Czech: Record high foreign trade

The volume of exports reached a record level in 2017, supported by a strong automotive segment whose share of the total Czech export market reached 29% last year

Record-high export activity in 2017

The latest foreign trade statistics confirm record-high export activity in 2017. Although the foreign surplus itself slightly declined compared with 2016, this was attributed to higher commodity prices in 2017, mainly oil, increasing the trade deficit in the category last year. Total exports in nominal terms reached CZK 3,885bn, which represents an increase of 5.6%. This figure was mainly driven by stronger exports of motor vehicles, which increased by 7.8% in nominal terms and reached a new record volume of CZK 995 billion.

| CZK3,485bn |

Nominal exports in 2017increased by 5.6% YoY |

Car segment gains importance

The share of exports of motor vehicles in total Czech exports reached 29% in 2017. This share has been gradually rising from 23% in 2014 and "only" 20% in 2011, increasing the sensitivity of the economy to the car segment (see the Table). The economy has benefited from this development as the car segment has been performing exceptionally well in recent years. This was driven not only by favourable foreign demand and central bank FX-interventions to weaken the currency but also by newly introduced models, which successfully attracted foreign attention. Skoda Auto, for example, increased production by 12% YoY in 2017, while production by the two other most important car producers stagnated or even slightly declined.

The share of the main segments in total Czech exports (%)

Auto sector also the main driver of industrial growth

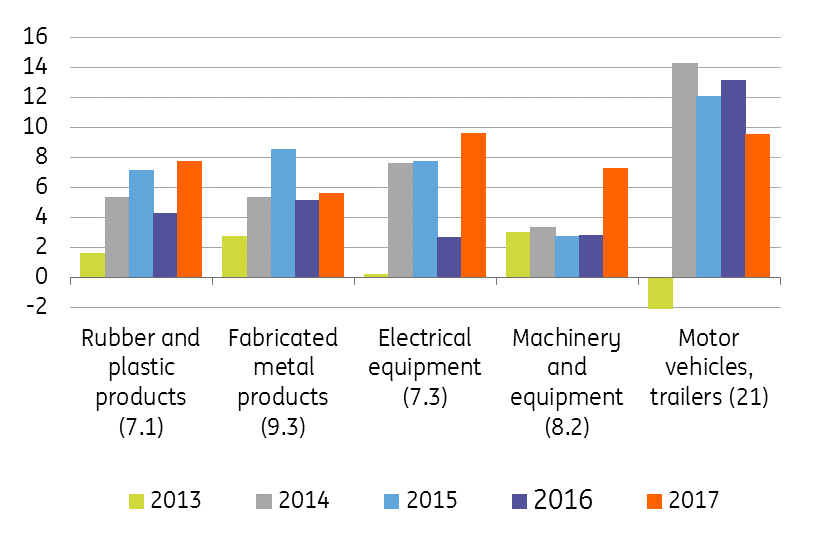

The strong car segment was also the main driver of Czech industrial production, which increased by 5.7% YoY in 2017. This represents the fastest growth rate in the last six years. Not surprisingly, the highest contribution to the YoY growth came from the automotive segment, which picked up by almost 9.5% and maintained its double-digit growth rate for the fourth year in a row. But 2017 was successful for other manufacturing segments, too, as their growth rates accelerated in 2017 (see Chart).

Growth in the main industrial segments (%YoY)

Deceleration in industry is expected

The fast-growing automotive sector brings some concern for the future, and signs of deceleration ahead are starting to appear.

- Firstly, new car registration in the EU is slightly decelerating

- Secondly, new orders in the automotive segment stagnated in 2017 after growing between 10-20% in previous years.

- Last but not least, high capacity utilisation and the tight labour market are constraints, which make it almost impossible to increase production again by10% this year, even if even foreign demand continues to be strong.

- As such, we expect the car segment and also total industrial production to decelerate this year. Industrial production might growth around 3.5%, which given the high base effect, would be still a favourable figure.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Czech RepublicDownload

Download article