slower 25bp pace, at the upcoming February 7 meeting. This would bring the SELIC rate to 6.75%. The bank has also indicated that it could not provide much guidance beyond this meeting, signalling a more data-dependent approach for what should be the last meeting of this cycle (March 21) during which a rate cut should be considered.

| 6.75% |

Policy rate to drop to a record lowCycle could conclude with a cumulative 750 bp in rate cuts |

FX dynamics and prospects for a social security reform vote late in February may play a large role at the March meeting. In our base-case scenario, we assume that a social security reform will not be approved by Congress, limiting the potential for BRL appreciation and reinforcing the case for the end of the easing cycle with a SELIC at 6.75%.

Fully-anchored inflation expectations, up to 2020 according to central bank surveys, suggest that prospects for an extended period of monetary stimulus look promising. But the medium-term outlook for monetary policy should depend heavily on the outlook for fiscal policy.

The local yield curve currently incorporates close to 100bp in rate hikes during 2H18 and 240bp in additional hikes throughout 2019. This contrasts with our expectation of stability for the policy rate for most of that period but is consistent with a scenario of heightened political uncertainties, FX volatility and persistent fiscal challenges.

Fiscal accounts improve marginally

The faster-than-expected rise in tax collection along with the tighter control over the budget have helped improve fiscal accounts at the end of last year, which resulted in a significantly lower-than-expected public sector primary deficit (1.7% of GDP), comfortably within the target (-2.5% of GDP). But this improvement is not sufficient to offset rising burden represented by social security imbalances, which threaten the survival of the current fiscal framework, marked by an inflation-adjusted freeze in spending and the so-called golden rule for debt issuance.

For 2018, keeping government spending below the ceiling should not present a major challenge but the Treasury estimates a financing gap of about BRL206bn, to meet the golden rule in 2018. The administration hopes to cover that gap with a BRL130bn repayment from the BNDES and other administrative actions, but the arrangement is clearly unsustainable, and highlights the urgency of advancing a social security reform.

Without a reform, the medium-term trajectory for fiscal accounts would worsen markedly. Maintaining the current fiscal framework should become increasingly costly politically, with rising pressure, over the next couple of years, to weaken fiscal constraints and postpone fiscal austerity measures. Any such changes is bound to cause considerable financial market turmoil and precipitate further credit rating downgrades.

A more fragmented electoral landscape

The election of a fiscally responsible candidate in the October Presidential race remains critical to sustaining prospects for an economic recovery. The high likelihood that former President Lula da Silva will be ineligible to run, following last week’s conviction, boosted investor expectations for a market-friendly result in October.

But Lula’s likely exit did not bring clarity to the race; it has merely taken off the table the possibility of a high-probability negative outcome. Opinions vary among local political experts about who benefits/loses from Lula’s disqualification. Perhaps its most immediate implication is that it has levelled the playing field somewhat, increasing the number of potential candidates and creating greater fragmentation both within the left and the right.

Over the next few months, more candidates should test the waters, to assess their potential to rise in opinion polls. April is looking to be an important month for potential contenders to make their final decision, with April 2 set as the deadline for a candidate to be enrolled in a party and April 7 the deadline for candidates holding executive positions to step down, to be eligible to run.

Political alliances should begin to solidify a bit later, around May/June, at which time we should be able to better assess of how state-funding and state-sponsored advertising resources will be distributed to the candidates. The deadline for candidates to register is August 15, with state-sponsored advertising starting on August 31.

This more fragmented political landscape suggests that a high-conviction call about which candidates will make the second-round may be unusually tough this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article