Record UK gilt yields are justified, for now

The UK's 30Y gilt yield has hit its highest level since 1998, and although we think structurally the rate should be lower, changing direction may need time. Sticky inflation, government spending, higher US rates and supply pressures will keep upward pressure on GBP rates. Sterling has started to sell off, but further weakness should be limited – since this is not a sovereign crisis

The stars are aligning for record gilt yields

Gilt yields have risen strongly over the past few months and with a yield of 5.3%, the 30Y is at its highest level since 1998. The 10Y gilt yield has also risen sharply, but 4.7% is still within the range seen during the early 2000s. Myriad factors contributed to the stretch higher, including Labour’s spending ambitions, sticky inflation, higher US rates and supply pressures. We still see gilt yields settling lower later in the year, but as long as these factors linger, a change in direction may take some time.

Compared to the previous highs pre-2008, the 10s30s gilt curve is steeper, adding to higher 30Y yields. In our view, the 10s30s should be upward sloping given a positive term risk premium and thus returning to a flatter curve seems unlikely in our view. Having said that, the 10s30s rate can also be driven by volatility (due to convexity) and by supply and demand factors, such as pension funds managing liabilities. But these factors are unlikely to change in the near term.

30Y gilt yields are being helped to new highs by an upward sloping curve

Sticky inflation and Labour’s budget plans have also contributed to the higher gilts by moving the landing zone of the Bank of England (BoE) up. The first scatter plot shows how these two correlated tightly over the past year, although 30Y yields did move above the linear line in the last month. The December SONIA forward now suggests a terminal rate of 4%, which means just three 25bp rate cuts are priced in from here. We think the BoE will cut more, but with services inflation still high, more data is needed to convince markets of this.

The second scatter shows that higher UST yields have also contributed significantly to the rise in gilt yields. But also here the relation broke over the past month, with the 30Y now some 20bp higher than implied by the historical relation, suggesting not everything can be explained by this. The recent rise in UST yields is consistent with our concerns about inflationary pressures under US President-elect Donald Trump and high government deficits.

30Y yields tied to BoE expectations and USTs, but broke higher recently

The gilts-swap spread is the last piece of the puzzle and together with the repricing of the BoE terminal rate and rise in UST yields justify the record 30Y yields. Since the BoE started with quantitative tightening (QT), the spread between 30Y gilts and swaps has gradually widened, a phenomenon also seen for USTs and Bunds. The gradual nature of the widening suggests QT alongside elevated funding needs are the main driver, and not a form of sovereign risk premium which is sometimes speculated about.

Wider gilt-swap spreads are the last piece of the puzzle

Supply pressures are expected to remain elevated keeping the pressure on gilt-swap spreads. Not only will supply pressures come from the Labour government's intended spending, but also the BoE’s continuous QT. The BoE actively reduces its balance sheet by £100bn per year, which is relatively faster than the Fed and ECB.

It's important to note that the demand from foreign buyers remains strong, which reduces the repeat risks of a Liz Truss moment. So whilst rates can stay higher, we don’t expect any steep sell-offs on the back of sovereign risk. Also, keep in mind that the Truss turmoil was exaggerated by a liquidity crunch among pension funds due to interest rate hedges suddenly moving against them. This time the move up is more gradual, which should prevent such a spiral higher in gilt yields.

Supply pressures remain elevated adding to wider swap spreads

To conclude, the factors we have identified justify the current 30Y gilt yields, and although we think gilt yields should come down on a more dovish BoE, this may take some time. Higher UST yields will also continue to pull up gilt yields, which are particularly sensitive to US rates. Swap spreads add to the upward pressure, especially in the near term as issuers frontload their funding for 2025. From a more medium to long-term perspective, we maintain a target range of 4.5-4.7% for the 30Y.

GBP: This is not a sovereign crisis

As discussed above, the sell-off in gilts looks to be more a function of factors peculiar to the bond market than investors demanding a risk premium of UK assets per se. Notably, the UK’s five-year sovereign Credit Default Swap has not moved much over the last month.

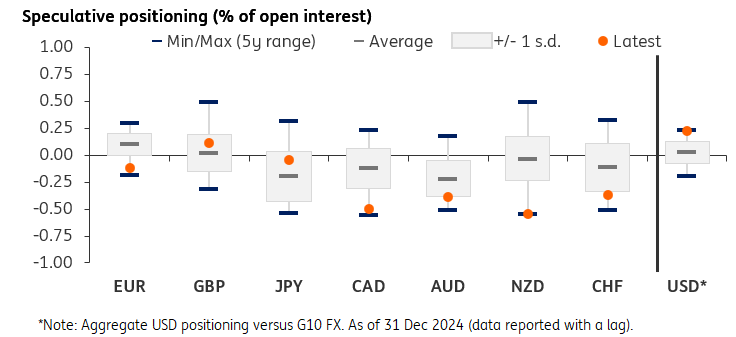

True, sterling has started to see some independent weakness today. However, we see that as a function of positioning. As of late last year, sterling was the only long position investors were prepared to run against the dollar – most probably because: i) GBP pays the highest one-week deposit rate in the G10 space (4.75%) and ii) with relatively small goods exports, the UK was seen as less exposed to the looming tariff threat from the incoming Trump administration.

In a way, today’s sterling sell-off can be seen as a mini-capitulation of the overriding theme of a Trump-inspired strong dollar in 2025.

Where to from here? As above, we do not view this as the start of a chapter of independent sterling weakness and retain our forecasts that EUR/GBP will not stray too far from the 0.82/83 region this year. 0.8450/8500 could be the extent of the current EUR/GBP correction should market positioning have further to unwind. We are bullish on the dollar this year and have 1.24 as an end-year GBP/USD forecast. At this point, however, GBP/USD downside does look vulnerable to positioning and the incoming Trump agenda. 1.2250 is very possible, but 1.20 looks a bit of a stretch.

GBP was the only long position held against the dollar by speculators

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Rates DailyDownload

Download article