Zinc still has new stories to tell

Just when the world turned bearish on zinc as the market finally transitioned into surplus, the Covid-19 pandemic may have rewritten some parts of the script for the market, at least in the short term

What the Treatment Charges could be suggesting

As the Covid-19 pandemic sweeps across countries, the impacts vary among commodities and each sector along the individual supply chain. That impact continues to unfold and we can't yet gauge the full disruptive impact, but so far the damage to upstream mining and downstream consumption appears to be larger than for the smelting business.

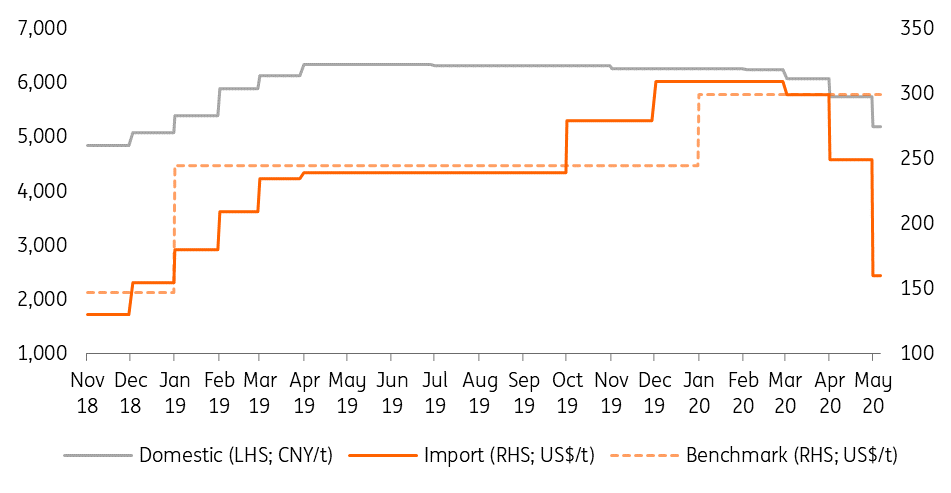

The pain could well be spilling across the chain. The Treatment Charges (TCs) in the spot market have been declining across the Chinese domestic mine supply and the import market. The lowest TC has fallen to USD160/t this week (see Fig 1), some distance away from the 2020 annual benchmark which was agreed at USD299.75/t between Teck Resources and Korea Zinc earlier this year.

Fig 1. Zinc treatment charges

It takes two to tango

The plunging TCs are the net outcome of the concentrate market supply and demand status. It is telling us two things: demand for concentrate is strong while supply has fallen.

- Back in February, Covid-19 was mainly threatening those major smelters operating in Asia including the world largest producer China and South Korea which has the world largest single smelter. What has transpired is that the Chinese refined zinc output actually grew by 8% YoY during 1Q20. The growth continued in April with refined production rising by another 2.5% from the month previously. Clearly, the appetite for raw materials has been strong so that could sustain strong growth in refined production. In contrast, domestic mine production fell by 9.2% during the first four months of this year according to consultancy Onenessinfo.

- Following Covid-19 sweeping through the Americas and Oceania, where major zinc mines are located, the disruption to mining and smelter began to emerge. Countries announced lockdowns and kept on extending them. Last week, three countries in South America extended lockdowns from 30 April until 10 May (at the time of writing). The San Cristóbal mine in Bolivia, among the biggest in zinc and polymetallic mining, has remained shut since late March. According to Antaike, by mid-April 374kt of zinc were affected and primarily from those South American countries.

Plunging TCs are hurting smelters' margins

As Treatment Charges are a key source of smelters' revenue, the fallout squeezes their margins. In zinc’s case, could this potentially help to cool down the refined production growth?

During late 2018 and early 2019, the output was capped by bottlenecks in the smelting business in China. Ever since those restrictions were cleared, production has been growing fast as rising TCs are incentivising refined production. On the other end of the ‘see-saw’, higher TCs are costing miners a small fortune. In a non-Covid world, one would expect the trend to inflect later rather than sooner.

However, the Covid-19 pandemic has caused disruption which has helped erase some of the surplus expected in the concentrate market balance, and this remains the ‘X-factor’ as things are still playing out. We can already see the consequences. Our modelled smelters' margin gives a proxy of the average smelters' margin trend (see Fig 2). In this case, the TC is the biggest game-changer in the formula; this is now signalling a fast deteriorating smelters' margin.

Fig 2. Implied zinc smelting margins (cny/tonne)

Implications for the zinc market

So this all means that the script for the zinc market may need to be rewritten a touch in the few weeks. So far we expect the mine disruptions are likely to improve as countries ease their lockdowns. Chinese domestic mines are expected to accelerate their production. Nevertheless, for the full year, we still have a 210kt surplus sitting in our world refined zinc balance, and yet there is little temptation to chop off the refined surplus due to what we have just discussed above about the concentrate market.

In the short term, the pressure from falling TCs has been felt by the smelters, which has started to weigh on refined production growth and we expect that growth to be muted over April and May. This could help to absorb some of the negative impacts on China demand via the export market. While zinc’s prone-stimulus nature, particularly to the infrastructure sector, suggests that domestic demand may turn out to be better-than-expected should Beijing accelerate the investment.

In the next couple of weeks, a marginal improvement in demand elsewhere, along with lockdowns been eased, could be a more prevailing driver to the price in the short term market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article